Unsecured Loan Services

An unsecured loan is a loan that doesn't require any type of collateral. Instead of relying on a borrower's assets as security, lenders approve unsecured loans based on a borrower's creditworthiness.

...more

Trade Finance Consultant Services

Smart KG Financial Services can help you examine long-term loans, export credit, working capital and trade finance. We have direct experience with commercial and investment banks, development banks, multilateral financial institutions, investment funds, and export and investment insurance agencies. Our team of specialists regularly analyzes finance trends to ensure that we are at the forefront of trade finance. Our International Trade Finance Group offers expert advice to mitigate risk and enhance revenue opportunities when conducting international trade. We understand credit and payment risks and can help formulate a tailored trade solution to improve your competitiveness in the global markets. Therefore choosing us to get trade finance consultant services is the best choice.

...more

secured loan services

A secured loan is a loan backed by collateral—financial assets you own, like a home or a car—that can be used as payment to the lender if you don't pay back the loan. The idea behind a secured loan is a basic one. Lenders accept collateral against a secured loan to incentivize borrowers to repay the loan on time.

...more

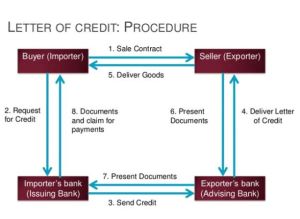

LC Import Services

An Import LC is one of the most secure methods of importing goods and it allows you to control shipping dates or facilitates a shipment schedule. Many Exporters will not provide goods unless they receive payments in advance or are guaranteed payment by a bank. An LC is a conditional payment guarantee provided by an Importer's bank to the Exporter. The payment guarantee is conditional upon the Exporter providing documentary evidence of the shipment of goods in accordance with the terms of the LC. Import LCs are subject to credit approval. The Facility includes Collateral and non Collateral Facility.

...more

LC Document Preparation

Preparation of Own Documents As per the regulations and requirement of the Letter of Credit Received, by an Professional Trade Finance Team. Helps Exporter to avoid Discrepancy Fee and unnecessary Disputes on the Documents presented for Payment. This helps business to get payment on Time and to reduce unwarranted Cost.

...more

LC Bill Discounting

Discounting of Letter of Credit is a short-term credit facility provided by the bank to the beneficiary. Bank purchases the documents or bills of the Seller (beneficiary) after he fulfills certain compliances and provides the required documents to be dispatched to LC opening bank. On meeting these compliances as per the LC terms, the bank makes him/ her the payment for a security or a fee.

...more

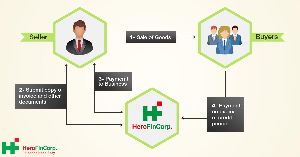

import export services

Smart KG Financial Services offers customers the best import export services to customers all around the world. Thinking why to choose us? Companies that provide import and export services face the everyday legal provocations of dealing with the laws and rules that govern this industry. Since each country throughout the world has its unique laws that regulate outsourcing import and export services, the legality surrounding the way a private company deals with these laws can be confusing and overwhelming. Not being familiar with the laws of a country that you would like to conduct business with, often results in imports and exports being held in customs for an indefinite amount of time. This is why choosing us is the best idea.

...more

GOODS EXPORT SERVICES

Exporter is a person or a company authorized by government agency to move the goods out of the border of a country. The value of goods is received from the overseas buyer by the exporter, as he is considered the seller of goods. The exporter receives export order against goods to be exported.

...more

Good Import Services

Imports are the goods and services that are purchased from the rest of the world by a country's residents, rather than buying domestically produced items. Imports lead to an outflow of funds from the country since import transactions involve payments to sellers residing in another country.

...more

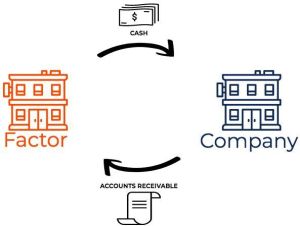

Financial Factoring

Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable (i.e., invoices) to a third party (called a factor) at a discount. Factoring is commonly referred to as accounts receivable factoring, invoice factoring, and sometimes accounts receivable financing.

...more

Facility Arrangement Services

Also known as a loan or credit facility agreement or facility letter. An agreement or letter in which a lender (usually a bank or other financial institution) sets out the terms and conditions (including the conditions precedent) on which it is prepared to make a loan facility available to a borrower. The loan facility is typically a Term Loan, Pre Shipment Finance or overdraft. A facility agreement may contain more than one loan facility.

...more

Domestic Business

Domestic Business Service Domestic business is where a company has economic transactions that are done within the country's geographical limits.

...more

Business Overdraft

A Business overdraft is a credit facility that allows you to withdraw an amount as and when needed. You can also repay the withdrawn amount at your convenience. Hence, it is one of the most preferred credit options availed to meet varied personal funding requirements without limit. This is available against Collateral or Cash Credit Account.

...more

lc document preparation services

We prepare LC Document Preparation as per the requirements and conditions of the LC. We prepare own party documents and provides support on checking the Third party documents required in the LC. Terms and Condition Apply

...more

LC Discounting Services

We arrange for Usance Letter of Credit discounting at the best pricing with Banks. This is generally a Post Shipment Financing. Upon shipment documents will be presented to the Bank. Once the Bank receives the Acceptance to pay on future due date, the Exporters bank will Finance the document. Terms and conditions apply.

...more

Import Letter of Credit

We arrange for Import Letter of Credit for the Importers and Buyers. Based on the country of Import we can arrange for non collateral Import Letter of Credit. For other customers, we can arrange for collateral Import Letter of credit at a best rates Terms and Conditions apply

...more

Invoice Discounting

Also called as Factoring. This is done by NBFC. This facility is without recourse. Means, once the financing is done, even if the Importer did not pay, its not the responisbility of the Exporter to repay the Finance. Normally 90% of the Invoice will be financed. Terms and Conditions apply

...more

Bank guarantee

This is a document issued by the Bankers. Performance Guarantee, Financial Guarantee, Payment Guarantee, etc are types of Guarantees. These arre specially required for Govt Supplies. We have option to get Collateral Free Bank Guarantees Terms and Conditions apply.

...more

Standby Letter of Credit

This is an Financing Tool available for the Exporter. We can arrange for a Banking Facility against this document received from the Importer. Terms and Conditions Apply

...moreBe first to Rate

Rate ThisOpening Hours