Smallcase Investment Service

Get Price Quote

What is a smallcase? A smallcase is a basket of exchange traded securities (like stocks & ETFs) to reflect a certain objective (ideas, themes, strategies). A smallcase has a minimum of 2 securities and a maximum of 50 securities. How is it different from stocks? Investing in a basket of stocks gives you diversification benefits that minimize stock-specific risk. Instead of picking stocks, you can invest in ideas you believe in with research-backed portfolios that are tied to relatable themes. No fees are charged for smallcase transactions. Standard brokerage applicable as per your broker. Which smallcase should you invest in? smallcases work best when used for long-term investing. So ideally, you should be investing in a smallcase whose theme/strategy you think will do well in long run. Additionally, you can use risk labels assigned to smallcases to find one that suits your risk appetite. How do you track your smallcases? When you invest in a smallcase, the index value is set to 100 on the day of investment - this helps you track the total returns without having to monitor each stock. You can also use the performance metrics to get a more detailed understanding of your smallcase. Can you add or remove stocks yourself? With smallcases, you have complete flexiblity over your investments, so you can add or remove stocks anytime with the 'manage' option. However, please ensure that you don't sell any smallcase stocks directly on the trading platform. Are there any lock in periods? There are no lock-in periods, so you may sell your smallcases anytime. As a concept however, smallcases work best when used for long-term investing. Do's and Don'ts Start an SIP to invest periodically Once you have invested in a smallcase, you can safeguard your investments from market volatility by starting SIP to invest more regularly. When your SIP instalment is due, you can confirm investing more in 2 clicks. Rebalance your smallcases regularly Rebalancing is the process of ensuring the constituents of the smallcase continue to be true to the underlying idea/strategy. You can apply rebalance updates to your smallcase in 2 clicks to ensure it is on track with the strategy. Do not sell stocks on broker platform To ensure that your smallcase constituents are in sync with your holdings, please refrain from selling smallcase stocks on the trading platform. Any sell orders placed directly on the trading platform won't reflect in your smallcase. Don't let emotion drive investment decisions You can assess how the theme that you have invested in is playing out and reap its benefits only when you stay invested for a long term. It's best to not base investment decisions on short-term fluctuations.

Advertising Services For School

5 - 10 Per Day

हमारी कंपनी 20 साल पुरानी है जोकि आउटडोर एडवरटाइजिंग में नंबर वन कंपनी है और हमारे दोस्तों प्लस क्लाइंट्स हैं जिनको हम कई सालों से सर्विस देते आ रहे हैं हमारी कंपनी को भारत सरकार और राजस्थान सरकार से करीबन 20 प्लस अवार्ड मिल चुके हैं हमारी कंपनी ऑल ओवर इंडिया बेस्ट कंपनी है हम लोग आउटडोर में नंबर वन कंपनी हमारी मानी जाती है हमारा मेन जो काम है मोबाइल वैन पब्लिक सिटी बोर्डिंग डीलर ब्रांडिंग एंड डीलर मीटिंग फ्लेक्स प्रिंटिंग पब्लिक स्कूल में आते हैं हमारी कंपनी लगभग 200 प्लस एमएनसी कंपनी के साथ काम कर चुकी है हमारी कंपनी आउटडोर और ऑफलाइन एडवरटाइजिंग में प्रचार प्रसार में नंबर वन कंपनी हमारी कंपनी 200 प्लस ऑटोमोबाइल सेक्टर कंपनी के लिए काम कर चुकी है हमारी कंपनी रूरल मार्केटिंग के लिए नंबर वन कंपनी है हमारी कंपनी लगभग 20 साल में ऑटोमोबाइल सेक्टर मोबाइल सेक्टर टेलीकॉम सेंटर और ऑटोमेटिक बैटरी सोलर यूपीएस एंड अन्य सेक्टर में काम कर चुकी है हमारे पास की आवाज में और सर्टिफिकेट में हैं हमारी कंपनी 20 सालों में लगभग 1 प्लस रहता है हमारी कंपनी लगभग पूरे भारत में काम करती है हमारी कंपनी नॉर्थ इंडिया में नंबर वन मानी जाती है हमारी कंपनी भारत की कंपनी है हमारी कंपनी को लगभग 20 साल पूरे हो चुके हैं काफी दिनों से मेहनत कर रहे हैं हमारी कंपनी फाइनेंस इंश्योरेंस ऑटोमोबाइल एमएनसी ऑयल एंड सीएनसी एंड अन्य सभी कंपनियों के साथ काम कर चुकी है हमारे सभी सेक्टर में एक लाइन अवेलेबल है जिनके साथ हमारा बहुत अच्छा व्यवहार रहा है और हमने उनके लिए बहुत अच्छा काम किया इसलिए मैं घोषणा करता हूं कि हमारी कंपनी के साथ काम करें और हम आपकी कम भविष्य में आपके काम को और आपकी कंपनी को बढ़ावा करने में सहायता करेंगे

Looking for Investment Service Providers

Nri Services

Get Price Quote

MAP Global Logistics, in collaboration with its sister concern Gold Vanlines, offers comprehensive services tailored for Non-Resident Indians (NROs). With two decades of experience, we provide expert international trade services for imports and exports, ensuring efficiency and commitment. Our offerings include: Custom Duty and Policy Guidance Import/Export Data Analysis VISA Assistance International Trade Consultancy Sea & Air Freight Brokerage Government Approved Custom House Agents Our specialized outsourcing services guarantee significant cost savings and top-notch quality, completed on schedule by highly trained staff. Benefit from our expertise and let us handle your international business needs seamlessly.

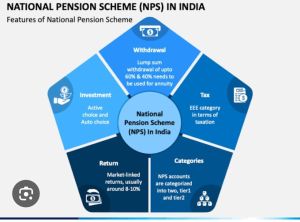

National Pension System Service

Get Price Quote

NPS INVESTMENT--- The National Pension System (NPS) is a retirement savings plan that allows individuals to contribute to their pension account while they are working. The goal is to build a pension fund that can provide a regular income after retirement. Here are some things to know about NPS: Eligibility NPS is available to all Indian citizens between the ages of 18 and 70, including those living abroad. It is mandatory for Central Government employees who started working on or after January 1, 2004, with some exceptions. Many State Governments have also adopted NPS for their employees. Contributions Individuals can contribute to their NPS account, and their employer can also contribute on their behalf. Account opening When an individual opens an NPS account, they receive a unique Permanent Retirement Account Number (PRAN). Withdrawals Individuals can make partial withdrawals from their NPS account up to three times during the account's lifetime. They can withdraw up to 25% of their contributions at any time, excluding employer contributions. Phased withdrawals Subscribers can choose to withdraw their lump sum amount in phases over a period from age 60 to 75. Tax efficiency NPS is a tax-efficient way to save for retirement. Risk tolerance NPS may be a good option for people who are willing to take moderate risks and seek higher returns.

investment casting services

Get Price Quote

Perfect Engineers offers top-quantity investment casting services. Our in-house services comprise advanced machining, ceramic mold making, heat treatment, and casting for numerous materials and project results. We give dimensional precision and precise components depending on the precise requirements of your project. Our supreme industry experience and access to advanced tools give project managers the ability to create high quantity metal parts and elements within the size and range of timelines, budgets, and quality standards. If machining is necessary, our one-stop-shop can deliver outside finishing for intricate geometry parts. If you are interested in our services, contact us now for more information.

Insurance & Investment Consultant Services

Get Price Quote

As a prominent figure in the industry in providing of Insurance & Investment Consultant Services, we bring you a wide range of perfect quality. We hire a team of trained professionals who are able to analyze the market and provide consultation accordingly. We offer to help you with all kinds of insurance and investment decisions. Our fascinating services are immensely popular in the market. We help our clients to steer clear of the hassles that come along with the tedious details and get them the best investment alternative with a long term view. Details : More than providing peace of mind your family and yourself, life insurance can be one of the best investment decisions you have ever made. With stringent regulatory conditions to safeguard policyholders, traditional life insurance policies carry minimum investment risk and provide long-term insurance benefits. Most life insurance policies include retirement income on maturity. Another advantage of life insurance is that the coverage amount can be increased over time. So, while presently, you can afford only a low insurance premium with your current salary, over time with increasing income through promotions or new income sources, you can increase your insurance cover by paying slightly higher premiums and provide a better life cover for your family even when you are not around. It is always better to invest your hard earned savings which will provide you with long-term benefits than to seek short-term benefits from high-risk investment ventures. Whether you have just started your career, are recently married or blessed with a family, securing adequate life insurance can prove to be the best investment decision you ever made.

Fund & Investment Management Services

Get Price Quote

Fund / Investment management is the professional asset management of various securities (shares, bonds and other securities), money or cash and other assets (e.g., real estate) in order to meet specified investment goals for the benefit of the investors. Investors may be institutions (insurance companies, pension funds, corporations, charities, educational establishments etc.) or private investors (both directly via investment contracts and more commonly via collective investment schemes e.g. mutual funds or exchange-traded funds).By selecting the already developed application you will not only save your precious time but will also save money which really matters for any business. And there is no chance of failure for our products as they are already tested by our previous customers. As this Fund management application is developed by us thus there is always a possibility of customisation whenever you require.It Includes Regular Bhishi Lilav Bhishi Lucky Draw Bhishi Other ways So Enjoy the benefits like Registration of fixed customer collection of monthly deposits from members Distribution of money in member with 1% / 2 % interest Money collection management for distributed members for three months It show the interest rate per month and 3rd month it shows total collected amount plus interest and there monthly deposited amount in total Features Save member details Send monthly collection sms alerts Save monthly collection detail, apply fine if any. Send monthly amount paid sms Send monthly selected member name, token no. Generate statement for members Generate common statement for fund admin Each member can view monthly updates, personal profile, change contact details etc.

Investment Services

Get Price Quote

It’s filled with the fruits of the past and the blossoming buds of tomorrow. However, it is also filled with the thorns of uncertainties and eventualities. Most of us, in our worries about the uncertain, forget to enjoy our lives. Edelweiss Tokio Life Insurance offers solutions in the form of Investment Plans. These plans offer protection for life as well as the opportunity for wealth creation, so that you can reap its benefits in the future and enjoy the fragrance of flowers!What are Investment Plans?An investment plan is an insurance plan that helps you in saving wealth for the future. The premium payments are used to build a savings corpus, and to provide life cover to you and your family. People choose investment plan because it provides an opportunity to grow their wealth to fulfil their future goals. Investment Plans provide the opportunity to create short-term and long-term wealth for the future. They help you meet your financial goals like child’s education, buying a house, car, or even your dream vacation by accumulation of wealth over a period. Investment plans help you save in a systematic manner, protect your loved ones, and save on taxes.For example, a guaranteed income plan can help you in building the engines of income for tomorrow with life cover and tax benefits. Another great example of an investment plan can be a Unit Linked Insurance Plan (ULIP) that combines the benefits of investments and life cover under a single plan. Premiums paid are invested in market-linked investment instruments, as well as to provide life cover to you. Though ULIPs are moderate-to-high-risk plans, they are mainly chosen for their potential to generate higher returns.

sebi registered investment advisory service

3,999 Per Month

30 Days (MOQ)

We are SEBI Registered Research and Investment Firm. Option (Call Put)is our best product with highest customer satisfaction. Generally Options are considered as instruments for highly skilled traders, but we provide them in very simple language. Options provide increased cost efficiency, are less risky than other equities, have potential to deliver higher percentage returns and offer a number of strategic alternatives. · In Option (call put) pack we provide daily 4-5 calls in Index and Stocks both. · Calls are hedging based and trading in all calls would require a capital of 50 k. · Calls are given on What’s app and telegram both and customer support is excellent. · In this package we provide hedging based calls. · Low risk Limited return is our motto. · Follow up for all the calls will be provided. · Service fees start with just 6500/- per month. Our SEBI Registration Number is INA000002348

investment portfolio management

Get Price Quote

Blue Sky Realty is an Ahmedabad-based company that offers top quality and personalized investment objectives for a variety of clients from different walks of life. Our Company provides the best investment solution to our clients based on their niche segment to guarantee the creation of wealth. Our team of experts provides ample time for our clients to discuss their portfolio spread & returns. We believe in value-added services and therefore is the ready answer to all the queries of our clients 24/7 regarding investment portfolio management. We follow ethical business practices and offer great services at Market Competitive prices to our valuable customers.

Investment & Property Advisory Services

Get Price Quote

Property Shoppy is an acclaimed organization in terms of investment in the real estate sector. We are a group of well-trained experts hailing from diverse backgrounds in the real estate business. We at Property Shoppy provide the best Investment & Property Advisory Services to our customers. With deep research and market analysis, we help you to choose the best property for investment. The complete process of documentation is detailed smoothly to avoid any confusion for finalizing the deal. Stay ahead by joining the best minds in the real estate segment. Count on us at Property Shoppy, for bagging a wonderful opportunity to invest in properties.

real estate investment services

Get Price Quote

You may concentrate on your primary business by choosing the perfect partner to help you with the ongoing back-office activities of your real estate investments. such as producing profits for your investors and finding new chances. We at Agra Property Bazar in Agra, Uttar Pradesh, can assist you thanks to our extensive knowledge and global network of real estate investment services experts. Throughout the fund lifespan, we assist with the shifting operational needs and monitor the progress of your funds over time. Regardless of how you choose to collaborate with us, you'll gain from our in-depth familiarity with regional regulations and our expertise in managing intricate cross-jurisdictional fund structures.

investment planning

Get Price Quote

Investment planning can be done for anything you want or need it. Investment management is probably the most complicated area of financial planning and is therefore where many of us procrastinate. But it doesn’t need to be so difficult: incorporate simple money truths into your financial strategies so you can make decisions with confidence and understand the potential risks and benefits of investing by Investment planningWe all have different goals – buying a house, giving the best education to the kids, see them building family, retirement and a lot more. Many of us also hope to achieve a level of wealth while providing for other goals. But the ultimate goal for anyone would be achieve the freedom from financial worries. This freedom is possible with smart goal-based investments.Just as people have different goals, there are investments to help achieve these objectives. Smartly investing your hard-earned money ensures that the right amount of funds are available in the right time.Investment planning is the process of matching your financial goals and objectives with your financial resources. Investment planning is a core component of financial planning. It is impossible to have one without the other.Investment PhilosophyOur objective is to invest your portfolio so that it will yield the return you seek with the lowest possible risk. The best way to achieve this is through diversification, in other words, the allocation of your portfolio among different asset classes. Simply stated, depending on your situation, your money is invested in a variety of stocks, bonds, commodities, natural resources, precious metals, and cash, and then rebalanced periodically.Investment Decision-MakingBeing diversified among asset classes does not mean living with low returns; rather, it delivers better volatility-adjusted returns. In addition, we believe: that portfolios should be rebalanced periodically in order to maintain a long-term chosen asset allocation (that can change when financial objectives change over time); that over the long-term common stocks outpace income investments (their higher expected returns are coupled with compounding interest); and that reasonable expenses and tax efficiency are important to total return.Types of Investments Stocks. A stock is an investment in a specific company. … Bonds. A bond is a loan you make to a company or government. … Mutual funds. If the idea of picking and choosing individual bonds and stocks isn’t your bag, you’re not alone. … Index funds. … Exchange-traded funds. … Options. Define Your GoalsInvesting begins with the determination of your ultimate goals. Knowing the results you want will help you more easily choose the right avenues and strategies to reach them.Defining your goals, such as earning money for a big purchase or growing your retirement fund, is an important part of investment planning that allows you to look at the big picture when creating your investment plan

Investments / Loan Syndication

Get Price Quote

Sach Consultant provides you the most comprehensive Investments / Loan Syndication. Our home loan consultants are the professionals who give you reliable and unbiased advice, while taking home loans in Delhi and NCR. The scenario of finance market keeps fluctuating and our home loan consultants keep you abreast with the market conditions. Sach Consultant has tie ups with Standard Chartered Bank and other reliable banks that can get you home loan on comparatively lesser rates. We can get you residential as well as commercial property loan in Delhi and NCR. Our consultants do thorough research and provide analyzed statistics of the market. Knowledge and experience of home loan consultants is the major asset of Sach Consultants. It provides major help to you and gets the most suitable home loan solutions. Our home loan consultants understand your requirement and provide you with the best home loan solutions. We can also assist you in getting loan against property in Delhi. We at Sach Consultant are fully equipped to assist our clients in arriving at safe, secure, marketable, liquidable investments on competitive Returns on their Investments. Our team of associates work regularily to attain the goals set by our clients with our assisstance and advice. The decision of our clients are always taken care of religiously to the core.

property investment

Get Price Quote

We at Gd properties are experts hired to study how well a property might meet the requirements of an investor. Our detailed knowledge of the industry allows them to offer top-notch advice to those looking for new properties to invest in. We will advise clients on opportunities in a specific real estate market so that the investment of the client increases many folds.

property investment

Get Price Quote

Investing in a property is always a great idea. The reason is that the price of the property always increase and your money will always be safe and might increase in a year. It is like a bank with no interests. But you must invest in a good property to get the maximum return. It might be difficult for you to get the best property to invest every time. Therefore, get help from the best professionals in our company. At Gudaria Group you will get the best property investment advises from our experts who have been in this field for several years.

property investment

Get Price Quote

Property investment is the best way to multiply your money. We are a Gwalior-based Real Estate Consultant. We can suggest you the right property and area in Gwalior, where you should invest your money. Currently, we have many investors who have decided to partner with us. We share our in-depth knowledge about the real estate sector with the clients and help them in making right property decisions. We deal in variety of property verticals and offer services all over Gwalior. Our services are being backed by a team of diligent professionals and we offer genuine advice.

property investment

Get Price Quote

property investment, Property in Thane, Property Buying Agent

Property Investment

Get Price Quote

Real Estate Developers, Builders & Developers, Real Estate Consultant

Equity Mutual Fund Investment Services

Get Price Quote

Elevate your investment journey with our Equity Mutual Fund Investment Services. Experience the potential for substantial growth by diversifying your portfolio with professionally managed equity funds. Our expert advisors tailor strategies to align with your financial goals and risk tolerance. Benefit from the dynamic nature of the stock market while mitigating risks through strategic asset allocation. Realize the power of compounding and long-term wealth creation with our transparent and efficient investment platform. Stay informed with market insights and personalized advice. Partner with us to navigate the complexities of equity investing, unlocking opportunities for capital appreciation and financial success. Your prosperous future begins with our Equity Mutual Fund Investment Services.