Taxation Advisory Services

Get Price Quote

Our services goods & service tax (gst) accounting & supervision shop & establishment registration msme registration income tax returns (itr) company pvt. Ltd. Ltd. Incorporation & roc society trust (ngo) partnership firm proprietor firm import-export code no. (iec) trade mark registration food license investements loan documents

tax refund service

Get Price Quote

All businesses and companies are supposed to pay service tax online. This is mandatory for the companies to pay the taxes on time for the smooth running of the business. However, companies file their taxes in advance and pay any estimated amount as part of the tax. Hence, you sometimes end up paying more than the actual tax amount. This amount can be refunded by applying for a tax refund online. The process of claiming the tax refund can be confusing if the procedure is not understood properly. Thetax refund service offered by the expert team members of Hero Tax Solutions will ensure that your refund is filed and tracked until it is returned to you.

Looking for Taxation Service Providers

Income Tax Services

Get Price Quote

We are ranked among well reckoned service providers of Income Tax Services in India. We are here to help you out for varied income tax related services such as filing of income tax returns, transfer pricing, Income Tax Scrutiny assessments, Income Tax Appeals, Income Tax Refunds, etc. Additionally, while preparing for income tax returns, our services also include assistance in terms of return assessment, return of loss, belated return and revised return etc. We also assist our clients in getting their income tax related documents such as PAN and TAN cards prepared by authorized agencies. Get in touch with us any time of the year for our services.

Income Tax Law Consultant

Get Price Quote

If you are in search of reliable income tax law consultants, then your search ends with us. Ours is a Delhi, India based organization that is involved in rendering dependable consulting services at very reasonable charges. Our consultants are well aware of all the intricacies involved in the income tax and its law. We guide you at every step and work lawfully. The consultants will guide you to pay the taxes on time and file income tax returns. Details : Tax Planning for Corporates and others. Consultancy on various case matters pertaining to Income tax. Effective tax management, tax structuring and advisory services. Filing Income Tax and Wealth Tax returns for all kinds of assessees. Filing Income tax returns for employees of corporate clients. Advance tax estimation and deposit. Assessing the liability towards deferred taxes Designing / restructuring salary structure to minimise tax burden. Obtaining Advance tax Rulings. Obtaining No Objection Certificates from Income tax department. Obtaining PAN for assessees, employees etc. Providing regular updates on amendments, circulars, notifications & judgments. Liaison with Income tax department for rectification, assessment, obtaining refunds etc. Expertise in complicated direct tax assessments. Filing and pleading appeals under various provisions of IT Act. Special expertise in search, seizure and prosecution litigation. Advice on future tax implications in respect of the potential acquisition. Opinions on the various Double Tax Avoidance Agreement related issues. Settlement of various issues raised under FEMA.

tax planning services

Get Price Quote

There is more to tax planning than the exemptions available on savings made by you. With our Tax Planning advice, you will pay the right amount of tax and know how to tax proof your income and gains. After all, your capital is more productive in your hands and it can work wonders for you if planned properly. We guide you in Planning & managing your finances and achieving your financial goals. Basic planning starts with tax planning services which can increase the take home income. These investments can also cater to a few of your needs if this is well planned. Tax planning is not restricted only to tax savings investments (Section 80C). There are several other components e.g. HRA, Home Loans, LTA, Sec 80D, Re-imbursements, etc to reduce the taxable income.

service tax registration services

Get Price Quote

We provide Service Tax Registration Services online as well as offline from our office at Delhi. The service is available only at INR 1849, and we only need 2-7 days for complete processing. As a bonus, we provide accounting Software QuickBook subscription worth INR.5000 free for the first year. We also assist in taking care of service tax returns to avoid late penalties, and charge a very nominal fee for that.

Domestic & International Taxation Services

Get Price Quote

Working in the industry since 1982, S K Surana & Co. LLP has become a well-known name in the service sector of New Delhi (India). Our domestic taxation includes compliance, tax planning & structuring, exemption and Income Computation and Disclosure Standards (ICDS). Whereas, our international taxation services will take care of the organization’s entry meeting with expatriates, FRRO registration, review of the agreement, advisory on taxation matters, etc. Clients who wish to avail the benefits of our domestic & international taxation services can contact us at our numbers at any time of the day.

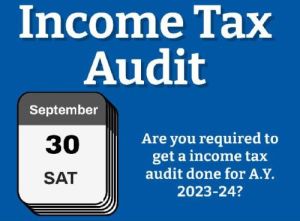

Income Tax Audit Service

10,000 - 80,000 Per Application

Are you required to get a income tax audit done for A.Y. 2023-24? If your gross receipts or turnover is above the applicable audit limit, you are required to get a income tax audit done. The due date for filing the Income tax audit report is September 30, 2023. If you fail to get a tax audit done when it is required, you may be subject to penalties. The penalties can be quite heavy, so it is important to make sure that you comply with the Income tax audit requirements. If you have any questions about the tax audit requirements, please consult with a CA.

Income Tax Registration

Get Price Quote

With our capacious storage facility, urgent and voluminous requirements of the buyers are easily furnished by us. To maintain optimum product environment, we use superior grade packaging material that is nontoxic. The labels on packs provide products details clearly and are smudge-proof. Registration in compliance with Sec 80 G of the Income tax act-1961.

Tax Returns Planning

Get Price Quote

Annual Taxation Compliance ▪ Taxation Planning, objections and rulings ▪ Taxation Advice – GST, CGT, FBT, Employment Taxes, International Taxation Tax and taxation compliance can be major costs for many businesses. We help our clients by minimising their costs and maximising their potentials. We have tax accountants who are up-to-date with the most recent tax regulations and issues. We provide Taxation services to individuals and to a range of small, medium and large businesses – whether they are structured as sole traders, partnerships, trusts, companies, consolidated entities or a combination of these.

sales tax services

Get Price Quote

This act also covers transactions of import of goods into or export of goods out of india. Sales tax is not imposed on import of goods into the country or export of goods out of the country. The rates of tax under central sales tax act vary from state to state and product to product. The standard rate of cst is 2 per cent or the lower rate applicable in the state of seller if the purchaser is purchasing the same for resale or for use in manufacture of goods for sale or for specified purposes and both the seller and buyer are registered dealers. Otherwise, the rate is higher of 12.5 per cent or the rate applicable in the state of sale.

Taxation Advisory Services

Get Price Quote

Apart from providing consultancy services for various types of taxes, we also offer taxation advisory services to various clients across the country. The advisory services offered by us are known for strict adherence to specified norms and regulations. We offer these services in very cost effective and personalized manner. It includes tax planning, preparation and filing of tax returns and settlement of cases before the tax authorities.

income tax consultancy services

Get Price Quote

income tax consultancy services, Tax Advisory, tax preparation

Sales Tax Registration Service

Get Price Quote

Sales Tax Registration Service, accounts finalization service

Tax Audit Consultancy Services

Get Price Quote

Since incepted in 2019, Astraea Business Advisors LLP has been able to gain a long list of satisfied clients in Delhi (India). The reason for this success is the best-in-class tax audit consultancy services that we are providing to the clients. Working for us is a team of highly experienced auditors, who are professionally trained and have in-depth knowledge of various auditing techniques as well. Many organizations in Delhi have approached us for availing the benefits of our services.

Indirect Taxation Services

Get Price Quote

Clients in need of Indirect Taxation Services can contact us anytime of the year. We are a team of highly experienced and trained chartered accountants capable of handling indirect taxation requirements of our clients. Under the umbrella of our Indirect Taxation Services, we carry out the following Representation & Litigation support for Service Tax, Value Added Tax (VAT), Sales Tax/ Central Sales Tax and other allied legislations Advisory services on Service Tax, Value Added Tax (VAT), Sales Tax/ Central Sales Tax, Foreign Trade Policy, Special Economic Zones and other allied legislations Planning of entry strategies, structuring and analysing for tax efficiency in Service Tax Service Tax Health Checks & Due Diligence General Indirect Tax consultations, advise & compliance support

tax management consultancy

Get Price Quote

We provide complete Tax Planning and Tax Management Consultancy for Corporate and Individual of Direct Tax & Indirect Tax. Our services have been described in detail as follows : Income Tax Assisting in obtaining Permanent Account Number (PAN) & Tax Deduction and Collection Account Number (TAN) of both Individual and Company Firm & NGO.Assisting in filling and filing of various forms and issue of Tax Deducted at Source (TDS) certificates.Assisting in filing of appeals, claiming of refunds under various sections of the Income Tax Act and getting the transaction registered.Advising on tax management and tax saving schemes.Filing of Income-tax and Wealth-tax returns of residents and non-residents.Individuals, domestic and foreign companies and other entities. Sales Tax, Services Tax & Excise Registration, Returns Filling, Amendment & Annual Assessment of Central Sales Tax (CST), Value Added Tax (VAT), Services Tax & Excise of both Individual and Company Firm.Acting as authorized representative before the sales tax authorities during assessment proceedings in any case.Complete solution of Accounting & Auditing.Book keeping and preparation of final accounts & Annual accounts.Annual Audits & Tax Audits.

Taxation Services

Get Price Quote

We are specialized in providing the Taxation Services from India. We have valuable experience in taxation solutions viz direct tax issues, cross-border tax, international taxation, interpretation of tax treaties, transfer pricing. We provide authentic and reliable solutions to our esteemed clients at the various taxation issues. We are dedicated towards fulfilling our client�s requirements in optimum manner. Our trustworthy services are widely appreciated by overseas clients. We proffer wide gamut of services which includes: Routine Compliances viz returns filing, opinions etc. Ticklish issues viz Tax withholding Representation before Tax Authorities Approvals from Authorities viz custom, CBDT, Income Tax Authorities Transfer Pricing Tax modeling, Tax structuring and Advisory Services Planning for achieving Mergers, Acquisitions, Demergers, re-organizations Expatriates Taxation Foreign Direct Investment /Exchange Control Treaty Interpretation i.e. interpretation on various terms used in DTAA.

Taxation Services

Get Price Quote

Audit Services, chartered accountants

Direct Taxation Services

Get Price Quote

We are providing a complete services like direct taxation services

tax management services

Get Price Quote

We are ready with solutions relating to all your Tax Management requirements. Our extremely competent team of professionals will guide you through the entire process of Tax Management. We are recognized as the dependable real estate Tax Management Service consultants and we base this recognition on the trust you have bestowed on us. We take maximum care to offer the clients comprehensive tax management solutions considering the specifications and needs of the clients. Amidst our vast clientele network we have been able to build a name of repute because of high standards of personalized Tax Management Services we offer. We offer the services in Income TaxObtaining Permanent Account Number (PAN)Filling and Filing of forms under the Income Tax act and issue of TDS CertificatesActing as authorized representatives before the income tax authoritiesFiling of appeals, claiming of refunds under various sections of the Income Tax Act and getting the transaction registered.Advising on tax management and tax saving schemeSales TaxAssisting in filling, filing and registration of Value Added Tax (VAT) ReturnsActing as authorized representative before the sales tax authorities during assessment proceedings in any case

Indirect Tax Planning Services

Get Price Quote

We are a Chartered Accountant Firm.

tax management services

Get Price Quote

tax management services, financial consulting, Legal Consulting

Service Tax

Get Price Quote

Service Tax, Auditing Services, Income Tax Services, vat services

Sales Tax Registration Service

Get Price Quote

Sales Tax Registration Service, society registration, ngo registration

income tax returns services

Get Price Quote

income tax returns services, Income Tax Services

E Account and Taxation

Get Price Quote

E Account and Taxation, HR Course

taxation training

Get Price Quote

taxation training, Business Analytics Training Service, Accounting Training

Tax Professional Services

Get Price Quote

Income Tax Consultants, Service Tax, passport, Digital Signature Certificate

online income tax form filling services

Get Price Quote

online income tax form filling services