Corporate Debt Syndication And Restructuring Service

Get Price Quote

Our Corporate Debt Syndication and Restructuring Service provides comprehensive financial solutions to optimize your business's capital structure. We specialize in arranging syndicated loans from multiple lenders, offering flexible terms and competitive rates to meet large-scale funding needs. Our restructuring services help revitalize your financial stability by renegotiating debt terms, reducing costs, and improving cash flow. With a focus on strategic planning, we ensure a seamless process, from assessing your requirements to executing tailored solutions. Backed by industry expertise and strong lender networks, we enable businesses to manage debt effectively, achieve growth, and navigate financial challenges with confidence.

Fixed Deposit and Bond Services

Get Price Quote

1 SHRIRAM,BAJAJ,ICICI, (MOQ)

Offered by banks and other financial institutions, a fixed deposit is an instrument that allows an individual to grow a sizable amount over a fixed term at a fixed rate of interest, and that too with absolute safety. The interest rate of the fixed deposits remains unchanged by market variation and the person will get maximum guaranteed returns on maturity. At HMK Finserve, we are indulged in providing outstanding fixed deposit services to our clients. We help our clients to select a suitable fixed deposit plan offered by a reliable bank or institution. Our team of professionals understands their requirements and financial condition and then helps them to get the best fixed deposit plan suiting their needs. We also help them with all the paperwork needed during the process.

Looking for Banking Services Providers

International Banking Service

Get Price Quote

Access the world of opportunities with our International Banking Service. Seamlessly manage your finances across borders with our comprehensive suite of solutions tailored to your global needs. Enjoy hassle-free international transactions, including fund transfers, currency exchange, and account management. Our dedicated team provides personalized support and expert advice to navigate the complexities of international finance. With secure platforms and competitive rates, trust us to optimize your global banking experience. Expand your horizons with confidence through our trusted International Banking Service.

Cheque Bounced Case

Get Price Quote

The very act of paying someone by way of cheque without having enough money in the bank may land the drawer of the cheque in jail. Cheque Bounce occurs when the cheque presented to the bank returns unpaid. There have been various important changes in the way cheques are issued, bounced, and dealt with. As there is an increase in trade and commerce, the use of cheque has also increased and also cheque bouncing disputes. Cheques are a major part of transactions in the country. Cheques are used as a mode of payment for several purposes such as repayment of a loan, payment of salary, business transactions, etc. Issuing a cheque as a mode of payment also secure the proof for the payment and it is one of the most reliable modes of payment for many people. As businesses in India continue to go digital, the sanctity of cheque transactions continues, particularly for small and medium businesses. Cases of dishonor-of-cheques are a growing problem and can adversely impact SME’s and MSME’s growth and sustenance. In case of a dishonored cheque, if there is no payment within 15 days of sending legal notice, you need to file a criminal complaint in Court to recover the amount. P4 Legal IP Associates will help you draft and file the cheque bounce case through an expert cheque bounce lawyer. In a cheque bounce case, a legal notice needs to be sent first before filing of the complaint. Timelines in a Cheque Bounce caseThe legal notice must be sent within 30 days from the date of bouncing of the cheque. The legal notice provides the cheque issuer 15 days from the date of receipt of notice to make the payment. In case the drawer fails to pay within 15 days, then a criminal complaint is to be filed in the Court within 30 days from the expiry of the 15 days.

Banking Outsourcing Services

50,000 - 150,000 Per

If you are looking forward to having highly effective banking outsourcing services, no other company can offer better service than Elect Elite BPO Services India LLP. Being one of the most well-acknowledged outsourcing companies, we offer high-quality banking outsourcing services that are extremely essential to make payments through debit or credit card, UPI, Aadhaar Enabled Payment System (AePS) etc. Since 2020, Elect Elite BPO Services India LLP Is offering banking outsourcing services with a team of highly efficient trained members such as payment experts, bank professionals and other executives. All these experts function in a single team to offer highly beneficial banking outsourcing services that are extremely necessary for any effective business. All our executives are specially trained and well-experienced to deliver the best payment-related services. Hence contact us to get the best quality banking outsourcing services with the highest usefulness.

Fixed Deposits And Bond Service

Get Price Quote

What are Governments bonds? When you lend money to the government in exchange for an agreed-upon interest rate, the transaction is known as a government bond or G-sec. They are frequently thought of as one of the safest asset classes. How do they operate, though? When you purchase a government bond, you are lending money to the government, which will utilize the funds raised to finance infrastructure or project development. The bond coupon specifies the frequency of the government’s fixed interest rate payments in return. The bond will keep making these payments until its maturity date, at which point it will expire and you will receive your initial investment back. From one year to 30 years or more, there are several maturities. Types of Government Bonds Indian Government issues several bonds in order to execute various projects. What is the Difference Between Corporate Bond and Government Bond? a. Treasury Bills (T-bills) The central government of India issues treasury bills, often known as T-bills, which are short-term government securities with a maturity of less than a year. Short-term financial instruments known as Treasury Bills come in three varieties: 1) 91 days 2) 182 days 3) 364 days Treasury bills are zero coupon securities and do not pay interest, although a number of financial instruments do. They are instead issued at a discount and redeemed at face value when they reach maturity. For instance, a 91-day Treasury bill would normally cost Rs. 100, but an investor can get it for Rs. 98.20, saving them Rs. 1.80. The investor will receive the returns after 91 days, computed on the basis of Rs. 100, the actual price. Investors will receive a total amount = Rs.721 Treasury Bills b. Cash Management Bills (CMBs) In the Indian financial sector, cash management bills are new securities. This security was first made available in 2010 by the Indian government and the Reserve Bank of India. Cash management bills are issued to cover short-term inconsistencies in the government of India’s financial flow. The RBI issues the bills on behalf of the government. Treasury bills and cash management bills are both short-term securities that are issued when necessary. However, the main distinction between the two is the maturity period CMBs are an extremely short-term investment option because they are issued with maturity duration of fewer than 91 days. For instance, if a Cash management bill has a face value of Rs.50, we can purchase it for Rs. 45 and receive Rs. 50 at end of the maturity period, which is typically 60 days. Due to the short maturity period, there is no interest payment in this case. However, a discount is received as payment for purchasing the Cash Management bill. c. Dated G-Secs Dated Government Securities are a distinct class of securities since they can carry a fixed or fluctuating interest rate, generally known as the coupon rate. They are first issued at face value, which remains constant until redemption. Government securities, as opposed to Treasury and Cash Management Bills, offer a wide variety of tenure ranging from 5 years to 40 years, making them known as long-term market vehicles. Those who are investing in dated government securities are called primary dealers. There are different types of dated government securities issued by the Government of India 1) Fixed Rate Bonds 2) Floating Rate Bonds 3) Capital Indexed Bonds 4) Inflation Indexed Bonds 5) Bonds with Call/Put Options 6) Special Securities 7) STRIPS – Separate Trading of Registered Interest and Principal of Securities 8) Sovereign Gold Bonds (SGB) 9) Zero Coupon Bonds Let us understand what are those 10 types of Government securities. 1. Fixed Rate Bonds Fixed rate bond’s coupon rate is constant for its entire life as a government obligation. In other words, regardless of changes in market rates, the interest rate stays the same throughout the investment period. For instance, an investor might purchase a fixed-rate bond from the government with a face value of Rs. 1000 and a coupon rate of 10%. The bond’s term is 10 years, and the payment schedule is either semi-annual or annual. Following that, the investor would get Rs. 50 (5%) every six months and Rs. 100 (10%) every year for the following ten years. While the market rate may fluctuate greatly, the coupon rate on this bond will not change at all. 2. Floating Rate Bonds Bonds usually have a specified coupon rate or interest rate. However, a floating rate bond, on the other hand, is a type of debt obligation without a fixed coupon rate and instead has an interest rate that changes according to the benchmark from which it is taken. Benchmarks are tools of the market that have an impact on the national economy. Examples of benchmarks for a floating rate bond are the repo rate and the reverse repo rate. You might have got confused now, about how this is going to work out – don’t worry let us illustrate with an example. Bond Price Rs. 1000 Quoted margin – 4% (It will not change the entire tenure of the bonds) Liable – 6 months Liable rate – 1% Tenure – 2 years Then the investor gets the following after the six months 4% (quoted margin) + 1% liable rate at the time of purchase = Rs.50 Since every six months’ the liable rate changes, if it increases to 2% Then the investor will receive it after one year – 4% (quoted margin) + 2% liable rate since it is reversed = Rs.60 Most of the bonds also will come up CAP which means – the coupon rate can go a maximum of 6%, not beyond that. For example, Coupon rate is 5 % and the liable rate is 1.5 % then it is 6.5%. It cannot be paid to the investors because the CAP rate is 6%, it should not go beyond. Therefore, the investors will only receive 6% irrespective of the liable rate changes. 3. Capital Indexed Bonds Bonds known as “Capital Indexed Bonds” (CIBs) have periodic adjustments made to their capital value and interest payments to account for fluctuations in the Consumer Price Index (CPI). Typically, a fixed rate of interest is charged on the recalculated face value. Investors receive the bond’s adjusted face value along with the final coupon calculated from the modified face value when the bond matures. 4. Inflation Indexed Bonds Inflation Index bonds (IIBs) are where the principal amount and the interest payment are linked to an inflation index. The Consumer Price Index (CPI) or the Wholesale Price Index may be used as an indicator of inflation. Investing in these bonds ensures steady real profits. Additionally, it might protect the investor’s portfolio from inflation rates. For example. Governments issue Inflation Index bonds Bond price – R.1000 The interest rate or coupon rate – CPI (The consumer Price Index) + 5% Here the interest rate of 5% would remain constant and CPI may change based on inflation. Tenure – 5 years Payment – Semi-Annually At the end of the 6 months if the inflation is 8 % then the investor would be receiving = 8 % + 5 % = 13% = Rs.130 At the end of the year if the inflation is 6% then the investors would be receiving = 6 % + 5 % = 11 % = Rs.110 How does Inflation Affect Bond Price? 5. Bonds with Call or Put Option These bonds include a call option that gives the issuer the opportunity to repurchase the bond or a sell option that gives the investor the option to sell the bond to the issuer (put option). Only five years after the date of issue will the investor or issuer be able to exercise their rights. Example Bond Price – Rs. 1000 Tenure – 10 years Government can buy back the same bond at the same price Rs. after the completion of 5 years before the maturity period (10 years). If only the government wants to re-purchase the bond. In the same way, the investors can sell the bond to the government at the same price which they had purchased five years before. 6.. Special Securities The Government of India also occasionally issues special securities to companies like Oil Marketing Companies, Fertilizer Companies, the Food Corporation of India, etc. under the market borrowing program as payment in place of cash subsidies. These securities are known as oil bonds, fertilizer bonds, and food bonds, respectively. These securities are often long-dated and have a little larger coupon than the yield of similarly dated assets with a similar maturity. Example companies – Indian Oil, Hindustan Fertiliser Corporate limited, 7. STRIPS – Separate Trading of Registered Interest and Principal of Securities Separate Trading of Registered Interest and Principal of Securities is referred to as STRIPS. Here, a fixed-rate bond’s cash flow is transformed into separate security. The secondary market is where they are traded after that. Additionally, they resemble zero-coupon bonds in many ways. They are made from the securities that already exist, though. I’m sure you might be confused with the definition of STRIPS. Let us understand with an example. Bond price Rs.1000 Coupon rate – 10 % Tenure – 5 years Payment mode- Semi-Annually Now let’s apply the STRIPS concept- since it’s a 5-year bond and the payment period is semiannual; the bonds will be stripped into 10 semiannual coupons and each coupon will be treated as a standalone coupon bond. The final payment of the principal payment also will be treated as a standalone zero-coupon bond. Here the investor either can trade the coupon rate or principal amount separately 8. Sovereign Gold Bonds (SGB) We are so dramatically attached to its physical gold, but Sovereign Gold bond (SGB) online issued by the government. The best part is the interest on these bonds falls under tax exemption for individual taxation. Minimum investment in the Bonds shall be one gram with a maximum limit of subscription per fiscal year of 4 kg for individuals, the nominal value of the bonds will be determined in Indian Rupees using the three last working days of the week before the subscription period’s simple average closing price of gold with a purity of 999.9, as announced by the India Bullion and Jewelers Association Limited. For investors applying online and making a payment in response to their application via digital means, the issue price of the Gold Bonds will be Rs. 50 per gram less than the nominal value. The Bonds will accrue interest at a fixed rate of 2.50 percent (annually) on the nominal value. The last interest payment will be due along with the principal at maturity and will be made in half-yearly installments. What is Sovereign Gold Bond? 9. Zero Coupon Bonds The majority of bonds give monthly, quarterly, semiannual, or annual interest based on the coupon rate; but zero-coupon bonds do not have any such interest. With a zero bond, you purchase the bond at a discount from its face value and are paid the face amount when the bond expires rather than receiving interest payments. Let us take an example. The actual face value –Rs. 10000 You buy it at a discount price – Rs 7000 Tenure or lock-in period – 5 years At the end of the five years, you will receive Rs. 10000 (which was the face value of the bond while you were purchasing) This situation can vary if the market fluctuates, and the face value can be lesser than the purchase price. Let us take an example. The actual face value –Rs. 10000 You buy at a discount price – Rs 7000 Tenure or lock-in period – 5 years At the end of the five years, if the same bond is trading at Rs. 6500 then you will receive only Rs. 6500 due to the market fluctuation. You can also sell the same bond before maturity in the secondary market. The face value can depend on the again the market condition. It can be sold at a discount price or a higher price. Closing Thoughts It’s significant to have a better option for your portfolio because Government issues a wide variety of government securities. You can select the G-Sec that best fits your investment timeline because tenure is one of the key distinctions from other instruments. Government bonds or G-sec not only provide assurance of better returns and comes with less risker than other types of bonds. FAQ’S ON Government Bonds Can government bonds be redeemed before maturity? Callable bond can be redeemed by the issuer before it’s maturity date. They are typically issued with a face value and a maturity date, at which point the bonds can be redeemed for the face value What is the minimum amount to invest in bond? The minimum amount to invest in savings bons is Rs 1000 and in multiples thereof. Are govt bonds tax free? Government bonds in India are not tax free. However, the interest earned on these bonds is exempt from tax. This means that you will not have to pay any tax on the interest you earn from investing in government bonds. For example, interest on certain municipal bonds may be exempt from federal and state taxes. Capital gains from the sale of government bonds are also generally taxable.

Banking Services

Get Price Quote

Are you looking for a trusted partner to manage your finances and achieve your financial goals? Welcome to our comprehensive banking services, where we offer a wide range of solutions designed to meet your banking needs, whether personal or business-related. Why Choose Our Banking Services: Trust and Reliability: With years of experience and a strong reputation in the banking industry, we are your trusted partner for all your financial needs. You can rely on us to safeguard your assets and provide expert guidance every step of the way. Diverse Product Portfolio: From savings and checking accounts to loans, investments, and insurance, our extensive product portfolio offers a one-stop solution for all your banking requirements. Whatever your financial goals may be, we have the right products and services to help you achieve them. Personalized Service: We understand that every customer is unique, with different financial goals and preferences. That's why we offer personalized service tailored to your individual needs, ensuring that you receive the attention and support you deserve. Innovative Technology: Stay ahead in the digital age with our cutting-edge banking technology. Enjoy convenient access to your accounts, secure online transactions, and advanced financial management tools that make banking easier and more efficient than ever before.

Banking Law Attorneys

Get Price Quote

Banking is an integral part of Commerce and Business. We support our clients with goal-oriented strategies for recovery and other banking-related matters before

Clone credit card

20 - 1,000 Per Piece

5 Piece (MOQ)

Banking Security Services

Get Price Quote

Electromec Associates is a leading name in offering marvellous banking security services to customers at affordable prices. Our services have been in great demand due to our quality services accomplishment within the stipulated period. Our services are executed by our professionals and also customized services to the customers. Incorporated in the year 2012, we are advancing under the leadership of Mr Sunil Dutt. We understand the needs of customers for their security and reliability. We are providing excellent banking security services to various reputed banks. We execute our services within the time-bound as agreed upon with the customer. Our skilled and experienced professionals have vast experience and knowledge of the area provide outstanding banking security services to our clients.

Banking and Financial Services

Get Price Quote

Our company is known to offer reliable Banking and Financial Services. The backbone of our firm is the team of experienced professionals, who have years of experience in this domain. We provide end-to-end Turnkey based Project Finance Consultancy to farmers and corporate houses. Our services include Project Profile, Project Report, Financial Workings and Complete File Documentation towards the loan sanction to loan disbursement. We also have good network/tie up with many public sector and private sector banks. One can obtain the Services at nominal rates.

Banking Customer Service Point

Get Price Quote

VADB is a Bhagalpur (Bihar, India) based service provider agency and considered as a specialist in handling the works of banking customer services. We have established our name in the service industry of Bihar through our scheduled operations and excellent customer support services. Being a responsible name, we lay special emphasis on our client’s queries and provide legitimate solutions within the promised timeline. Those who availed our services have appreciated the work. So, contact us anytime.

Best Teenagers Prepaid Debit Card Services

Get Price Quote

undefined undefined (MOQ)

akudo refers to "peaceful wealth" and came into existence with the mission to empower the country’s teenagers with financial literacy and knowledge. It offers excellent banking facilities to both teenagers as well as their parents. The best aspect of akudo is that it enables the kids to be financially independent and sound about investments while allowing parents to keep a close check on their activities all the time. akudo extends its banking services to these parents who can closely check their kids' activities and determine the expense limits. So, akudo offers incredible banking for teensas well as their parents.

Fixed Deposit Services

Get Price Quote

We are a noted service provider of Fixed Deposit Services. Fixed Deposits refers to deposition of an amount in a company for a certain period of time that can earn fixed rate of return. The rules governing the types of company that can accept Fixed Deposit Services are contained in the Companies Act, 1956 (soon will be governed by the Companies Act, 2013) and the Companies Acceptance of Deposit Rules (currently, Companies (Acceptance of Deposit) Rules, 1975. With our team of experienced professionals, we explain the clients about all the aspects of Fixed Deposit Services and help them invest efficiently.

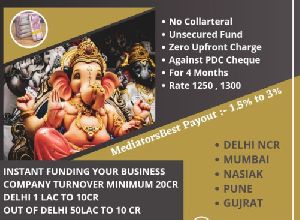

Unsecured Corporate Loan Services

Get Price Quote

Unsecured corporate loans are financial instruments that do not require collateral, relying solely on the borrower's creditworthiness and financial standing. These loans provide businesses with funding flexibility, as they do not require the pledging of assets. However, due to the higher risk for lenders, interest rates on unsecured corporate loans may be comparatively higher. Borrowers should carefully assess their financial position and repayment capacity before opting for these loans, as they can be a valuable resource for companies seeking quick capital without risking specific assets. No Collateral required On Turnover Basis Unsecured Business Loan Pan India Against PDC Cheque For Running Business Tenure 4-6 months cibil default file accepted Minimum turnover 20cr (Turnover in white) Starting funding 1cr TO 50cr No upfront

stemcell storage banking

Get Price Quote

provide protection of your baby for lifetime with cord blood stem cell banking. umbilical cord blood(UCB) is the blood that remains in the cord of the baby at the time of birth. cord blood is richest source of stem-cells which can be safely collected, processed and preserved for potential medical use in the future. over 80 types of terminal blood disorder including leukaemia, thalsemia, sickle cell anaemia, myeloma and lymphoma are being currently treated across the worldwide cord blood stem-cell. umbilical cord blood stem-cell banking is a means to safeguard and invest in your baby's and family's future health. cord blood cells are genetically unique and are a 100% match for the same child. the probability of a matches high for siblings and also be a match for other family members. StemCyte India is the only cord blood bank in the country that is actively involved in 1)public bank: the UCB is donated to StemCyte for processing and storage for further therapeutic use by unrelated patients. 2) private banking: UCB is collected, processed and stored for the future medical needs of the child or the family. 3) advance therapeutics: treatment of patients in need. 4) clinical trials: use of cord blood stem cells in indications like spinal cord injuries, stroke etc. StemCyte India facilitated as many 2000 transplant across 315 centres in 38 countries across 6 continents.

Debt Management Services

Get Price Quote

Our innovative solutions are designed to help individuals facing financial challenges overcome the burden of the debt trap. With Settle Loan, customers can rely on our expert loan settlement advisors to negotiate on their behalf, providing a way out of the debt trap.

Kiosk Banking CSP Point

30,000 Per piece

Your search for the best Kiosk Banking CSP Point is over with us. Our company Nasir Quraishi Pvt Ltd is the right choice. Kiosk Bank CSP is a Business Correspondent and Technology Service Provider to numerous banks. It has partnerships with among the greatest banks in India. The cash switch carrier is to be had at all Outlets from Tier I to Tier III towns and Tier IV Towns. It enables Customers to transfer cash whenever everywhere. Utility Payments allows customers to pay any sort of bills like strength, telephone, mobiles, water etc. With the available mode of tool(pc or cellular). Get the best Banking CSP Point services today. Contact us to know more.

Credit Cards

Get Price Quote

Ascot has a principal relationship with M/s CPCL Dubai for procurement of Master/Visa cards. CPCL is a Master/Visa approved plant located at the Jebel Ali Free Trade Zone in Dubai. This facility is one of the most modern and well equipped and is a short flight away from India.

Clone credit card

1,800 - 2,900 Per Piece

10 Piece (MOQ)

pigmy fixed deposits service

Get Price Quote

It is a financial instrument where a member gets assured ROI. We offer attractive returns on fixed deposits and investing in them is really simple and convenient.

microfinance services

Get Price Quote

Microfinance software is the best micro finance software provider in india and aboard. We provide the best micro finance software. Contact us immediately for a free demo. There are more than hundred fields to enter a client�s information. For credit products one can enter unlimited products.

Correspondent Banking Services

Get Price Quote

Financial institutions are constantly searching for better products and services that they offer to clients and the communities. In its easiest form, Correspondent Banking Services is when banks give services and get engaged in mutually helpful transactions with each other. At Vityajaya, we are ready to assist you with flawless financial services. Contact us now for more information.

Unsecured Corporate Loans

Get Price Quote

Do you need an urgent loan we offer worldwide loan to who in need of loan the business opportunity you having being looking for is here again.

Fixed Deposit Services

Get Price Quote

1 Bag (MOQ)

Invest. Earn. Grow. Earn upto 7.75% interest p.a. Book Online today. CRISIL Ratings “CRISIL AAA/Stable”| India Ratings “IND AAA/Stable”| Additional 0.25% interest rate for senior citizens.

Corporate Debt Restructuring Advisory Services

Get Price Quote

For expert Corporate Debt Restructuring Advisory Services in Worldwide, you can simply rely on us. CDR is a reorganization of a company's outstanding obligations, which is achieved by reducing the burden of the debts on the company. It is done by decreasing the rates paid and increasing the time after which the company has to pay back the obligation levied on it. With the help of this criterion, a company becomes able to meet the obligations easily. In addition, some of the debts may be pardoned by creditors in exchange for an equity position in the company.

Bank guarantee

Get Price Quote

1 Lack USD (MOQ)

A bank guarantee is a promise by a bank to cover a loss in case a borrower defaults on a loan.

banking service

Get Price Quote

banking Service

credit card

Get Price Quote

Credit card : looking for best credit card services? your search ends here. With the specialized “smart” algorithm we have designed in http:www.ruloans.com, we help you to compare the different types of credit cards available and suggest to you the one most suitable and apt for your needs. With an unbiased credit card eligibility calculator, our suggestions of the card apt for you, is free from any inclination or favoritism. For more information contact us on our website: https:www.ruloans.comcredit-card