Spiral Binding Services

Get Price Quote

Spiral binding is helpful in keeping your records in a managed form. And, you can get professional assistance from us if looking for the same. At Das Photostat Centre, we are a group of professionals having immense industry experience and instrumental in furnishing spiral binding requirements related to documents, reports, presentations and proposals. With this, we make use of strips of plastic/ wire that pass through a series of holes to bind stacked paper. For more information or personalized solutions, reach us anytime 24*7. We are based in Assam, India.

book binding services

20 - 25 Per Book

25 Books (MOQ)

Book binding services offer professional solutions to preserve and enhance the appearance of books, documents, and manuscripts. These services cater to a wide range of needs, including repairing damaged books, custom binding for theses or dissertations, and creating bespoke covers for special editions. Options include hardcovers, softcovers, spiral binding, and perfect binding, each providing a different level of durability and aesthetics. Whether for academic, corporate, or personal use, book binding services ensure that your documents are not only well-protected but also visually appealing, making them ideal for both everyday use and special presentations.

Looking for Binding Service Providers

Spiral Book Binding Service

Get Price Quote

M/S Jaina Offset Printers is the best company for spiral book binding services. The twisting (or loops) is embedded and twisted through the book. The curl restricting is then cut and creased at the finishes to hold the books back from loosening up. Winding restricting makes an appealing, dependable booklet, appropriate for a wide scope of involved utilizes. Winding bound books can be altered to suit any subject. Browse our gigantic paper list, in addition to hued curls, vinyl sponsorships, a variety of poly covers and pocket covers. Also, presently, get a moment to evaluate almost any custom size twisting bound book, as well. Choose us and get our services.

MS and GI Binding Wire Manufacturing Project Consultancy Services

Get Price Quote

1 undefined (MOQ)

Detailed project report (dpr) available for rs. 5300. The content of the project report 1. executive summary 2. introduction 3. quality standards 4. market - domedtic & export potential 5. basis & assumptions 6. production & technical aspects 7. project facilities & cost estimation 7.1 land & building 7.2 plant & machineries 7.3 pollution control & energy conservation 8. cost summary & operating expenses 9. financial analysis ( projected cash flow for next 5 years ) 10. How to set up this project – an action plan 11. Various options of arranging finances

Soft Cover Binding Services

Get Price Quote

Fixed Deposit and Bond Services

Get Price Quote

1 SHRIRAM,BAJAJ,ICICI, (MOQ)

Offered by banks and other financial institutions, a fixed deposit is an instrument that allows an individual to grow a sizable amount over a fixed term at a fixed rate of interest, and that too with absolute safety. The interest rate of the fixed deposits remains unchanged by market variation and the person will get maximum guaranteed returns on maturity. At HMK Finserve, we are indulged in providing outstanding fixed deposit services to our clients. We help our clients to select a suitable fixed deposit plan offered by a reliable bank or institution. Our team of professionals understands their requirements and financial condition and then helps them to get the best fixed deposit plan suiting their needs. We also help them with all the paperwork needed during the process.

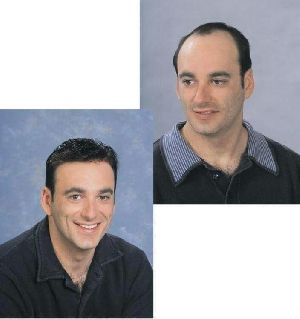

Hair Bonding Services

Get Price Quote

We, at Famous Exports, offer Hair Bonding Service which is guaranteed for perfect Hair Bonding Service make and authentic looks. Our Hair Bonding Service is made by the experts who know every detail about manufacturing a flawless Hair Bonding Service. Hair and other materials used in our Hair Bonding Service are of best quality and are reliable. We process hair with the use of specialized technique and make sure that they are clean and conditioned. Our Hair Bonding Service is very easy to wear and is available in various styles, colors and sizes as per the needs of the clients.

Indemnity Bond Agreement Drafting Services

Get Price Quote

Indemnity Bond Agreement Drafting Services are essential for individuals and businesses looking to formalize indemnity arrangements. These services specialize in creating legally binding agreements that define the terms of indemnification, outlining the responsibilities and liabilities of the parties involved. Experts in this field ensure compliance with legal requirements, protecting the interests of both indemnifiers and indemnitees. Indemnity Bond Agreement Drafting Services provide clarity, reduce risks, and help prevent disputes by clearly specifying the conditions and extent of indemnification, ultimately ensuring that parties are adequately protected in various legal and financial scenarios.

Security Bond & Agreement Services

150 - 200 Per one

07 piece (MOQ)

If you are seeking professional aid for security bond and agreement requirements, then it is good to approach SKPF. Ours is a Ramanagara (India) based agency and trusted by many owing to our scheduled operations and excellent customer support services. Backed by a sound security purpose bond & agreement facility and a team of qualified individuals, we provide solutions complying with the stated industry norms. We prepare T&C of the agreement as per client’s requirements. For further discussion, feel free to ring us on the given numbers.

book binding service

Get Price Quote

Our Book Binding Service offers professional solutions for all your binding needs, ensuring durability and elegance. We specialize in hardcover, softcover, spiral, and custom binding options suitable for books, journals, manuals, and more. Using high-quality materials and advanced techniques, we provide strong, long-lasting bindings that enhance the presentation and usability of your documents. Whether you need binding for personal projects, academic theses, or corporate reports, we deliver impeccable craftsmanship tailored to your preferences. With timely delivery and competitive pricing, our service guarantees satisfaction for individuals, publishers, and organizations alike. Trust us to preserve your work with care and precision.

Hair Bonding Services

Get Price Quote

You can consult with us about these options. Our experts will tell you the whole thing about Hair Bonding. According to our experts, Hair Bonding is more comfortable than Hair Transplant. So collect all the information on Hair Bonding and understand what is best among all the treatments. Also, it is not very costly when you go for the hair bonding option to get your hair bonding in KolkataThere are many treatments available for Hair Loss or Hair fall problems. Hair Bonding comes under Hair Extension. It is the quickest way to get rid of baldness or hair fall. Hair bonding is a painless and non-surgical way to add compatible hair extensions to your existing hair.You Have To Go For Hair Bonding, If : Hair falls in patches Abnormally thinning of Hairs Facing baldness There Are Two Options For Best Hair Bonding in Kolkata. Soft Hair Bonding Hard Hair Bonding

Spiral Binding Services

Get Price Quote

Ours is a Delhi, India based organization that is engaged in offering trusted spiral binding services. We are supported by advanced spiral binding machines that ensure the completion of the spiral binding task in bulk with ease and perfection. We are entrusted for providing quality services as we are highly professional. We complete the designated task within the promised time frame. Moreover, we offer our services at affordable charges.

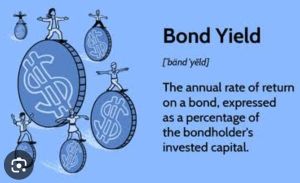

Bonds Investment Service

Get Price Quote

A bond is a fixed income instrument in which investor loans money to an entity (Corporate or Government) which borrows the funds for a defined period of time at a variable or fixed interest rate. Bonds are used by Corporate or Government to raise money and finance a variety of projects or activities. It is a market meant for trading (i.e. buying or selling) fixed income instruments. Fixed income instruments could be securities issued by Central and State Governments, Municipal Corporations, Govt. Bodies or by Private entities like Financial institutions, Banks, Corporate, etc. Why invest in Bonds? · Regular fixed income · Higher interest rate · No TDS on GSec, SDL, SGS · Portfolio diversification · Tradable publicly

Steel Connection Design Services

Get Price Quote

Steel Connection Design Services specialize in designing safe, efficient, and cost-effective connections for steel structures, ensuring structural integrity and compliance with industry standards. These services involve designing connections for beams, columns, braces, and other components, considering factors like load-bearing capacity, stress distribution, and material properties. Engineers use advanced analysis tools to optimize connection design for ease of fabrication, assembly, and long-term durability. Services include both standard and custom connections, addressing requirements for seismic, wind, and load considerations. Steel Connection Design Services play a crucial role in enhancing the overall performance and safety of steel structures in various industrial and commercial projects.

Project Book Binding Service

220 - 350 Per Unit

1 piec (MOQ)

Elevate your projects with our Project Book Binding Service. We specialize in transforming your work into professionally bound volumes, adding a touch of sophistication. Choose from a variety of binding options, including spiral, comb, or perfect binding, tailored to your project's needs. Our skilled team ensures precision and durability, creating a polished presentation that enhances your content. Whether it's reports, presentations, or academic projects, our binding service adds a professional edge. Trust us to bring your work to life, combining functionality with aesthetics. Opt for our Project Book Binding Service, where attention to detail meets quality craftsmanship, making your projects truly stand out.

Fixed Deposits And Bond Service

Get Price Quote

What are Governments bonds? When you lend money to the government in exchange for an agreed-upon interest rate, the transaction is known as a government bond or G-sec. They are frequently thought of as one of the safest asset classes. How do they operate, though? When you purchase a government bond, you are lending money to the government, which will utilize the funds raised to finance infrastructure or project development. The bond coupon specifies the frequency of the government’s fixed interest rate payments in return. The bond will keep making these payments until its maturity date, at which point it will expire and you will receive your initial investment back. From one year to 30 years or more, there are several maturities. Types of Government Bonds Indian Government issues several bonds in order to execute various projects. What is the Difference Between Corporate Bond and Government Bond? a. Treasury Bills (T-bills) The central government of India issues treasury bills, often known as T-bills, which are short-term government securities with a maturity of less than a year. Short-term financial instruments known as Treasury Bills come in three varieties: 1) 91 days 2) 182 days 3) 364 days Treasury bills are zero coupon securities and do not pay interest, although a number of financial instruments do. They are instead issued at a discount and redeemed at face value when they reach maturity. For instance, a 91-day Treasury bill would normally cost Rs. 100, but an investor can get it for Rs. 98.20, saving them Rs. 1.80. The investor will receive the returns after 91 days, computed on the basis of Rs. 100, the actual price. Investors will receive a total amount = Rs.721 Treasury Bills b. Cash Management Bills (CMBs) In the Indian financial sector, cash management bills are new securities. This security was first made available in 2010 by the Indian government and the Reserve Bank of India. Cash management bills are issued to cover short-term inconsistencies in the government of India’s financial flow. The RBI issues the bills on behalf of the government. Treasury bills and cash management bills are both short-term securities that are issued when necessary. However, the main distinction between the two is the maturity period CMBs are an extremely short-term investment option because they are issued with maturity duration of fewer than 91 days. For instance, if a Cash management bill has a face value of Rs.50, we can purchase it for Rs. 45 and receive Rs. 50 at end of the maturity period, which is typically 60 days. Due to the short maturity period, there is no interest payment in this case. However, a discount is received as payment for purchasing the Cash Management bill. c. Dated G-Secs Dated Government Securities are a distinct class of securities since they can carry a fixed or fluctuating interest rate, generally known as the coupon rate. They are first issued at face value, which remains constant until redemption. Government securities, as opposed to Treasury and Cash Management Bills, offer a wide variety of tenure ranging from 5 years to 40 years, making them known as long-term market vehicles. Those who are investing in dated government securities are called primary dealers. There are different types of dated government securities issued by the Government of India 1) Fixed Rate Bonds 2) Floating Rate Bonds 3) Capital Indexed Bonds 4) Inflation Indexed Bonds 5) Bonds with Call/Put Options 6) Special Securities 7) STRIPS – Separate Trading of Registered Interest and Principal of Securities 8) Sovereign Gold Bonds (SGB) 9) Zero Coupon Bonds Let us understand what are those 10 types of Government securities. 1. Fixed Rate Bonds Fixed rate bond’s coupon rate is constant for its entire life as a government obligation. In other words, regardless of changes in market rates, the interest rate stays the same throughout the investment period. For instance, an investor might purchase a fixed-rate bond from the government with a face value of Rs. 1000 and a coupon rate of 10%. The bond’s term is 10 years, and the payment schedule is either semi-annual or annual. Following that, the investor would get Rs. 50 (5%) every six months and Rs. 100 (10%) every year for the following ten years. While the market rate may fluctuate greatly, the coupon rate on this bond will not change at all. 2. Floating Rate Bonds Bonds usually have a specified coupon rate or interest rate. However, a floating rate bond, on the other hand, is a type of debt obligation without a fixed coupon rate and instead has an interest rate that changes according to the benchmark from which it is taken. Benchmarks are tools of the market that have an impact on the national economy. Examples of benchmarks for a floating rate bond are the repo rate and the reverse repo rate. You might have got confused now, about how this is going to work out – don’t worry let us illustrate with an example. Bond Price Rs. 1000 Quoted margin – 4% (It will not change the entire tenure of the bonds) Liable – 6 months Liable rate – 1% Tenure – 2 years Then the investor gets the following after the six months 4% (quoted margin) + 1% liable rate at the time of purchase = Rs.50 Since every six months’ the liable rate changes, if it increases to 2% Then the investor will receive it after one year – 4% (quoted margin) + 2% liable rate since it is reversed = Rs.60 Most of the bonds also will come up CAP which means – the coupon rate can go a maximum of 6%, not beyond that. For example, Coupon rate is 5 % and the liable rate is 1.5 % then it is 6.5%. It cannot be paid to the investors because the CAP rate is 6%, it should not go beyond. Therefore, the investors will only receive 6% irrespective of the liable rate changes. 3. Capital Indexed Bonds Bonds known as “Capital Indexed Bonds” (CIBs) have periodic adjustments made to their capital value and interest payments to account for fluctuations in the Consumer Price Index (CPI). Typically, a fixed rate of interest is charged on the recalculated face value. Investors receive the bond’s adjusted face value along with the final coupon calculated from the modified face value when the bond matures. 4. Inflation Indexed Bonds Inflation Index bonds (IIBs) are where the principal amount and the interest payment are linked to an inflation index. The Consumer Price Index (CPI) or the Wholesale Price Index may be used as an indicator of inflation. Investing in these bonds ensures steady real profits. Additionally, it might protect the investor’s portfolio from inflation rates. For example. Governments issue Inflation Index bonds Bond price – R.1000 The interest rate or coupon rate – CPI (The consumer Price Index) + 5% Here the interest rate of 5% would remain constant and CPI may change based on inflation. Tenure – 5 years Payment – Semi-Annually At the end of the 6 months if the inflation is 8 % then the investor would be receiving = 8 % + 5 % = 13% = Rs.130 At the end of the year if the inflation is 6% then the investors would be receiving = 6 % + 5 % = 11 % = Rs.110 How does Inflation Affect Bond Price? 5. Bonds with Call or Put Option These bonds include a call option that gives the issuer the opportunity to repurchase the bond or a sell option that gives the investor the option to sell the bond to the issuer (put option). Only five years after the date of issue will the investor or issuer be able to exercise their rights. Example Bond Price – Rs. 1000 Tenure – 10 years Government can buy back the same bond at the same price Rs. after the completion of 5 years before the maturity period (10 years). If only the government wants to re-purchase the bond. In the same way, the investors can sell the bond to the government at the same price which they had purchased five years before. 6.. Special Securities The Government of India also occasionally issues special securities to companies like Oil Marketing Companies, Fertilizer Companies, the Food Corporation of India, etc. under the market borrowing program as payment in place of cash subsidies. These securities are known as oil bonds, fertilizer bonds, and food bonds, respectively. These securities are often long-dated and have a little larger coupon than the yield of similarly dated assets with a similar maturity. Example companies – Indian Oil, Hindustan Fertiliser Corporate limited, 7. STRIPS – Separate Trading of Registered Interest and Principal of Securities Separate Trading of Registered Interest and Principal of Securities is referred to as STRIPS. Here, a fixed-rate bond’s cash flow is transformed into separate security. The secondary market is where they are traded after that. Additionally, they resemble zero-coupon bonds in many ways. They are made from the securities that already exist, though. I’m sure you might be confused with the definition of STRIPS. Let us understand with an example. Bond price Rs.1000 Coupon rate – 10 % Tenure – 5 years Payment mode- Semi-Annually Now let’s apply the STRIPS concept- since it’s a 5-year bond and the payment period is semiannual; the bonds will be stripped into 10 semiannual coupons and each coupon will be treated as a standalone coupon bond. The final payment of the principal payment also will be treated as a standalone zero-coupon bond. Here the investor either can trade the coupon rate or principal amount separately 8. Sovereign Gold Bonds (SGB) We are so dramatically attached to its physical gold, but Sovereign Gold bond (SGB) online issued by the government. The best part is the interest on these bonds falls under tax exemption for individual taxation. Minimum investment in the Bonds shall be one gram with a maximum limit of subscription per fiscal year of 4 kg for individuals, the nominal value of the bonds will be determined in Indian Rupees using the three last working days of the week before the subscription period’s simple average closing price of gold with a purity of 999.9, as announced by the India Bullion and Jewelers Association Limited. For investors applying online and making a payment in response to their application via digital means, the issue price of the Gold Bonds will be Rs. 50 per gram less than the nominal value. The Bonds will accrue interest at a fixed rate of 2.50 percent (annually) on the nominal value. The last interest payment will be due along with the principal at maturity and will be made in half-yearly installments. What is Sovereign Gold Bond? 9. Zero Coupon Bonds The majority of bonds give monthly, quarterly, semiannual, or annual interest based on the coupon rate; but zero-coupon bonds do not have any such interest. With a zero bond, you purchase the bond at a discount from its face value and are paid the face amount when the bond expires rather than receiving interest payments. Let us take an example. The actual face value –Rs. 10000 You buy it at a discount price – Rs 7000 Tenure or lock-in period – 5 years At the end of the five years, you will receive Rs. 10000 (which was the face value of the bond while you were purchasing) This situation can vary if the market fluctuates, and the face value can be lesser than the purchase price. Let us take an example. The actual face value –Rs. 10000 You buy at a discount price – Rs 7000 Tenure or lock-in period – 5 years At the end of the five years, if the same bond is trading at Rs. 6500 then you will receive only Rs. 6500 due to the market fluctuation. You can also sell the same bond before maturity in the secondary market. The face value can depend on the again the market condition. It can be sold at a discount price or a higher price. Closing Thoughts It’s significant to have a better option for your portfolio because Government issues a wide variety of government securities. You can select the G-Sec that best fits your investment timeline because tenure is one of the key distinctions from other instruments. Government bonds or G-sec not only provide assurance of better returns and comes with less risker than other types of bonds. FAQ’S ON Government Bonds Can government bonds be redeemed before maturity? Callable bond can be redeemed by the issuer before it’s maturity date. They are typically issued with a face value and a maturity date, at which point the bonds can be redeemed for the face value What is the minimum amount to invest in bond? The minimum amount to invest in savings bons is Rs 1000 and in multiples thereof. Are govt bonds tax free? Government bonds in India are not tax free. However, the interest earned on these bonds is exempt from tax. This means that you will not have to pay any tax on the interest you earn from investing in government bonds. For example, interest on certain municipal bonds may be exempt from federal and state taxes. Capital gains from the sale of government bonds are also generally taxable.

gi bend pipes connection service

Get Price Quote

service connection gi bend pipes is used in rural electrification projects.we have approvals from numerous state electricity board for gi bend pipes. More than 28 districts in various state of india have our gi bend pipe. saubhagya, rgggvy, ddujy are all different names for the projects where these service connection pipes are used.

Leather Binding Services

Get Price Quote

We provide an exceptional quality leather binding services to our customers. These executed services are offered by our specialized team and good quality leather is used to offer the quality work. We are providing these expert services at most economical rates.

book binding services

Get Price Quote

The fundamental techniques of measuring, cutting, and glueing are used in bookbinding to join isolated pages together. As a result, Square Brothers Printing Pvt. Ltd from Chennai, Tamil Nadu provides trustworthy book binding services to consumers. We can provide cost-effective and timely solutions for binding various sorts of books due to our extensive experience in this field. Our services are provided at a low cost. As a result, our exclusive customer has come to rely on and prefer our bookbinding services over others. We have maintained our high market standards by offering only high-quality products, which are made possible by the use of high-quality raw materials sourced from trusted sources.

CUG Connections

Get Price Quote

PostPaid Connections in Hyderabad, secunderabad, Adilabad, Karimnagar, Khammam, Mahbubnagar, Medak, Nalgonda, Nizamabad, Rangareddy, Warangal, Anantapur, Chittoor, East Godavari, Guntur, Krishna, Kurnool, Prakasam, Nellore, Srikakulam, Visakhapatnam, Vizianagaram, West Godavari, YSR Kadapa, Eluru, Ongole, Machilipatnam, Kakinada, Maharashtra, Mumbai, Ahmednagar, Akola, Aurangabad, Kolhapur, Latur, Nagpur, Nashik, Pune, Karnataka, Bangalore, Mysore, Coorg, Hampi, Mangalore, Badami, Shimoga, Hassan, Delhi, New Delhi :Vodafone is the world's leading mobile communications group with around 358 million proportionate customers worldwide. We employ approximately 80,000 people in our group operations and national operating companies in more than 74 countries across the globe. We have also forged Partner Market agreements in more than 40 countries round the world. Vodafone as an organization has always set high standards in technological innovation and Customer Service. We have a team of professionals ready for assistance round the clock with a Happy to Help Philosophy. For customers like you, Vodafone now offers the following range of products and services: · Customized talk plans · Customized data plans · Vodafone Business Solutions In addition to the above you can avail various products and services like Call Filter and Busy Message on your Vodafone connection to avoid unwanted calls. Please feel free for availing other Vodafone Services like Vodafone Alerts, BlackBerry, and Vodafone Mobile Connect etc.