tax return filing services

Get Price Quote

Those who are in need of a reliable assistance for tax return filing requirements can count on us. We are based in Delhi, India and catering to clients in the region. Whether you hold a business profile or you are an employee, we provide solutions to both. We have a support of qualified individuals, who coordinate with clients, disclose the details of their incomes, and claim the applicable deductions. Besides, we take care of the paperwork. So, get associated with us and avail the benefits of cost effective solutions.

Tax structuring services

Get Price Quote

Consultancy on various intricate matters pertaining to Income tax. Effective tax management, tax structuring and advisory services. Tax Planning for Corporates and others. Designing restructuring salary structure to minimise tax burden.Filing Income Tax and TDS Return for all kinds of assesses. Filing Income tax returns for employees of corporate clients.

Looking for Tax Consultancy Service Providers

TAN Registration Services

Get Price Quote

Our services goods & service tax (gst) accounting & supervision shop & establishment registration msme registration income tax returns (itr) company pvt. Ltd. Ltd. Incorporation & roc society trust (ngo) partnership firm proprietor firm import-export code no. (iec) trade mark registration food license investements loan documents

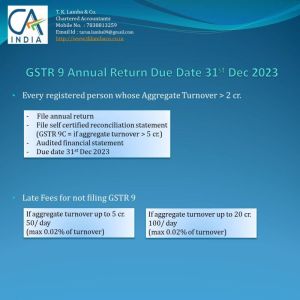

File GST Annual return

10,000 Per per return

File GST Annual return and Reconciliation Statement before 31st Dec 2023

taxation consultancy service

Get Price Quote

Paying taxes can be complicated especially when the policies and regulations keep changing. One needs to keep himself or herself updated with these policies and regulations that can be tough with daily pressure in the work front. To ensure that you are using the right form and filling it properly, you can seek the assistance of a taxation consultancy firm. Hero Tax Solutions are professional taxation consultants offering high quality taxation consultancy service. We have professionals and experts who have a background in finance, accounts, and law. This makes us the best choice for getting your taxation done in the most professional and efficient manner.

TDS Return Service

Get Price Quote

Get in touch with and enjoy the pleasures of our TDS Return Service! With the aid of our knowledgeable financial experts and CA professionals, we are capable n guiding our clients about the tax laws and rules. We are here to help you out for varied income tax related services such as filing of income tax returns, transfer pricing and others. We make sure that our services are offered with particular guidelines for diverse categories like for private limited companies, individuals, proprietorship firms, corporate houses and many others.

Income Tax Audit

10,000 - 90,000 Per Application

Are you required to get a income tax audit done for A.Y. 2023-24? If your gross receipts or turnover is above the applicable audit limit, you are required to get a income tax audit done. The due date for filing the Income tax audit report is September 30, 2023.If you fail to get a tax audit done when it is required, you may be subject to penalties. The penalties can be quite heavy, so it is important to make sure that you comply with the Income tax audit requirements. If you have any questions about the tax audit requirements, please consult with a CA.

DVAT Registration Services

Get Price Quote

Based in Delhi, India, our company is one of the reputed accountancy organisations offering DVAT Registration Services. We provide D-vat return filling and all D-Vat /CST compliance related works Our service fees are reasonable and we do not impose hidden charges. You can contact us for free consultation or proper assistance any time.

tax planning services

Get Price Quote

There is more to tax planning than the exemptions available on savings made by you. With our Tax Planning advice, you will pay the right amount of tax and know how to tax proof your income and gains. After all, your capital is more productive in your hands and it can work wonders for you if planned properly. We guide you in Planning & managing your finances and achieving your financial goals. Basic planning starts with tax planning services which can increase the take home income. These investments can also cater to a few of your needs if this is well planned. Tax planning is not restricted only to tax savings investments (Section 80C). There are several other components e.g. HRA, Home Loans, LTA, Sec 80D, Re-imbursements, etc to reduce the taxable income.

GST Registration Services

Get Price Quote

Working in the industry with a team of GST specialists accountants, Astraea Business Advisors LLP has become a notable name in the service sector of Delhi (India). Our GST registration services are widely availed by many clients in the city. Our GST specialist accountants have in-depth knowledge of various concepts of GST registration. Right from starting till getting the appropriate GST registration certificate, our accountants work on behalf of various clients.

Income Tax Services

Get Price Quote

Ours is a professionally managed firm, involved in providing solutions for all sorts of income tax needs. At C&C, we are a team of qualified individuals, who work together and assist clients in filling & filing documents, preparation of income tax returns, assessment of tax returns, etc. Besides, we provide consulting on different matters and tax planning. We are based in New Delhi, India and serving clients in the surrounding regions. Our service charges are moderate; feel free to approach us anytime.

GST Training service

Get Price Quote

goods and services tax (gst) is an indirect tax levied on the supply of goods and services in india. the gst system has simplified the taxation process by replacing multiple indirect taxes with a single unified tax system. gst course in laxmi nagar, delhi teaches students about the gst system, including its features, compliance requirements, and implications for businesses. in gst course in delhi, students will learn about the various gst registration processes, gst rates, and filing of gst returns. they will also learn about the various compliances required by businesses under the gst system, such as invoice generation, credit claiming, and payment of taxes. gst training in laxmi nagar, delhi will also cover topics such as gst audit, gst penalties, and gst refunds. students will learn about the various types of gst audits, the penalties imposed for non-compliance, and the process of claiming refunds. gst training in delhi can be beneficial for business owners, finance professionals, and tax consultants. the knowledge and skills gained through the course can help businesses comply with the gst regulations, avoid penalties, and reduce the risk of non-compliance. in addition, gst certification in laxmi nagar, delhi can provide a competitive advantage to individuals seeking employment in accounting, finance, or tax consulting roles. 100 % placement assistance by "sla consultants delhi"

Tax Returns Planning

Get Price Quote

Annual Taxation Compliance ▪ Taxation Planning, objections and rulings ▪ Taxation Advice – GST, CGT, FBT, Employment Taxes, International Taxation Tax and taxation compliance can be major costs for many businesses. We help our clients by minimising their costs and maximising their potentials. We have tax accountants who are up-to-date with the most recent tax regulations and issues. We provide Taxation services to individuals and to a range of small, medium and large businesses – whether they are structured as sole traders, partnerships, trusts, companies, consolidated entities or a combination of these.

service tax registration services

Get Price Quote

We are proving Registration under Service tax, Consultancy for maintenance of proper records, Consultancy for proper accounting for Service tax., Consultancy on various issues relating to Service Tax, Compilation of data of Cenvat credit, Assistance in availment of notified Abatements, Utilization and availment of service tax credit in accordance with the Service Tax Credit Rules, 2002. etc.

Tax Consultant Service

Get Price Quote

Atul goel & associates are highly committed to offer sales tax, income tax, auditing services, service tax registration services to our clients based at delhi, gurgaon, noida, ghaziabad, ncr region.

tax consultancy service

Get Price Quote

We provide Professional Services from the very starting of your business and services required at each Phase of business. List of Services Provided by us: Registration Service: Company Registration, Partnership Registration, NGO & Society, Trademark, ISO Certification etc. Legal Compliance & Registration: VAT & CST Registration, Service tax, ESI- PF, Income tax Return etc. Management Reporting: Internal Audit of Books of Accounts, Fixed Stock Verification, Stock Audit Consultancy: Tax Consultancy, Company formation, Business Development Strategies, Tax Planning etc Other Business Services: Clearing and Forwarding Services, Financial Services, Book Keeping Service

vat no registration services

Get Price Quote

Government of n.c.t. Of delhi. Shiladxit .. Dvat m-sewa registration for applicant is available. We are providing the vat services.

Income Tax Consultant

Get Price Quote

Income Tax Consultant, Chartered Accountancy Services

GST EXCLUSIVE

Get Price Quote

GST EXCLUSIVE, CERTIFIED PROFESSIONAL ACCOUNTANT

Indirect Taxation Services

Get Price Quote

Clients in need of Indirect Taxation Services can contact us anytime of the year. We are a team of highly experienced and trained chartered accountants capable of handling indirect taxation requirements of our clients. Under the umbrella of our Indirect Taxation Services, we carry out the following Representation & Litigation support for Service Tax, Value Added Tax (VAT), Sales Tax/ Central Sales Tax and other allied legislations Advisory services on Service Tax, Value Added Tax (VAT), Sales Tax/ Central Sales Tax, Foreign Trade Policy, Special Economic Zones and other allied legislations Planning of entry strategies, structuring and analysing for tax efficiency in Service Tax Service Tax Health Checks & Due Diligence General Indirect Tax consultations, advise & compliance support

taxation consultant

Get Price Quote

We are a chartered accountant firm.

Direct Taxation Services

Get Price Quote

We are providing a complete services like direct taxation services

service tax registration services

Get Price Quote

service tax registration services, Company Incorporation Services

Income Tax Return

Get Price Quote

Business Return

Direct Taxation Services

Get Price Quote

Under the Direct Taxation Services we provide complete Tax Planning and solutions comprising of Filing of Income Tax Returns, Follow up of Income Tax Refunds, Advance Tax Computation, Quarterly Returns of TDS/TCS and Consultancy in TDS matters. We also assist our clients for drafting and submitting appeals and aid them to attend Scrutiny cases. Our Direct Taxation Services includes Income Tax ReturnsAssessment Appeals

tax registration services

Get Price Quote

We provide full services to obtain all tax registration including vat, service tax, excise and income tax pan for all types of business.

Taxation Services

Get Price Quote

We are specialized in providing the Taxation Services from India. We have valuable experience in taxation solutions viz direct tax issues, cross-border tax, international taxation, interpretation of tax treaties, transfer pricing. We provide authentic and reliable solutions to our esteemed clients at the various taxation issues. We are dedicated towards fulfilling our client�s requirements in optimum manner. Our trustworthy services are widely appreciated by overseas clients. We proffer wide gamut of services which includes: Routine Compliances viz returns filing, opinions etc. Ticklish issues viz Tax withholding Representation before Tax Authorities Approvals from Authorities viz custom, CBDT, Income Tax Authorities Transfer Pricing Tax modeling, Tax structuring and Advisory Services Planning for achieving Mergers, Acquisitions, Demergers, re-organizations Expatriates Taxation Foreign Direct Investment /Exchange Control Treaty Interpretation i.e. interpretation on various terms used in DTAA.

tax management services

Get Price Quote

tax management services, financial consulting, Legal Consulting

Taxation Service

Get Price Quote

legal compliances, secretarial works, Legal Service

INCOMETAX

Get Price Quote

INCOMETAX, taxation, GST, Audit