Smeta 2 Pillar and 4 Pillar Audit Sedex Certification Consultancy

90,000 - 120,000 Per Set

1 pack (MOQ)

The Supplier Ethical Data Exchange, or Sedex for short, is a globally renowned online platform that allows members to provide customers and partners with detailed information about their social and ethical performance. The aim is to ensure greater transparency across the entire supply chain.The SMETA Audit Methodology :SMETA audits use the ETI Base Code, founded on the conventions of the International Labour Organization, as well as relevant local laws. SMETA audits can be conducted against two or four auditing pillars. The two pillars mandatory for any SMETA audit are Labor Standards and Health & Safety. The two additional pillars of a 4-pillar audit were introduced to further deepen the social responsibility aspect of SMETA audits.A SMETA 2-pillar audit comprises the following modules: Labor Standards Health and Safety Additional Elements : Management Systems Entitlement to Work Subcontracting and Homeworking Environmental assessment (shortened) A SMETA 4-pillar audit covers the above elements, plus: Environmental assessment (extended) Business Ethics

Audit & Assurance Services

Get Price Quote

Getting an expert to perform auditing and assurance services for your company is essential. Working for our base office in Delhi, India, we are offering audit & assurance services that are in adherence to the Accounting & Auditing Standards (AAS) and the IFRS. Our auditing officers keep a close tab on all the latest amendments in the legal books to perform auditing accordingly. They analyze your financial books, account books, statements, and other things to offer reliable audit & assurance services at a fair charge. As your auditing officer, we perform a variety of services like: Audit & Assurance Statutory Audit Internal Audits Tax Audits Management Audits Concurrent Audits Sarbanes Oxley Compliance Information System Audit (ISA) Due Diligences Stock Audits Project Audits Compliance Audits Special Audits Payroll Audits Productivity Improvement Audits Regulatory compliance and reporting Limited Review

Looking for Auditing Services Providers

Transfer Pricing Audit Service

Get Price Quote

In Transfer Pricing Audit (TPA) we examine the pricing of transactions between related two or more associates. By applying and documenting various test methods, it is determined whether the transactions are conducted under market conditions and survive the scrutiny of the IRS and other tax authorities. Section 92E of Income Tax Act, 1961 is applicable on the TPA. The TPA is applicable on every person who has entered into an international transaction and aggregate value of such transactions exceeds Rs. 1 crore and specified domestic transactions exceed INR 20 crore in a financial year. In case the aggregate value of such transactions does not exceed its prescribed limited then it is not mandatory to maintain the aforesaid information and documents

Documentation Audit Service

Get Price Quote

Documentation audit services involve a thorough review and assessment of a company’s legal, financial, and operational documents to ensure accuracy, compliance, and proper record-keeping. These audits help identify gaps, errors, or risks in contracts, corporate records, agreements, and other critical documentation. By examining the consistency, completeness, and adherence to regulatory standards, audit professionals provide insights for improving documentation practices. Regular audits safeguard organizations from potential legal or financial liabilities and ensure compliance with laws and industry regulations. Documentation audit services enhance transparency, reduce risks, and support better decision-making, helping businesses maintain their operational integrity and legal standing.

Auditing Services

Get Price Quote

Audit is an official inspection of an organization accounts by an independent body. It is a systematic and independent examination of books, accounts, statutory records, documents and vouchers of an organization to ascertain how far the financial statements as well as non-financial disclosures present a true and fair view of the concern. It also attempts to ensure that the books of accounts are properly maintained by the concern as required by law. Auditing has become such a ubiquitous phenomenon in the corporate and the public sector that academics started identifying an "Audit Society". The auditor perceives and recognizes the propositions before them for examination, obtains evidence, evaluates the same and formulates an opinion based on his judgement which is communicated through their audit report.Broadly, an Audit involves : In-depth study of existing systems, procedures and controls for proper understanding and give suggestions for improvement and strengthening. Ensuring compliance with policies, procedures and statutes. Comprehensive review to ensure that the accounts are prepared in accordance with Generally Accepted Accounting Policies and applicable Accounting Standards/IFRS. Checking the genuineness of the expenses booked in accounts. Reporting inefficiencies at any operational level. Detection and prevention of leakages of income and suggesting corrective measures to prevent recurrence. Certification of the books of account agreeing with the Balance Sheet and Profit and Loss Account. Issue of Audit Reports under various laws. Audit At a Glance : We conduct following types of audit : Statutory Audit of CompaniesTax Audit under section 44AB of Income Tax Act, 1961 Audit under any other provisions of Income Tax Act, 1961 Internal Audit Branch Audit of Companies, whether in India or Outside India Stock Audit Audit of Public or Private Trust Audit of Co-operative Societies Audit of Government NGO’s Audit of Schools, Hospitals, etc.

Auditing & Assurance Services

Get Price Quote

We have developed knack of providing a superior range of Auditing & Assurance Services in compliance with Accounting & Auditing Standards (AAS) and IFRS. We hire a team of experienced professionals who are experienced in delivering these services. Our zero error performance translates into high satisfaction among our clients. All day round, we make our services available. We conduct our services making it hassle free for the clients. For providing our services, we make use of modern approaches and techniques. Details : We are counted amongst the prominent providers of Audit & Assurance Service. Our entity is based in Delhi, India. We offer these services in complete adherence to the Accounting & Auditing Standards (AAS) and IFRS. We are well acquainted with the latest amendment in the laws and standards, which enable us to render a highly authentic and reliable service. Under this, we offer various related services like internal audit, due diligence report, statutory audit, stock audit, etc. Our offered services are well-known for their excellence and timely execution. We offer our clients a comprehensive range of Audit & Assurance Services that ensures efficient management of risks within organization in various operational activities. Our professional members and CAs endeavour to follow the Accounting & Auditing Standards, IFRS and related laws. Our services are destined to achieve desired business objectives of our valued clients and also help in finding out accurate and fair view of financial statements of the organization. Our audit & assurance services include Internal Audit and Management Audit. Stock Audit and Reporting. Accounting Compliance and Reporting. Statutory Audit or Audit Required By Any Law. Financial Statement Audit. Sustainability Reporting. Systems and Controls Assessment. IFRS Reporting. Independent Controls & Systems Process Assurance. Regulatory Compliance and Reporting. Corporate Reporting Improvement. Due Diligence Reporting. Investigations.

Compliance Audit & Consulting Services

Get Price Quote

Are you facing compliance or risk challenge? Do you seek compliance expert that understands your industry? or you just want consultancy to gain peace of mind that your business is meeting its compliance obligations? Well, we can help you in all such concerns. Ours is a Delhi, India based service provider agency, specialized in providing compliance audit and consulting services to SMEs and large enterprises. Our consultants work alongside, perform assessment of your business and provide analysis report detailing key finding and recommendations- essential information to improve and move forward. So, contact us anytime.

NAAC Green Audit Services

80,000 - 90,000 Per piece

CDG is an ISO 17020 accredited inspection agency for NAAC green audits in India. CDG conduct green audit in India. CDG is an accredited certification services in India. Green Audit can be defined as systematic identification, quantification, recording, reporting and analysis of components of environmental diversity. The Green Audit aims to analyse environmental practices within and outside the college campus, which will have an impact on the eco-friendly ambience. It was initiated with the motive of inspecting the work conducted within the organizations whose exercises can cause risk to the health of inhabitants and the environment. Through Green Audit, one gets a direction as how to improve the condition of environment and there are various factors that have determined the growth of carrying out Green Audit. Green audit is assigned to the criteria 7 of NAAC, National Assessment and Accreditation Council which is a self-governing organization of India. The purpose and focus of the audit were mainly to review all environmental aspects in university which included following: 1. Review of all environment related applicable legal requirements and other requirements to which organization subscribes. These include regulatory compliance documents like statutory permissions / NOCs from statutory authorities, Pollution control board related norms, Emergency Preparedness Plan, and Spill Prevention Plan etc. 2. All environmental monitoring reports pertaining to air pollution, water pollution, noise pollution and status of results against applicable standards. 3. Examination of existing environmental management practices and procedures, including those associated with procurement and contracting activities. 4. Monitoring and review of all preventive maintenance of equipment’s connected with direct or indirect pollution. 5. Chemical management like storage, handling and use of chemicals, special arrangement for flammable chemical, and consumption tracking etc. 6. Waste management at site that includes storage and disposal, use of PPEs, hygiene conditions, any means of recycling through vendors. Hazardous waste and e-waste management and disposal in compliance with applicable norms. 7. Review of all critical areas and production processes in premise that has connection with environmental aspects and impacts. 8. Review of all the systems and processes in relation with environment that is part of environmental management system. 9. Review of environmental aspects including those associated with normal operating conditions, abnormal conditions including start-up and shut down, and emergency situations and accidents. 10. Review of overall environmental performance and practices of contractors and suppliers. 11. Review of extraction and distribution of raw material and natural resources. Distribution will include use and end life of product. 12. Evaluation of organization performance against the management objectives and targets in relation with environment. 13. Analysing the awareness level in premise for environmental policy and objectives which includes competency, awareness and understanding of roles and responsibility. 14. Operational control of all those operations that are associated with its identified environmental aspects and to check that control is effective in reducing the adverse impact associated with them. 15. Evaluation of previous emergency situations and accidents and review of emergency preparedness and response plan.

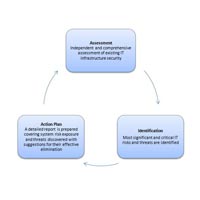

Cyber Security Audit Services

Get Price Quote

We are an organization that is engaged in rendering the most efficient solutions for cyber security audit at competitive charges. We are regarded as one of the best service providers in India. Thus, we ensure that all the cyber security requirements of our clients is fulfilled by our seamless solutions. With an increasing risk of data loss, information loss, and cyber threats, our audit solutions help you in protecting the important data. Cyber audit consultancy for the enterprise being provided, beside that training and consultancy works are being carried out, using various tools and techniques across the cyberspace.

Auditing & Assurance

Get Price Quote

JKC&C is a professionally managed firm offering auditing services, thereby, assisting businesses in their operational and financial operations through management auditing. We are based in Delhi, India and we undertake an internal audit, concurrent audit, management audit, stock audit, tax audit and all statutory audits. Backed by a crew of qualified CAs and accountants, we help corporates make more informed and better decisions. The fee we charge for our auditing and assurance services is reasonable, feel free to contact us anytime. Varieties of Services : Statutory Audit Internal Audit Tax Audit

Auditing Services

Get Price Quote

Accounting is a kind of process that involves making journals, ledgers, trial balances, financial statements, cash books, etc. It also involves making a record of all the transactions of a particular company. To provide these accounting services to the clients, Taxzuiver Consultancy Pvt. Ltd. has steeped in the market. We have a team of highly experienced and adroit accountants, who are widely known for controlling and managing various accounting operations of various organizations in an easy manner. We are based in Delhi (India).

COC Audit in Okhla , Delhi

Get Price Quote

Code of Conduct Service is performed based on the Social Accountability Standards or Code of Practices as per client requirements. The aim of Social Accountability -code of conduct, human rights, ethical requirements, audit and monitoring is to ensure that the business partners or the supply chain abide with the brand or the company’s commitment to corporate social responsibility and the code of practices. To validate transparency, consistency, and integrity, most companies use a 3rd party like auditors to conduct social accountability compliance audits. Main elements that are verified in a typical code of conduct audits are: Child labour Forced labour Health & Safety Freedom of assessment Discrimination Disciplinary practices Working hours Environment

Security Auditing

Get Price Quote

Are you on the lookout for a reliable company that provides Security Auditing services? If your answer is an emphatic yes, we are the right choice to opt for. Our professionals systematically evaluate security of a company's information system by measuring how well it conforms to a set of established criteria. Thousands of clients have benefitted with our Security Auditing services and the next one could be you. For obtaining our services, feel free to contact us anytime.

Sedex Consultants & Audit in Jaipur.

Get Price Quote

BENEFITS OF SEDEX AUDITS: SEDEX Audits reports reduce supply chain audit duplication by providing a widely acceptable single format for Social Compliance Audits. Social Compliance Audits as per SMETA Standard enable companies to effectively share and manage supply chain ethical information. SMETA Audits enhances ethical trading programs in supply chain. Reduces risks in social responsibility and sustainability through Social Compliance Audits as per SMETA Standard. Brands and buyers are able to view, share data of suppliers’ social compliance audits on SEDEX database,

bank audit services

Get Price Quote

If you want to maintain the overall transaction records of your company then contact us now. We are based in New Delhi (India) and provide the bank auditing service. By assessing the annual transactions of a company (own expenses, official transactions, fines {if any}), the log sheet can be prepared according to the bank’s duties and accuracy towards the account of the company. The same will be updated periodically.

Audit & Assurance Services

Get Price Quote

S K Surana & Co. LLP is a New Delhi (India) based company, which is offering the best audit & assurance services to the clients. It is a known fact that an audit and assurance are a large part of a firm's practice. With the support of our professionals, we are providing statutory audits and fraud investigation & special audit. We are also providing due diligence that eliminates the risk and potential flaws of investing at various locations.

Internal Audit Assurance Services

Get Price Quote

We render Internal Audit Assurance Services based in Delhi. Our services are sure to achieve desired business objectives of our clients. Our experienced audit team comprises of expert consultants and auditors, who have numerous years of experience in this domain. They advise clients for regulating everyday transactions; which includes division of authority over key control areas and compliance with operating policy and guidelines. Our services ensure efficient management of risks within organization in various operational activities. One can obtain the Services at nominal rates.

statutory audit services

Get Price Quote

If you are looking for statutory audit services from Delhi (India), then you can rely upon Govind Singh & Co., a prestigious name in the industry. We are known in the industry for following the generally accepted accounting principles and standards, and abiding by the provisions of auditing laws and guidelines to ensure total compliance for the clients. Our service ensures comprehensive coverage and complete emphasis on the critical aspects of record keeping and physical verification.

Statutory Auditing Services

Get Price Quote

We are the main supplier of this services.

audit assurance services

Get Price Quote

For all those who are looking out for Audit Assurance Services, rely on us! We are a reputed name when it comes to Audit Assurance Services in India. From Statutory Audit, Tax Audit, Internal Audit and Stock Audit and Fixed Asset Verification; we have experienced team with to guide you for all of these. Amongst many other things and matters our veterans will also give you their opinion whether the system is properly operated in practice. All these services can be availed at the most discounted rates.

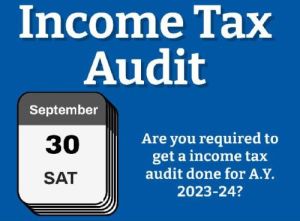

Income Tax Audit Service

10,000 - 80,000 Per Application

Are you required to get a income tax audit done for A.Y. 2023-24? If your gross receipts or turnover is above the applicable audit limit, you are required to get a income tax audit done. The due date for filing the Income tax audit report is September 30, 2023. If you fail to get a tax audit done when it is required, you may be subject to penalties. The penalties can be quite heavy, so it is important to make sure that you comply with the Income tax audit requirements. If you have any questions about the tax audit requirements, please consult with a CA.

Audit and Assurance Services

Get Price Quote

Audit And Assurance

Income Tax Audit services

Get Price Quote

We have gained a huge amount of trust in the market for providing high quality and reasonably priced Income Tax Audit Services. We maintain highest level of accuracy and offer our services on time and this has contributed to our reputation. We are able to provide these services with great confidence for we have on our team only the best and the most skilled income tax audit professionals who leave no room for any error.

GST Audit

Get Price Quote

Owing to the assistance of a team of professionals, we are able to meet the exact requirements of the clients.

Fire Safety Audit Service

Get Price Quote

A fire safety audit is an examination of the premises (manufacturing unit, factory etc.,) and relevant documents to ensure how the premises are being managed with regards to fire safety. Fire safety audit is an effective tool for assessing fire safety standards of an organization or occupancy. Our comprehensive fire safety audit addresses the inherent fire hazards associated with the day to day activities in an occupancy and recommend measures to reduce the potential fire hazards.

internal auditor training services

Get Price Quote

B4Q Management Ltd is an eminent and respected Internal Auditor Training Services provider that offers outstanding services to customers. We are one of the experts in offering Training services to various corporate. Our certifications are rendered by skilled professionals and also follow strict quality control and also to deliver services within the specified time limit. We are providing Internal auditing services on a large scale. We are providing more effective and personnel certification services. We train the professionals with better quality management to meet industry norms. We also motivate and engage the client's staff for more efficiency in internal processes. We also train the professionals for efficiently saving time money and resources of the organisation. Internal Auditor Training Courses: ISO 9001 (QMS); ISO 27001 (ISMS); ISO 14001 (EMS); ISO 45001 (OH&S); ISO 27701 (PIMS); ISO 220000 (FSMS); ISO 20000-1 (ITSMS; ISO 22301 (BCMS); ISO 37001 (ABMS); ISO 31000 (RM); ISO 50001 (EnMS). In the modern world, trained manpower for Internal auditing on ISO Standards has become crucial and extremely important and this will be a great opportunity for you to learn and get trained. This internal auditor course will be a blend of training sessions, exercises and group discussions coupled with learning to achieve its objectives. Course Objectives: Understanding the roles and responsibilities of an Internal auditor. Learning to plan, conduct and report the audit. Understanding the interpretation of Concern ISO standard. Understanding the principles and practice of auditing. Learning through case studies & exercises. Course Contents: Revision history of ISO Standard. Terms and Definitions. AIM of ISO Standard. Management System Model. Planning and Conduct Audit. Audit Reporting Writing. Final Exam ISO Standard Clauses: Scope. Normative Reference. Terms and Definitions. Context of Organization. Leadership and Worker Participation. Planning. Support. Operation. Performance Evaluation. Improvement. Evaluation: There will be a written examination at the end of the course. Day-wise exercise Minimum passing % criteria: 60%. Issue of Certificate : Candidates successfully completing the course with a minimum of 60% in the Online examination will be awarded with “Internal Auditor Training Certificate”. Unsuccessful candidates will be issued a “Certificate of Attendance”. Duration : Each Lead Auditor course duration 02 days or 16 hrs. Methodology : Online Lecture with presentations, role play, case studies & exercises. Eligibility : The candidates appearing for this assessment shall have: Education at minimum Diploma / Degree / University Level At least 3 years full time practical workplace exp., of which at least two years relating to the field of assessment the student is appearing. Prerequisite : Awareness / knowledge of Applicable ISO standard. Having command over oral and written in English or Local Language. Candidate age should be at least 18 years old on the date of application for personal certification. 1-2 years of minimum any work experience. Candidate at-least any degree, diploma or graduate in any education sector. For Online Session : You will get the most out of the course by working in a quiet room free from interruptions, as background noise can interrupt the training session for all attending. You will need a headset/speaker with mic. A stable broadband/internet connection. If you are attending this virtual training session alongside colleagues in the same location, you will each need to log onto the session and participate with separate devices to enable full interaction and so your attendance can be marked. Target Group: Management representatives. Other management Professionals. Executives from organizations willing to implement, maintain and improve the Management Systems. Managers (in middle and senior management) who are actively involved in the development, maintenance and Lead auditing of existing / proposed QMS Management System. Any other relevant person. B4Q will give soft copy of courses via Email, Google Drive or We Transfer.

Risk Based Audit Services

Get Price Quote

Internal auditing and other assurance services provide value to governing bodies and senior management as an objective source of independent advice. The scope of internal auditing within an organization is broad and may cover areas such as: Efficacy of operations, Reliability of financial reporting,

tax audit

Get Price Quote

VMK Professional provides expert tax and audit services, ensuring full compliance with India’s tax laws and regulations. Our team assists with accurate tax filing, minimizing liabilities, and conducting thorough audits to maintain transparency in financial reporting. With VMK, businesses can streamline their tax processes and stay compliant with confidence.

Forensic Audit Service

Get Price Quote

Bajai India is one of the dependable names for forensic audit services in the industry. Based in Delhi (India), the company renders the best forensic audit service to the individual as well as corporate clients. Our solutions are rated as the best by our patrons, who refer our services for its effectiveness and reliability. While auditing the objects on the parameters of science, we accurately assess the overall condition and furnish with the details reports for the audited objects.

compliance audit services

Get Price Quote

VMR & Company (Chartered Accountants) is a professionally managed firm instrumental in providing compliance audit services to the businesses in the city. With our services, we are rendering expert solutions for organization’s risk management and regulatory compliance effectiveness. Besides, our associates provide solutions keeping in mind governing rules and clients’ business requirements. As a service provider, we are operating in and around Delhi, India. One can approach us anytime through our website.