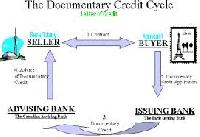

Letter of Credits

Banks issue letter of credits to ensure a healthy transaction between a buyer and seller without letting any fraud to take place. Letters of credit are very useful in International trades. A seller is ensured through a letter of credit that if buyer doesn’t pay for the purchased goods within specified time, the bank will pay on behalf of buyer. This is also good for buyer as the bank keeps an eye on whether the purchased goods have been shipped to the customer or not. The supplier is only paid when bank gets the confirmation that goods have been delivered. International trade using Letters of Credit function as per the guidelines of Uniform Customs and Practice of Documentary Credit of International Chamber of Commerce (UCP 600).

...more

Cash Credit

Cash credit limit is a running loan facility that a company can achieve by hypothecation of goods inventory. The inventory present in factory stores is submitted as security to the bank. Bank periodically assesses the value of secured inventory stock and checks stock statement. benefits: cc limit loan up to 20 % of estimated sales revenue, cc hypothecation loan: 25% of stocks, 50% of book debts interest rates may vary from 3% to 7%. Repayment tenure may vary from 2 to 5 years.

...more

Bank guarantee

Bank guarantee is a loan facility provided to a third party on behalf of a bank’s customer or guarantor. The bank guarantee is non-transferrable. bank guarantee amount can be achieved in inr or foreign currencies and can be invested in industries and real estate development. different kinds of bank guarantees are available that includes: performance, bid bond, financial, customs, tenders etc. Repayment tenure may vary from 2 to 7 years.

...more

Loan Service

At many instances of life, people feel urgent need of money and they are ready to take debts at suitable interest rates. Today many banks and financial institutions offer loans to needy people at reasonable interest rates. Loans can be acquired for different purposes and in different ways. Different types of loans are personal loans, home loans, car loans, gold loans, loan against property and others. When you get a loan by submitting some assets to a bank as security, it is called collateral loan.

...more

Personal Loan

Personal loan is an unsecured loan without any collateral. eligibility: a self employed person or a person on high salary package can apply applicant must be of minimum 24 years old the loan must be refunded before attaining 65 years of age or retirement, whichever comes first. requisite documents: photo id proof last 3 months salary slips and form 16 income tax returns for salaried persons last 3 years income tax returns for self employed last 3 years ca audited balance sheet for self employed pan card last 6 months bank statements you can apply for a personal loan to any leading financial institution such as hdfc bank, icici bank, bajaj capital, fullerton india and others. Depending upon income, one can get personal loan from 25,000 to 15 lakhs. Interest rates vary from 13.5% to 32%.

...moreBe first to Rate

Rate This