Insurance & Investment Consultant Services

Get Price Quote

As a prominent figure in the industry in providing of Insurance & Investment Consultant Services, we bring you a wide range of perfect quality. We hire a team of trained professionals who are able to analyze the market and provide consultation accordingly. We offer to help you with all kinds of insurance and investment decisions. Our fascinating services are immensely popular in the market. We help our clients to steer clear of the hassles that come along with the tedious details and get them the best investment alternative with a long term view. Details : More than providing peace of mind your family and yourself, life insurance can be one of the best investment decisions you have ever made. With stringent regulatory conditions to safeguard policyholders, traditional life insurance policies carry minimum investment risk and provide long-term insurance benefits. Most life insurance policies include retirement income on maturity. Another advantage of life insurance is that the coverage amount can be increased over time. So, while presently, you can afford only a low insurance premium with your current salary, over time with increasing income through promotions or new income sources, you can increase your insurance cover by paying slightly higher premiums and provide a better life cover for your family even when you are not around. It is always better to invest your hard earned savings which will provide you with long-term benefits than to seek short-term benefits from high-risk investment ventures. Whether you have just started your career, are recently married or blessed with a family, securing adequate life insurance can prove to be the best investment decision you ever made.

NRI Services

Get Price Quote

MAP Global Logistics, in collaboration with its sister concern Gold Vanlines, offers comprehensive services tailored for Non-Resident Indians (NROs). With two decades of experience, we provide expert international trade services for imports and exports, ensuring efficiency and commitment. Our offerings include: Custom Duty and Policy Guidance Import/Export Data Analysis VISA Assistance International Trade Consultancy Sea & Air Freight Brokerage Government Approved Custom House Agents Our specialized outsourcing services guarantee significant cost savings and top-notch quality, completed on schedule by highly trained staff. Benefit from our expertise and let us handle your international business needs seamlessly.

Looking for Investment Service Providers

property investment

Get Price Quote

property investment, Property in Thane, Property Buying Agent

retirement planning services

Get Price Quote

With retirement not far around the corner, your needs will be rapidly changing. And you will be asking the big questions – what does retirement mean to me, and will I have enough? How can I be better off? As our lives change, our financial needs and priorities change too. Even if you’re years away from retiring, you’re wise to be thinking about retirement planning. Years from now you’ll be a lot happier saying, “I’m glad I did” instead of “I wish I had”. A retirement plan is an assurance that you will continue to earn a satisfying income and enjoy a comfortable lifestyle, even when you are no longer working. Investment Locker will help you understand how much you need to grow your wealth before you retire and how to plan for it.

SYSTEMATIC INVESTMENT PLAN(SIP)

Get Price Quote

A Systematic Investment Plan or SIP is a smart and hassle free mode for investing money in mutual funds. SIP allows you to invest a certain pre-determined amount at a regular interval (weekly, monthly, quarterly, etc.). A SIP is a planned approach towards investments and helps you inculcate the habit of saving and building wealth for the future. SIP is not a financial instrument, but a way of investing in mutual funds, some people confuse SIP with PPF,NSC, and mutual funds. They think they can invest in SIP. SIP is not an investment its just a mode of investment How to Start SYSTEMATIC INVESTMENT PLAN (SIP) a>Pick any date of a month, then fill out an SIP form and an application form. b>Draw post-dated monthly quarterly cheques , adding up to at least minimum investment of scheme. c>Monthly - Start on any date of any month, and stick to the same date of every month. d>Quarterly - Start on any date of any month, and stick to the same date of every third month. e>If in any month the chosen date is not a Working Day, the transaction will be completed on the next Working Day.

Blocked Funds / Proof of Funds

Get Price Quote

Blocked funds Cash flows generated by a foreign project that cannot be immediately repatriated to the parent firm because of capital flow restrictions imposed by the host government. Vityajaya can help you in the process. Proof of Funds Proof of funds (POF) refers to a document or documents that demonstrate a person or entity has the ability and funds available for a specific transaction. Proof of funds usually comes in the form of a bank, security, or custody statement. The purpose of the proof of funds document is to ensure that the funds needed to execute the transaction fully are accessible and legitimate. Contact Vityajaya for more information of POF and Blocked Funds.

investment planning services

Get Price Quote

Being a well-reputed name in the market, we are engaged in offering Investment Planning Services. We carry out our operations from Delhi, India. These services are customised for every client according to the risk bearing capacity, financial stability, and other related aspects. We offer the best plant to the clients for a better utilisation of their saved money. We are well-equipped with the advanced techniques and software required for rendering a reliable and transparent service. Details : Investments can cater to a few of your needs if this is well planned. Our objective of Investment Management offering is to help you explaining the best plan of your investment by which you can get good benefits. People should have saved for a rainy day. Once you crave to save money for future emergencies you start thinking about investment so that it makes your money grow. Investment Planning is a good element of a growing business. Our expert MBAs having experience in investment field will assist you in planned investment, tax saving scheme, Mutual fund, and share Scheme. Saving every day a single coin can help you plan your investments so that you can reap adequate benefits and achieve your financial goals. We are providing best insurance plan, tax saving scheme, facility for companies business loan, plan of business management, tax management service and of course financial risk management service. The path of your benefit scheme of investment will stop at Ask Commercial Solutions which will be the only one shop for you to plan, detail and execute your investment decisions. Your investment Plan would be :- Customised According to Your Goals, Financial Situation, Life Stage and Time Horizon. Getting Digital Signature of Directors. Analysis of Goals: Attainability and Savings/ Investments Required. Customised Risk Management Including Financial Risk Management. Designed to Meet Your Goals After Matching Your Risk Tolerance Level. Designed to Meet Your Needs of Liquidity. Expense Protection/ Better Insurance Plan. Use Tax Efficient Investment Avenues. Taking in to Account Effects of Income and Wealth Tax. Based On Proven Asset Allocation Strategies and Required Diversification. Monitored and Rebalanced On Regular Basis to Keep It Fresh.

Inbound & Outbound Investment & FEMA Advisory Services

Get Price Quote

With the experience of more than 36 years, S K Surana & Co. LLP has become a prominent name in the service sector of New Delhi (India). Working for us is a skilled team of experienced professionals, who have in-depth knowledge of various inbound & outbound investment and FEMA advisory. These professionals are also experts in consulting services and compounding services as well. Many organizations in New Delhi also taken advantage of our services.

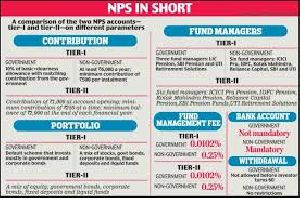

New Pension Scheme Plan

Get Price Quote

Pension plans provide security in terms of finance during old age when people don’t have any regular source of income. If you want to know more about any such plan and seeking professional assistance, look no further than D CA. Ours is a New Delhi, India based service provider company and can be useful for acquiring information related to pension scheme plans. We are backed by a team of qualified professionals, who work together and provide solutions as per the stated industry norms.

Finance & Investments Consultancy

Get Price Quote

XPRESS LOAN is a Direct Sales Associates for Various Banks & Non Banking Financial Institutions with interests in Home Loans, Loan Against Properties, Project Funding, OD, CC limits, Business Loans etc. Our Clients include both from Institution & Retail & the Marketing Strategies follows accordingly. With 60+ Associations into banks, NBFC’s and Other FI we committed to provide best tailor made solutions to our esteemed clients.

KG Preschooling investment services

Get Price Quote

American brand "qualitykg" low investment business, master franchise : qualitykg preschooling...new concept, little investment, very high returns, limited opportunity, regional franchise...join today & start your own business. We are a unique and dedicated pre-school accreditation organization, that introduce, prosper and sustain quality-control and development mechanism in pre-schools and 'early-childhood education' centers. We bring together the best global practices in the field of pre-school education and assimilate them under one umbrella, to deliver the best to you, your little students, their parents and your other resources. Qualitykg evaluates and improves your pre-school on the basis of 10 well researched standards, 38 indicators and over 200 observations. If any one is interested for taking franchise or master franchise and want to open chain school .

Financial Planning Investment Advisory

Get Price Quote

The dictionary meaning of financial planning is planning current and future needs and expenses. We create assets to meet our future expenses but financial planning helps apportion the available current income to immediate expenses and savings for the future. We prefer to buy loans to meet expenses and to create assets but we forget that loans creates liabilities. And these liabilities are to be settled in future only from your future income. The efficiency with which a strategy is developed between ‘income and expenses’ and ‘assets and liabilities’ determines the financial health of an individual. Financial planning is required for everybody irrespective of how much you earn. Investing money increases its efficiency. By investing wisely, you can create wealth for the future and improve standard of living. Inflation is increasing the cost of goods and services and eating away your capital, income and wealth. You need to save money and invest it well. To enjoy tax benefits, you need to invest efficiently so that your tax doesn’t erodes your capital and in come continuously. There are two approaches for financial planning viz. Goal specific and comprehensive financial planning. In goal specific, each financial goal is looked in insolation and a dedicated investment plan is made to realise the financial goals. Comprehensive financial planning takes a holistic approach and view all goals in consolidation. The investment plan too is a consolidated one. Comprehensive planning is better if there are multiple financial goals.

NRI Services

Get Price Quote

We at Bharathomes have a dedicated team for Non Resident Indian (NRI ) Customers . Investment in Real estate is governed by specific Laws . FAQ on NRI Investment in Real Estate in India: Can NRIs obtain loans for buying a house/flat for residential purpose from financial institutions providing housing finance? Reserve Bank has granted general permission to certain financial institutions providing housing finance to grant housing loans to non-resident Indians for acquisition of houses/flats for self-occupation subject to certain conditions. Can authorized dealer grant loans to NRIs for acquisition of a flat/house for residential purposes? Authorized dealers have been granted permission to grant loans to on-resident Indian nationals for acquisition of house/flat for self-occupation on their return to India subject to certain conditions. However, repayment of the loan should be made within a period not exceeding 15 years out of inward remittance. What are the schemes available to NRIs for direct investments in India with repatriation benefits? In the new issues of shares/convertible debentures of Indian companies, there are direct investment schemes such as 24% scheme/40% scheme/100% scheme. Domestic Mutual Funds floated by public/private sector institutions/companies and bonds issued by public sector undertakings is also a good option. Do NRI's require permission of Reserve Bank to acquire immovable property in India? No. NRI's do not require any permission to acquire any immovable property in India other than agricultural / plantation property or a farm house. Following is a comprehensive list of the type of transactions possible.

investment planning services

1 Per

Sanbun Investments has been delivering consistent returns over years and helped thousands of students achieve their aspiration of becoming full-time traders. We offer our services through online sessions and also provide personal assistance. The training is reliable, effective, and helpful for those who see Stock Market as a career option.

Investment Services

Get Price Quote

Investment Services

Social Return On Investment

Get Price Quote

Social Return on Investment (SROI) is an approach that measures the amount of impact created by an organization or an intervention on the socio-economic and environmental aspects of the stakeholders against the cost/effort incurred by the organization. It is a way through which an organization can align its interventions for the greater good of the people and the stakeholders who benefit out of such interventions. Unlike the impact assessment exercises, SROI has a larger coverage of the value that an intervention has created for the beneficiaries it was meant for.

Systematic Investment Plan

Get Price Quote

Being a prominent player in the industry, we take it upon ourselves to meet clients demands with perfection. Continuing in the same vein, we, being a Service Provider, present you Systematic Investment Plan in a wide variety. Under this plan, the money of clients is invested for long-term in a systematic manner. It fetches a good return to the investors. We hire a team of highly qualified finance and investment professionals to manage the wealth of our clients. Contact us to avail the services for an economical fee.Details :The Systematic Investment Plan we offer range from Debt to Equity and are drawn from renowned Asset Management Companies with a strong track record. Dedicated Relationship Manager to recommend the funds as per your investment objectives – short term and long term strategies Assistance at every step of the investment process An experienced research team to analyze and research the Mutual Funds available in the market A consolidated investment account to give you a snapshot of your entire mutual fund investments made through us and a lot more! Comprehensive recommendations that take into account all relevant factors including the investment philosophy of the Asset Management Company, portfolio quality, risk-adjusted returns and market trends. Recommendation Process : The recommended list of Mutual Funds is released on a half yearly basis. The selection criteria are based on a unique "Three Tier process" where factors like the consistency, alpha generation, risk management and Fund Manager skills are considered. The last 24 month performance of the funds is taken and various statistical tools are applied to arrive at the final set of recommended funds across various categories.

Investment in Europe Consultancy Services

Get Price Quote

Europe is boasting a flourishing economy. The European government has power-packed plans to escalate the growth of the EU economy by 2030. If you are willing to shift or diversify your business in Europe than you would be glad to know about the lucrative opportunities that Europe market can offer. Europe has one of the largest single market and home of 750 million people scattered over 50 different nations which suggests the incredible potential of the EU market. Being the wealthiest country, the bulk of the population enjoys a high standard of living and is always ready to spend money for a better quality of life. Europe hosts more than 500 biggest corporations in the world which itself signifies its economic competence and level of resources it has. To help you in the establishment of business in EUROPE, the Kytero team can guide you at every step of Europe business visa process with its in-depth knowledge about the procedure, policies, and opportunities for investing in Europe.

Investment Services

Get Price Quote

1. I am also loan consultant for bank,nbfc and private finance company ect. 2. I am also deal with home loan,lap,pl,business loan,project loan,commercial vechicle loan ect. 3.gpa property loan case done only if property register before 2002 march before. 4. Project loan case also done. 5. Commercial vechicle loan case done only for turkey basis and loan amount minimum 50 lakhs only not below them. 6.cibil defaulter case handle only for salary person and only for pl only. 7. One salary guranter is neded and have his own houses. 8. No business guranter is not permitted. 9. Roi is 18.9% flat yearly. 10. Tenure is 2 year only. 11. Salary should be minimum 30 thousand per month.

retirement planning

Get Price Quote

Preparing for your financial well-being is important throughout your life time, but it is critically important during that period, when you are heading towards retirement. Do You Know How Much Money You Would Require in Your Retirement?The answer to this, in fact nobody knows. Money is such a sweet fruit which entices one and all. No matter how much money you have, there is never enough of it. So, to ask such a question as "how much money is required for retirement is indeed very relative. There are a number of factors such as your standard of living, any liabilities or dependencies, your expenses and your targeted retirement age. A better to way determine this sum for yourself would be first of all make an estimate of your post-work income i.e. the amount of money you'll need when you are not working anymore. This should be around 80% of your current income. Now decide the age you want to retire in. Add up the market value of all your savings and investments and determine a realistic rate of return on them, assuming inflation is about 4% per year. This way you would have a fair idea of the amount you would need on a monthly basis to support your retirement.How Much to Save for the Retirement?For this, you need to make an account of your current expenses and liabilities. Now keeping in mind your present standard of living, you should make an estimate of at least 80% of your current income which will be your post-retirement income. Now subtract your expenses not spent on yourself from the total expenses i.e. in your retirement age, there won't be any dependencies on you, so lesser expense. Depending upon how the numbers work out, you may be able to save a large portion of your employment income toward your retirement, Why Do We Need Retirement Planning in Our Life?Retirement is one of the most important life events many of us will ever experience. Since growing old is not optional, so is earning income and then suddenly withdrawing from it. From both a personal and financial perspective, realizing a comfortable retirement is an incredibly extensive process that takes sensible planning and years of persistence. Retirement planning in today's times has become all the more important due to certain uncertainties of government retirement schemes. It is widely known that government pension plans are nothing to rely on these days because of the overgrowing population and corruption. Moreover, there are unforeseen medical expenses and emergencies in today's times which can't be anticipated. Another factor which indirectly and conventionally plays an important part is the withdrawing of children from parents when they grow up. In this competitive world, children are more ambitious who want to lead their private lives away from parents, so in their absence, there is no one to take care of your financial needs in your retirement age. Retiring from one's job is a trauma in itself, there is a growing need to support your living with an assured Retirement plan. After all, it is the quality of life that we all want and it lies entirely on what we contribute in present. If you too are trying to figure out the effects of expenses, inflation and those that appear to be fruitful for satisfying your retirement phase then, we at Financial Planning Arcade have a solution. What are the Benefits?A pension plan ensures regular income after retirement. There are two phases in any pension planning- accumulation and disbursement. First phase involves investing in different financial instruments. To build a huge corpus amount, one should start as early as possible. A person can start investing just a small amount and then increase the amount as per his financial ability. By starting with low amount for more number of years, a person can accumulate quite a big lump sum amount. If a person invests in pension plan, then at the end of policy term, one-third of the amount can be withdrawn as lump sum while the rest of amount is used to purchase annuity. We are a trusted Retirement Planning Service Provider in India.

Multiplex Brands Leasing Investment Service

Get Price Quote

On the basis of number of films produced and released, India is the largest market in the world. But in terms of screen density (movie screen per million people) it is among the lowest — eight screens per million compared to 126 in the US, 60 in the UK, 40 in South Korea and 26 in China. US-based National Association of Theatre Owners reported there are 40,837 screens in the US as of July. In India, however, there are only around 2,400 multiplex screens and around 6,700 single-screen theatres. However, nearly 45 per cent of the total domestic box office collections are generated at the multiplexes. The top four players based on screen count — PVR, Inox, Carnival, Cinepolis — account for over 70-73 per cent of the overall multiplex business. And that is why any major acquisition has a long-term impact on the films business in India. If you are planning to open Multiplex at your location and looking for brand association....

Financial Investment Services

Get Price Quote

Over the period of time we have widened our services in many sectors. Backoffice India is like a stop shop for your varied needs. Our experience and result oriented advisory plans have built us a class apart from others; we have gained reputation and expertise as a singular procedure. Our advisory services are recognized for high end optimization of investment opportunities. To obtain success in a project, it is the resultant of sound and precise design, cost effectiveness, result oriented features and consistency in providing support. We accept challenges to undertake your dream project; we strive hard with utmost desire to create your dream come true. Whether we are providing advisory service for financial investments or planning a task for you. We are technically savvy enough to provide you with an efficient design, which is capable of reaping the benefits of modern day technology. It takes a great deal of experience in planning and carrying out a project. We go step by step implementation and valuation on the various steps to furnish you a fool proof program. We trust in taking calculated risk to ensure the chances of maximizing earnings and decrease the probabilities of losses. Our team of expert analyses the viability of the project and approve. If, you are already running a business and not getting the desired results, we can still help you in making your business a profitable venture. We help you in organizing and eliminating the financial loopholes.

NRI Services

Get Price Quote

We are engaged in offering complete NRI solutions with the help of our team of experienced and professional members. Our NRI Services have the below mentioned things to offer Determination of your residential status in India Interpretation of DTAA with a view to reduce tax liability in India Handling of issues relating to inheritance, will, etc. Compliances with respect to the Income-tax Act, 1961, Wealth-tax Act, etc. Application for Permanent Account Number (PAN) Filing of India tax return Advising suitable tax saving investments

Inbound Outbound Investment

Get Price Quote

Advise for Inbound investments in India by foreign entities Advise Indian entities to set up their business outside India Foreign Exchange Management Act (FEMA) advisory / Compliance International Tax Structuring, Modeling Tax efficient structure Advise on International Taxation, Double Tax Avoidance Agreements (DTAA). Cross Border Tax compliance and reporting Transfer Pricing- Tax Compliances, Planning, Documentation

funds investment services

Get Price Quote

If you want Funds Investment Services, you are in the right place. Our company Easy Loans is one of the most reliable and trusted companies for a loan. In simple terms, a fund is an investment that is provided by different fund houses that pick the right bonds and stock of different sectors and bring them under a single portfolio. The combination of the Securities where the manager of the fund will decide the right exposure to debt or equity depends on the fund of different categories. The managers will have a diversified portfolio that will provide you with reasonable rates at reduced risk than the stock market. Get our investment services today.

foreign direct investment services

Get Price Quote

Based in Delhi (India), Sidharth Joshi & Associates is an eminent Foreign Direct Investment Services Provider. The company attends to foreign companies for entry strategies in India and assisting them through Government regulations and procedures for setting up their business operations in India, advising on foreign exchange management act (FEMA) and its regulations, foreign direct investment (FDI) we assists in establishing business in India. FDI approvals from foreign investment promotion board (FIPB) FIPB/Secretariat of Industrial Approvals (SIA); branch, liaison, subsidiary, project & site office approvals from reserve bank of India; Industrial licensing, Government contracts, transfer of technology and licensing, repatriation. The firm also provides advice on various provisions & procedures relating to imports and exports. We attends to formation of companies, drafting of memorandum and article of association, strategic planning and taking searches and filing the required documents, forms, applying for permission, approvals, co-ordination, inquiries, where ever required and also due diligence of companies prior to takeover, merger, purchase of companies and inspection. We also attends to all the issues and maintenance of the company even after formation of the company such as filing of annual reports, resolutions, filing of all the required forms, liasioning with government officials such as Reserve Bank of India, Registrar of Companies, SEBI etc.Whether your company is large or small, new or established, you can benefit from the wide range of services offered by our firm.

Investment Services

Get Price Quote

IndiaOne Consultants provide Investment Advisor Services for : To provide Assistance for purchase and sale of Shares, Securities, Units of UTI and other Mutual Funds, including investment in Private companies, Partnership Firms and Proprietorship organizations. Opening a Depository Account (DMAT) with any Depository Participant to invest and trade in Shares in script less format. Procedure :You need to inform us your requirement on Email and we shall ask you to provide us necessary information to :Complete the formalities to open a DMAT Account with a Depository Participant. Provide assistance to purchase and sell Shares, Securities, Units of UTI and other Mutual Funds, including investment in Private Companies, Partnership Firms and Proprietorship organizations.

Foreign Investment Consulting

Get Price Quote

We offer our services to foreign companies to start business in India. We facilitate Foreign Investment Structuring, and mode of investment suitable to their specific requirements for the purpose of investment in India.

Investment Banking Services

Get Price Quote

We are offering investment banking services. Smc capitals limited is the investment banking arm of smc group and is a sebi registered category I merchant banker with strong management team; financial sponsors and corporate partners to help corporate clients achieve their financial and strategic goals. We offer a wide spectrum of investment banking services covering corporate advisory, public issues management, capital restructuring, private placement and debt syndication, merger & acquisition advisory, valuation services and esop.

Foreign Direct Investment

Get Price Quote

Advisory on foreign direct investment and getting various approvals.