Green Audit Services in Noida

25,000 - 35,000 Per piece

CIL provides Green Audit Services in Noida, Uttar Pradesh, India. CIL is an ISO 17020 accredited inspection body.Scope and Goal of green Auditing Government of India through its National Environment Policy in 2006 has made mandatory for every organization to conduct green audit / environmental audit in order to ensure a clean and healthy environment within and outside the organization. Further, it also helps in effective learning and provides a conductive learning environment. Efforts are taking place around the world in order to address various environmental issues. Green auditing or environmental auditing is one among them for educational institutions. Green auditing helps organization to understand various environmental issues of the organization and identify existing lacuna or gap towards meeting the objective of National Environmental Policy and thus, to plan accordingly. Methodology: An environmental audit has three phases - pre-audit stage, audit stage and post-audit stage, accordingly the environmental audit was conducted. 1. Pre-Audit Stage: Pre-audit stage involved the identification of target areas for environmental auditing. Accordingly following target areas were identified: Land Use System, Biodiversity Status, Climatic Conditions, Air Quality, Noise Pollution, Water Resources and Management, Energy Consumption, Waste disposal and management, Environmental Awareness, Mitigation and Management practices 2. Post-Audit Stage: The Post-Audit Stage includes the production of the final report, prepare action plan to overcome the flaws and to keep a watch on the action plan. Green Audit provides an assessment of the environmental performance of a business or organization. The audit reveals details about the activities of a company and its compliance with environmental regulations. Audit information is presented to the management team and employees. Green audit evaluates and quantifies the environmental performance. It identifies compliance problems or management system implementation issues. When a green Audit is Necessary? Green audits are an important part of a company’s environmental policy and performance. However, many companies either don’t do them or do them improperly. There are many, many environmental rules and regulations that apply to every business. Is your business in compliance with all of them? Do you have all the permits you need and are you fully compliant with all the details of each? You don’t know unless you have done an audit done by an independent environmental auditor. If you are not an expert on environmental compliance and regulations, you need an environmental audit. When an inspector arrives at your work site, you’ll know that you are in compliance and be able to provide documentation that outlines everything you are doing to stay in compliance. Green Audit Steps: The environmental audit process includes the following steps as a minimum: • Planning the audit, including activities to be conducted and responsibilities for each activity • Review the company’s environmental protection policy and the applicable requirements, federal, state, and local requirements. • Assessment of the organization, it is management, and equipment • Gather data and relevant information • Evaluate overall performance • Identify areas needing improvement • Report findings to management

above 5 crore upto 10 crore gst audit service

20,000 - 21,000 Per

Looking for Auditing Services Providers

Social Compliance Audit

Get Price Quote

Sedex BSCI C-TAT GOTS GRS ICS WRAP FEM SLCP HIGGS Consultany services all over India. We are located in Mumbai, Maharashtra. More than 200 customers already complied

energy audit

Get Price Quote

1 Piece (MOQ)

Energy is often the single largest controllable cost in manufacturing. Proper management of energy has a direct positive impact on a company’s bottom line. Energy audit is the first step in knowing the potential energy savings. It identifies area where the energy is being wasted by taking measurements at the key energy consumption points and the systematic study. It determines existing level of energy usage and recommends possible measures that would result in energy savings.

Auditing Services

Get Price Quote

We are a Chartered Accountants registered firm, under Rules 190 of Chartered Accountant Act, 1949 since 2002. We are based at Kolkata. H Saraogi & Associates caters to the needs of its customers to ensure that its customers keep pace with the rapid changing times. Based at Kolkata (West Bengal, India), we stand among dependable Auditing Services providers. We consider that providing Professional Auditing Services are top priority and that the firm does not view such services as a commodity. We do this by emphasizing the importance of audit quality in training programs and annual performance reviews. Types of Auditing Services made by us : Statutory AuditsWe perform Statutory Audits of Public/Private Limited Companies in the Manufacturing/ Trading/ Assistance Areas, IT Companies, Nationalized Lenders, Economical Organizations, Non-Banking Finance Companies, Community Industry Venture (PSU), Non-profit Organizations, NGO, Resorts, Medical centers, Supportive Organizations and other little and medium-sized companies. Tax AuditsEvery company, Firm or Businesses whose income surpasses Rs.100 Lakhs or total claims from any occupation surpasses Rs.25 Lakhs in any previous year, is necessary to get its records precisely & punctually audited and obtain a review under the area 44AB of the Earnings Tax Act. We have a group of calm tax experts to perform such type of audits. Internal & Management AuditThe improving problem is to make sure awesome inner & handling management techniques to avoid unique or structured faults and omissions. Apart from, Protecting of valuable resources, sufficient department of power over key management places and strict conformity with the inner operating policies and corporate governance.

factory Social compliance & Quality audit service

25,000 - 60,000 Per Unit

Factory audit (FA) refers to an onsite factory inspection that is carried out on behalf of an importer at the premises of the manufacturer before placing an order to a new manufacturer. Factory Audit is aimed at avoiding getting involved in a bind working with the wrong factory. Retailers, importers and buyers all require a high level of confidence in the reliability, quality and production capacity of their vendors and suppliers. In situations where there is a limited pool of suitable supply chain partners, identifying or developing vendors who meet these requirements can pose real challenges. When vendors and suppliers fail to deliver the promised level of quality, your products may be rejected during the final production and inspection stages. These products may be barred from international markets if they do not meet international quality standards or legal and normative requirements.

Energy Audit Consultancy Service

Get Price Quote

Energy Audit & Consultation Energy audit and consultation services are crucial for individuals, businesses, and institutions seeking to optimize energy usage, reduce costs, and enhance overall sustainability. These services are typically offered by specialized companies and experts in the field. Our team of seasoned experts employs cutting-edge technologies and multiple software tools, such as EnergyPlus, Modelica, and many other Energy Simulation softwares, to conduct precise energy simulations. Through these simulations, we gain invaluable insights into your energy consumption patterns, enabling us to craft customized and forward-thinking solutions that are both sustainable and cost-effective. Benefits of Energy Audit and Consultation Services: Cost Savings: Identifying inefficiencies leads to targeted improvements, resulting in reduced energy consumption and operational costs. Environmental Impact: Optimizing energy use contributes to sustainability goals by lowering carbon footprint and greenhouse gas emissions. Enhanced Equipment Performance: Identifying and addressing issues with equipment and systems to ensure they operate at peak efficiency. Regulatory Compliance: Meeting energy efficiency standards and environmental regulations. Why Approach a Professional Company: Expertise: Energy audit companies have specialized knowledge and experience in assessing energy consumption patterns across various sectors. Certifications: Reputable companies often have certified energy auditors who hold recognized qualifications, such as Certified Energy Manager (CEM), ensuring high standards of service. Customized Solutions: Professionals tailor recommendations based on specific facility needs, offering customized strategies for energy optimization. Advanced Tools and Technology: Energy audit companies utilize sophisticated tools and technologies for data collection and analysis, providing accurate insights into energy usage. Comprehensive Services: Beyond audits, many companies offer consultation services, assisting in the implementation of energy-efficient technologies and ongoing monitoring to ensure sustained improvements. Regulatory Awareness: Keeping abreast of changing energy regulations, professionals help clients stay compliant with relevant standards and requirements. Return on Investment (ROI): Expertise in calculating and demonstrating the potential return on investment for energy-efficient upgrades and implementations. Why us? Advanced Energy Simulations: Utilizing sophisticated software tools, we conduct in-depth energy simulations to analyze your current energy consumption, identify inefficiencies, and propose targeted improvements. Customized Solutions: Our consultations result in personalized strategies tailored to your business's unique needs, ensuring sustainability and cost-effectiveness in every aspect of your energy management. Innovative Technologies: We stay at the forefront of technological advancements, recommending and integrating innovative solutions that optimize energy efficiency and reduce environmental impact. Approaching a professional energy audit and consultation company ensures access to specialized expertise, personalized solutions, and a strategic approach to achieving energy efficiency and sustainability goals. The investment in such services can result in significant long-term cost savings and environmental benefits, making it a valuable decision for individuals, businesses, and institutions.

Auditing Services

Get Price Quote

We are a trusted name, when it comes to reliable Internal Support Services for Auditing. Backed by a team of expert professionals, we offer perfect solution for assessing, designing, developing and implementing cost effective auditing process for corporate and business houses. We are preferred by clients because of the effective internal controls that guarantee smooth and efficient working of the organization. As part of our Auditing Services, we offer : Stock Verification Cost Control Audits System Designing Management Audit Due Diligenge Investigations Surprise Checks Why Us? Support Services for Auditing Auditing under various enactments as Income Tax, GST, and Company Tax etc. Online Library of forms, statements and declarations formats Compliances with Indian accounting and auditing standards and IFRS Auditing tutorials guidelines standards and information library

Cyber Security Audit Services

Get Price Quote

We are an organization that is engaged in rendering the most efficient solutions for cyber security audit at competitive charges. We are regarded as one of the best service providers in India. Thus, we ensure that all the cyber security requirements of our clients is fulfilled by our seamless solutions. With an increasing risk of data loss, information loss, and cyber threats, our audit solutions help you in protecting the important data. Cyber audit consultancy for the enterprise being provided, beside that training and consultancy works are being carried out, using various tools and techniques across the cyberspace.

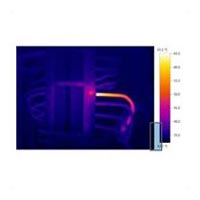

Electrical Safety Auditing Services

15,000 - 20,000 Per Day

1 Service (MOQ)

Electrical Safety Audit Services in Chennai, Tamil Nadu, Thermography Testing/Thermal Imaging Testing Service in Chennai. We are exporter engaged in offering Electrical Safety Audit Services – Thermography Test in Chennai, Tamil Nadu, India. Thermal Scanning is helps us to visualize and quantify changes in the surface temperature of electrical Switchgear. An infrared camera converts infrared radiation (heat) emitted from the surface of electrical equipment into electrical impulses. These impulses are Spotted as colours which represent the various temperatures. Thermal Imaging identifies equipment flaws and pinpoints any hot spots often invisible to the naked eye. When parts of your electrical systems begin to have problems, they give off heat – usually a sign of electrical resistance or excessive friction. Abnormal temperatures can be seen easily. Before an electrical component burns up, it heats up. Early detection with Infrared Thermal Scanning detects growing problems before they cause a system failure or fire. Maintenance personnel can correct the problem before the component fails. Infrared thermography is used to perform inspections on electrical equipment because excess resistance on electrical apparatus indicates electrical faults such as: Loose connections Overloads Imbalanced circuits Faulty Equipment Damaged switches Faulty fuses

Propriety Income Tax Audit Services

Get Price Quote

Fast and Reliable Propriety Income Tax Audit Services At Raj Taxation Consultancy Services, we have a vast expanse of highly-skilled CA’s and experts who offer comprehensive guide and support for propriety income tax audit services all across Bhopal. Our team of experts is great at helping businesses and people to improve their overall financial security. Since our inception, we have been helping people to make a well-informed decision regarding propriety income tax audit. Affordable Propriety Income Tax Audit Services Propriety income tax audit might be confusing, and hence our on-demand audit tax consultants are always there to help you through besides devising strategies to help our clients to meet their tax audit obligations and adhere to the law.

Auditing Services

Get Price Quote

With globalization, accounting rules & regulation and audit standards are changing very frequently. Successfully filling this role since incorporation. Our audit procedures are designed to ensure compliance with relevant statutory laws and specialization. Our approach focuses on ensuring that internal controls are effective and disclosure requirements of the accounting standards and applicable regulations are met with. Our team of result-oriented professionals has considerable expertise in the field of Financial Auditing Services, professional auditing services etc. MPA considers that providing Professional Auditing Services are top priority and that the firm does not view such services as a commodity. MPA do this by emphasizing the importance of audit quality in training programs and annual performance reviews. We stand among the dependable providers of Auditing Services based in India. Clientele across sectors such as manufacturing, textiles, energy, food processing, telecommunications, Information technology enabled services. System cum Transaction audit methodology with well defined audit planning and execution procedures Additional inputs on : System and efficiency improvement Internal control review Statutory compliances Note : Empanelled with C&AG from many years

SMETA Audit service

Get Price Quote

1 Set (MOQ)

Smeta is designed to improve social environmental performance through audit standards. It helps in reducing duplication of effort in ethical trade auditing; benefitting retailers, consumer brands, and their suppliers. We are a reputed agency who assists organizations in getting smeta audit done. our experienced auditors conduct insightful audits and share them through supplier ethical data exchange (sedex) system.

water audit services

Get Price Quote

Water, has become a precious resource and can no more be misused. Water Audit study is a qual itative and quantitative analysis of water consumption to identify areas for conservation of water. Knowing department wise water consumption with respect to production. Preparation of water system diagram. Knowing raw water balance of entire facility. Knowing eff luent water balance of entire facility. Identif ication of water recycl ing or reusing opportunities. Knowing water conservation opportunities. Setting up proper water consumption monitoring system. Knowing steps or act ion plan for implementation of water and also energy conservation opportunities.

Tax Audit services

Get Price Quote

Tax Audit comes under the purview of Section 44AB of the Act which specifies the persons who are required to get audit of their books of accounts. This section specifies particularly that except for the persons coming under the purview of the sections mentioned in the text of Section 44AB , all other have to get their accounts audited under Section 44AB. The object of audit under section 44AB is only to assist the Assessing Officer in computing the total income of an assessee in accordance with different provisions of the Act.This Audit effectively curbs tax Evasion and ensure tax compliance. Therefore, Even though the income of a person is below the taxable limit, he will have to get his accounts audited and if his turnover in business exceeds the prescribed limit. If Assessing Officer wants the assessee to get his accounts audited in cases where the figures of turnover as appearing in the books of account of the assessee do not exceed the prescribed limits, he has no option but to pass an order under section 142(2A) directing the assessee to get his accounts audited from a chartered accountant as may be nominated by the Commissioner of Income-tax or the Chief Commissioner of Income-tax Hence, it must also be understood that the issue whether the turnover/gross receipt exceeds the prescribed limit is to be determined in each year independent of the results obtained in the preceding year or years. This section applies only if turnover/gross receipt exceeds the prescribed limit according to the accounts maintained by the assessee. It would be advisable to maintain basic records to support the turnover/gross receipt for declare audit required or not. Analysis of Section 44AB: Applicability: This section is applicable to every person: Carrying on business shall, if his total sales, turnover or gross receipts, as the case may be, in business exceed or exceeds one crore rupees in any previous year; or Carrying on profession shall, if his gross receipts in profession exceed fifty lakh rupees in any previous year; or Carrying on business as specified under Section(s) 44AE, 44BB, 44BBB and declared profit less then as specified in the respective sections Carrying on business/profession as specified under Section 44AD, 44ADA and income exceeds the limits as specified in the respective sections Deriving income under Sections 44B, 44BBA and declared profit less than the limits specified Penalty for failure to get accounts audited:If any person who is required to get his accounts audited by an Accountant as compliance provision of 44AB, before the specified date fails to do so shall be liable for penalty under section 271B. The amount of penalty shall be one-half percent of turnover / gross receipts or Rs.150000/- whichever is lower. This penalty shows the seriousness that the Government affixes towards Tax Audit under section 44AB.

Kiln Audit Services

Get Price Quote

Acquire the best kiln audit services in Thane (Maharashtra) by approaching Allan Smith Engineering. We are backed by a professional staff that holds expertise in kiln auditing. We make sure that no client faces the slightest inconvenience after acquiring our kiln audit service. As per the client requirement, the data is maintained for clinker and cement used. For further queries, feel free to get in touch with us now.

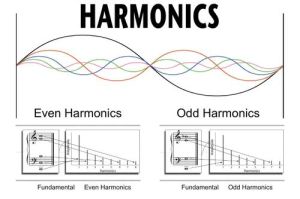

Harmonics Audit Services

Get Price Quote

Our Harmonics Audit Services offer a thorough analysis of your electrical systems to identify and mitigate harmonics-related issues. Our specialized team assesses equipment, measures harmonic levels, and recommends tailored solutions. By addressing harmonic distortions, we enhance power quality, improve equipment lifespan, and prevent disruptions. With our services, you can ensure a more stable and efficient electrical environment, minimizing downtime and maximizing productivity.

Pharmaceutical Auditing Services

Get Price Quote

Our company has earned accolades in offering Auditing Services to the clients. Our well-experienced charted accountants enable us to render these services that cover all direct and indirect taxation, auditing and book keeping, corporate law, MIS reporting and many others. We have team of professionals to conduct such audits. These services for in depth checking of day-to-day transactions, large business

Statutory Audit Service

Get Price Quote

Auditing of the records of accounting in accordance with the provisions of the Statute to maintain a accurate and equitable representation of the accounting in conjunction with the specific legal situation in which the audit is undertaken. To order to maintain accurate and equal accounting of transactions and other claims of incorporation of all accounting under the Indian Company Act, the reports will be audited by the CA. The auditor shall track and evaluate each report in accordance with the provisions and legislation of the Company Act. Statutory is essential for assuring the reliability of company’s annual accounts of various stakeholders like debtors, creditors, bankers, shareholders and government. The process of the statutory audits has become increasingly complicated recently. Statutory environment in cooperation with synchronization of various accounting parameters and the reliance of various stake holders on audited accounts have increased the questionability of statutory auditors. Our statutory auditing team consists if experienced professionals for effectively conducting the statutory auditing procedure. The team members remain acquainted with the latest changes in the statutory auditing arena for staying ahead in the loop. Our statutory audit department conducts audit by adhering to various global accounting and auditing standards for conducting fair and accurate audits for various stakeholders like government, bank, financial institution, general public and investors. You can contact us for enquiring more about the statutory audit services.

ROC Audit service

7,000 - 10,000 Per Others

ROC audit services help businesses ensure compliance with the regulations under the Companies Act, 2013. This audit involves a comprehensive review of a company's records, financial statements, and corporate filings with the Registrar of Companies (ROC) to verify that all statutory requirements are met. Professionals conducting ROC audits check the accuracy of filings such as annual returns, financial disclosures, and other forms like AOC-4 and MGT-7. The service also identifies any discrepancies or non-compliance, helping businesses avoid penalties. Regular ROC audits promote good corporate governance, enhance transparency, and ensure that a company’s operations are in line with legal requirements.

safety audit services

Get Price Quote

With Safety Audit Services, EHS India Services assists you in identifying skill gaps and mapping out your training requirements so that your organisation may reach its maximum potential. Our comprehensive training expertise is results-driven. As a result, we create training programmes that correspond with your operational goals, ensuring that the results transfer into measurable behavioural change. Our training expertise has also taught us that learning that allows learners to apply abstract safety abilities to very actual workplace circumstances results in long-term behavioural change. The ability to integrate these training programmes into the wider corporate safety culture and managerial procedures are critical to their effectiveness. We operate directly in your organisation or in an external location that we can select jointly based on your needs and budget.

Factory Audit Services

Get Price Quote

Forensic Audit & Investigations

Get Price Quote

Analyzing the opportunities as well as risks of performing outbound operations is imperative for any business and forensic audit and investigation is one of the first steps of it. The forensic audit & investigation services that we are offering from our office in Delhi, India, have assisted many companies across the globe in performing risk-free operations. Our team of forensic accountants, auditing experts, and investigators enable us to assist the companies in any type of fraud-related incidences or investigation. Our team works swiftly in such situations to ensure speedy investigation and audit.

auditing service

Get Price Quote

Our auditing services provide a thorough examination of your financial records, ensuring compliance and transparency. We offer internal and external audits, risk assessments, and regulatory compliance reviews, tailored to your business needs. Our experienced auditors deliver precise, unbiased reports, identifying areas for improvement and safeguarding against potential risks. With a commitment to integrity and accuracy, we help you maintain financial health, enhance operational efficiency, and build stakeholder confidence. Trust us for reliable auditing solutions that support your business's success.

Occupational Safety and Health Audit

Get Price Quote

We are a reputed firm engaged in offering Occupational Safety and Health Audit services. Located in Mumbai, Maharashtra, we take up audit projects from all over the state and surrounded areas. Occupational Safety and Health Audit is conducted in terms of IS 14489: 2018. These services are rendered to check the adequacy and suitability of safety systems of the company. Also, it takes in account the implementation of the safety systems in the plant. Audit provides an opportunity for the company to assess its own OS & H system against set standards/norms.

Pharmaceutical Auditing Service

Get Price Quote

Established in 2017, LSF MN has been operating as a single window solution provider for a variety of pharmaceutical auditing needs of the clients. The company is based in Noida (Uttar Pradesh, India) and has a support of qualified & experienced pharmaceutical auditors, who work proficiently to assist clients in adhering to the stated industry norms. With our pharmaceutical auditing services, we assess the client’s functional operations and providing assistance to meet the regulatory norms. For a detailed discussion, ring us on the given numbers.

Compliance Audit & Consulting Services

Get Price Quote

Are you facing compliance or risk challenge? Do you seek compliance expert that understands your industry? or you just want consultancy to gain peace of mind that your business is meeting its compliance obligations? Well, we can help you in all such concerns. Ours is a Delhi, India based service provider agency, specialized in providing compliance audit and consulting services to SMEs and large enterprises. Our consultants work alongside, perform assessment of your business and provide analysis report detailing key finding and recommendations- essential information to improve and move forward. So, contact us anytime.

Internal Auditor Training Courses

Get Price Quote

Eligibility to attend the course: Any degree holder .This course is designed to make a person capable of conducting Internal audit of any organization. Certificate would be provided to participant to give evidence for qualification as Internal auditor.Participant would understand the requirements of standard by undergoing this course and would get a general checklist for auditing an organization. Exercise would be provided to train the participants. On completion of the course a test paper would appear online for completion or this would be sent by e mail to participant for completion and return.The above is course content according to standards (I.E. ISP 9001:2015/ISO 14001:2015/ISO 45001:2018/ ISO 50001: 2018 either as a single topic or in combination as described in the course topic)Next step Register for the course by filling up following details. Attend course Attend examination Course pass when marks obtained is 75% and above - Download certificate Repeat exam when marks obtained in below 75%. Course Fee Per personSeparate standard ₹ 900 / US $ 12.5(for each topic, For combination of two topics ₹1700/ US $ 22 ; Combination of three standards ₹2360 / US $ 31

fire safety auditing services

Get Price Quote

We are engaged in rendering our quality Fire Safety Auditing Services that is widely demanded in several sectors. We are backed by experienced professionals who are capable of identifying the pressure points of fire in a territory and providing valuable insights on how to deal with it. We are proficient in timely covering all the aspects of the auditing services. Because of our prompt service and reasonable charges, we are regarded as a reliable Fire Safety Audits Service provider from Hyderabad.

Steam Audit Services

100,000 - 500,000 Per Set

Boiler House Efficiency Improvement : Establish the present steam generation from the boiler and the steam loading pattern of the plant i.e. peak, average and minimum loads based on the metering and system at plant Evaluate the efficacy of the present operating practices and recommend any changes to ensure optimum boiler efficiency. Study the present blow down philosophy and suggest methods to optimize blow down and heat recovery from blow down. Study the present feed water management philosophy and same will be evaluated to ensure optimum feed water temperature to the boiler. Evaluate use for LP flash steam in the plant or take it back to feed water tank of boiler Evaluate the efficacy / feasibility of using heat from available waste heat streams in the process towards heating the feed water Quantify the potential for steam reduction in the plant : Evaluate the steam distribution network in the plant: Line sizing and routing Distribution with respect to pressure drop if any Type, quality & health of insulation. Condensate removal from steam mains. Establish % distribution loss on account of leakages and radiation and suggest methods to reduce the same Evaluate the desired vs actual parameters for steam as required by the process equipment Evaluate the plant historic data and observe the current operations for anomalies such as batch time / throughput variations and evaluate the impact of the current steam and condensate network on such variations Evaluate the current steam supply parameters vis-à-vis the process recipe requirements including gradients etc. and evaluate gaps within the same Evaluate the plant for any throughput bottlenecks due to the steam system Evaluation of hot water generation and utilization in the process. Key Takeaway Points : Avoiding clinker formation inside the boiler Increase the inlet air temperature to increase boiler efficiency Avoid High Negative Draft in Solid Fuel Fired Boilers Generate Steam at Higher Pressure Dissolved oxygen should be removed from the feedwater tank Injection of flash steam and condensate into the feedwater tank should be via a deaerator head Air to fuel ratio should be monitored and controlled to minimize unburnts Efforts should be made to minimize addition of surface moisture content in fuel. To deliver the same amount of energy, the flowrate of hot water will have to be 45 times than that of steam. Monitor flue gas temperatures to control stack loss. Using steam instead of thermic fluids for indirect heating is more efficient. Monitoring flue gas temperature gives a good indication of the boiler operating conditions Operating boiler closer to full load improves efficiency Higher feedwater temperature increases the boiler output Use saturated steam for indirect heat transfer applications. Every 6 DEG. C rise in feedwater temperature reduces the fuel bill by 1%.