REGISTRATION OF SERVICE TAX

Get Price Quote

We are backed by a team of professionals having years of experience and in-depth knowledge in this field. Our services are widely acknowledged for the precision, reliability and on-time execution. Our experts keep pace with the newest trends and hence, it is easy for us to provide the most reliable services. Fret not over the prices as we aren√ĘÄôt going to charge you more. We are ranked among reliable providers of premium Professional Tax Services.

GST refund

Get Price Quote

1 Unit (MOQ)

We can provice the GST refund Services As per Section 54(3) of the CGST Act, 2017, a registered person may claim refund of unutilised input tax credit at the end of any tax period. A tax period is the period for which return is required to be furnished. Thus, a taxpayer can claim refund of unutilised ITC on monthly basis..We Can Give GST Refund service in all over TamilnaduGST Refund Service can be claim by below 1. GST Paid Excess the value of Actual Tax2. GST Wornlgy paid in vise verse head3. GST Paid on export bill4. GST on ITC for Export ServicesAbove all can claim GST Refund .. GST Refund time duration is 7-15 Working days . GST Refund  Application will fall in State office

Looking for Tax Consultancy Service Providers

monthly gst filings

1,000 Per Monthly

Monthly GST filings at Rs 1000. Payment will collected after work done

GST Registration Services

Get Price Quote

Finacserve in Chennai, Tamil Nadu, is one of the most trusted GST Registration Services providers. We help any business owner get their business GST registered and obtain their GSTIN. We cover various entities like proprietorship, company, enterprise, LLP etc. Our experts CA will guide you on the applicability of your commerce and compliances under GST for your business. Get your commerce registered under GST without hassle online with our GST registration services. We have a team of experienced CAs handling any requirement and filing for GST registration. We have the expertise to handle the GST Registration Service by submitting all the necessary documents. Join us now.

gst annual return filing

600 - 1,500 Per Month

Tax accounting and outsourcing services

Get Price Quote

Cfo angle is an organization which has 20+ years of experience of working. Cfo angle provide outsourcing services, they have well-trained and experienced staff. You can outsource all your legal responsibility to them like gst registration, gst return filing and tax accounting and outsourcing.

gst consultant

1,000 - 1,500 Per Bag

Goods and service tax registration and return filling is mandatory for all type of businesess.We assist you to register your business with GST and file your returns every month at @ 500/Month

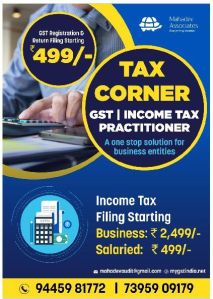

GST Registration by Vakilsearch

499 Per Bag

Vakilsearch is India’s top online platform for legal, tax, and compliance services. We streamline the GST registration process, making it fast and stress-free. Our team of experts manages everything from document preparation to submission, ensuring full compliance with legal requirements. With Vakilsearch, you can focus on growing your business while we handle the paperwork. Whether you're a startup, small business.

tax planning

Get Price Quote

Taxation being a highly specialized area requires skills relating to planning, documentation and representations. We provide services of experienced professionals at very competitive charges. Our network of professionals assists you in selecting the best alternative. Depending upon the subject matter, we select the right person to ensure that the best possible and well planned solution is achieved for your problem. Indian taxation environment is ever-changing, which can be challenging for any business. Our Main focus is to identify opportunities for our clients that can help them to manage their affairs in the most tax efficient manner. Our Tax team has particular expertise with taxation issues arising from commercial business transactions. By identifying taxation implications at the deal development phase, we can ensure that most tax effective approach is adopted for each transaction reducing the likelihood of any future disputes and litigation. To help you respond to these demands, we provide assistance in three key areas: Tax Accounting: Supporting quarterly and annual tax provision calculations, validating tax balance sheet accounts and implementing new accounting standards. Tax function performance: improving operating strategy and organization design, tax process and controls, and data and systems effectiveness Tax Risk: Identifying and prioritizing key risks and assisting with controls monitoring and remediation the scope and nature of our services may differ depending on whether you are an auditor non-audit client. What's consistent is the high-quality service our professionals provide to address your unique needs, throughout the entire tax life cycle of planning, provision, compliance and working with the tax authorities.

Tax Consultant

Get Price Quote

Gst Registration   Gst Returns   Income Tax Filing   Project Report - Provisional & Projected   Firm Reg - MSME - PVT LTD (ROC) - SSI   PF-ESI   FOOD LICENCE - Fssai   IE Code - APEDA - MPEDA   Digital Signature - DSC   Pan Card   TDS Refund..

tax planning

Get Price Quote

AssuredGain can help you to formulate strategies to reduce the amount of income taxes, thereby making funds available to allocate toward long term dreams. Tax Planning is an ongoing process that should be reviewed every year. The criteria of selection of investments are Risk & Return, Liquidity, Protection from Inflation and Tax exemption. Tax planning is a vital part of your financial planning. Efficient tax planning enables you to reduce your tax liability to the minimum. This is done by legitimately taking advantage of all tax exemptions, deductions rebates and allowances while ensuring that your investments are in line with your long term goals. Tax planning is the duty of every responsible citizen of the country. Simply paying all the taxes as applicable is the one option and minimizing the Taxes through proper Tax planning is the other. Most people choose second option as it is a fundamental right of every citizen to avail all the tax incentives provided by the government. Importance of business tax planning Tax planning strategies are typically employed to help a business achieve their financial and business goals. There are benefits of tax planning for both large and small businesses and planning plays an important role in: Lowering the amount of taxable income Reducing the tax rate Allowing greater control of when taxes get paid Maximising tax relief/tax credits available There are always new laws and changing allowances, so regular reviews are important.Overall, there are many reasons why tax planning is important. If you would like to know how you can begin to manage your tax more efficiently, whether you own a business or are a private individual, speak to a solicitor or a financial advisor today.

GST Return Filing Services

Get Price Quote

GST return is a documentation of all Sales details, Output tax liability and Input tax credit available. Filing these GST Returns requires tax liability payments to the government by the taxpayers.

GST registration consultant

Get Price Quote

Greetings from KMS License Service!!!!! GST Certificate MSME / SSI / UDYAM / UDYOGs Current Account Open FSSAI (FOOD LICENSE) - CATERING ,RESTAURANT ,HOTEL ISO Registration (9001: 2015, 22000 : 2018) HALAL Reg GMP TRADEMARK Registration For More details Whats app 80150 63438

Accounting Services, Taxation Services

Get Price Quote

Kbs accountant gamut of services include accounting services, audits, certification, reviews and compilations, bookkeeping/write-up, consulting services, tax services, legal services & documents drafting management consulting, other services.

Service Tax Registration

Get Price Quote

We have gained prominence for offering flexible Service Tax Registration Services in India. Our Service Tax Registration service adheres completely to the concerned rules and regulations. With the help of our legal advisers and consultants, we are able to figure out to the requirements of the clients.

file income tax return service

Get Price Quote

file income tax return service, Trademark Registration

Service Tax Consultancy

Get Price Quote

We the professional group offering consultancy services in service tax right from registration and collection and remittance of tax including offering opinion and suggestions.

Gst Consultant Service

Get Price Quote

Gst Consultant Service, payroll process outsourcing service, HR Consultants

GST Filing

Get Price Quote

GST Filing, roc filing

Service Tax Consultants

Get Price Quote

Service Tax Consultants, Income Tax Coaching Classes, tally training services

Sales Tax Registration Service

Get Price Quote

We do all tax related services like service tax,sales tax ,central excise, ie code registration ,private ltd, public limited,partnership,llp,trade mark,logo,shops & establishment,professional tax, pan/tan card,website , audit work & taxation work.we are experienced in this field for about 10 years.

Tax Advisory

Get Price Quote

Tax Advisory, Finance Consultant

income tax return filing service

Get Price Quote

we are providing income tax return filing service. RECKON is working for numerous clients and had gained good reputation for their quick, timely and intellectual responses over the needs of their clients

vat services

Get Price Quote

VAT Services, termed as indirect tax, has now an important part of day to day business activity. The complex functioning of this tax system leaves a substantial influence over businesses. To help you with complexities of VAT, we provide you several VAT related services. In India each state has different VAT Laws. We help our clients with VAT Registration, to plan reviews, help them in pricing the Products / Services and filling the periodical returns. Our effective, peerless Value Added Tax Services help you manage your VAT related problems efficiently to let you fast develop your business.

GST Return Filing

Get Price Quote

GST portal, attend webinars, and refer to official notifications and circulars issued by the government. By following these guidelines and maintaining accurate records, you can ensure smooth GST return filing in Chennai and stay compliant with tax laws.

Taxation Services

Get Price Quote

At IKIA we have our real estate tax advisory team offering tax planning, loan computation, capital gains assessment and returns on investment services to our clients to ensure effortless formation, acquisitions and disposition. The taxable and non taxable entities are structured and clearly demarcated. Assistance in preparing statements of finance for jurisdictional and cross border filings are done by our advisors. There are effective processes that work towards implementation of tax compliances to ensure safe investments.

Taxation Services

Get Price Quote

Your would be enjoying a good property here but are worried of caring the same. Your near & dear relatives, no doubt, would be willing to take care but depending on them all the time is certainly an embarrassment for both sides domestically and financially.

Taxation Service

Get Price Quote

We are offering TAXATION service

Taxation Service

Get Price Quote

Registration of concern with Service Tax Department Helps on reconciliation of amount to be paid with department before due date Online return filing on service tax Helping Client on Cenvat credit on Service Tax We give complete solution on refund of Service Tax from Department for SEZ Units in short time (end to end process) Helps in refunds for DTA units

gst consultant

Get Price Quote

gst consultant, esic consultant, Import Export license