Unsecured Corporate Loan Services

Get Price Quote

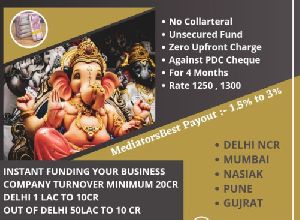

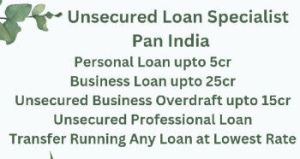

Unsecured corporate loans are financial instruments that do not require collateral, relying solely on the borrower's creditworthiness and financial standing. These loans provide businesses with funding flexibility, as they do not require the pledging of assets. However, due to the higher risk for lenders, interest rates on unsecured corporate loans may be comparatively higher. Borrowers should carefully assess their financial position and repayment capacity before opting for these loans, as they can be a valuable resource for companies seeking quick capital without risking specific assets. No Collateral required On Turnover Basis Unsecured Business Loan Pan India Against PDC Cheque For Running Business Tenure 4-6 months cibil default file accepted Minimum turnover 20cr (Turnover in white) Starting funding 1cr TO 50cr No upfront

Unsecured Corporate Loans

Get Price Quote

Instant funding from 10 lakh to 20 crore on your business turnover and banking without cibil score.Minimum annual turnover required 3 crore or more on paper. Serviceable area only Delhi ncr with running business. For further details connect with us. We don't charge any kind of upfront charges.

Looking for Investment Banks Service Providers

Unsecured Corporate Loans

Get Price Quote

Do you need an urgent loan we offer worldwide loan to who in need of loan the business opportunity you having being looking for is here again.

unsecured business loans

Get Price Quote

Big offers to all cutomers now we can get seured & unsecured loans on very low & attractive rates - secured loan upto 8 to 10 % - unsecured loan up to 15.99% to 19 % note :- within 4 to 5 days disbursement process.

Unsecured Corporate Loans

Get Price Quote

Get Loans Up-to Rs 50,00,000.00 - Bad Credit No Problem! We offer Loans to indians and NRI *Business Loans *Personal Loans *Home Loans *Investment Loans *Cash Loan…at 2.08% per annum We Loan from Rs1,00,000.00 TO Rs20,00,000.00 UP TO A DURATION OF 1 YEAR TO 25 YEARS

Working Capital Limit Arrangement

Get Price Quote

Making Arrangement of Working Capital Facilities (OD, CC , BG and LC) for Prospective Customers

Unsecured Corporate Loans

Get Price Quote

We are Specialised to Arrange Unsecured Loan at Best rate of Interest and Tenure. Quickly Sanction Fast Disbursement.

Investment Banks

Get Price Quote

12 Strip (MOQ)

Finding a genuine provider of financial instrument is very challenging but we are a direct mandate to a verifiable provider of Financial Instrument provider in Ireland. Presently, we only focus on BG/SBLC for Lease and Sale transactions. However, our Lease BG/SBLC is 4+2% and Sale at 32+2%. Should you find this interesting and acceptable? Kindly, contact us and we shall review and respond with draft Contract/MOU within 48hrs maximum.

Unsecured Corporate Loans services

Get Price Quote

Unsecured Corporate Loans services, private loans service, business loan

Merchant Banking NISM Series IX Certification

Get Price Quote

The field of Merchant Banking is exciting yet unpredictable. Success in this field depends upon a unique set of skills in developing financial plans, analyzing the crucial financial statistics, proposing strategies for clients and negotiating deals etc. One has to be on the go with enthusiastic approach beyond a 10 to 5 job. About SEBI: The Securities and the Exchange Board of India (SEBI) is the national regulatory body for the securities market. Its primary role is to protect the interest of the capital market investors and promote market development. In short, SEBI is the stock market regulator. For Investment Banking industry, one needs to know about the functioning of equity markets and stocks.SEBI learns from past fraud cases which occurred with naive investors. Therefore, now a days SEBI merchant banking courselike NISM Series IX: Merchant Banking Certification Examination has been made mandatory by SEBI.

Unsecured Corporate Loans

Get Price Quote

Unsecured Corporate Loans, MSME LOAN

unsecured business loans

Get Price Quote

Tab capital's unsecured business loans are available through a fast & simple online application form. Upload the documents, and get finance in just 2 working days. Loan upto 100 lac rupees with attractive interest rate. The loan can be availed by small, and medium enterprises & msmes.

working capital facilities

Get Price Quote

Working Capital Facilities, also called Cash Credits, is a type of facility that is used for withdrawing amount from business account even though the account does not have enough credit balance. Here, the amount limit which can be withdrawn is sanctioned by bank based on business cycle of client as well as working capital gap and drawing power of clients. Here, the drawing power is determined upon understanding the stock as well as book debts statements that are submitted by borrowers at monthly intervals against security through hypothecation of : Stock of commodities Book debts Here, the excess cash withdrawal facility is made on demand from customer where they have to pay interest on excess amount withdrawn. Further, the Cash Credit facility is also useful for those businesses where cash payment like wages, transportation need to be made and receivables are not realized in time.Our Expertise :Our company holds expertise in providing customers with Working Capital Finance that act as loans designed towards meeting cash flow needs without much hassles. The expertise of the company lies in : Setting up working capital facilities for WCDL, Cash credit, LCs, Guarantees, Export Credit for select dealers of Corporate where facilities are set up based on : Analysis of financials Need for funding Regulatory guidelines Security With a minimum margin of 25%, company also provides funding against : Hypothecation of Stocks Book Debts Documentation Process : Following steps are followed for completing application process. Application form accepted and acknowledged Personal interview /discussions held with customers by bank officials Bank's Field Investigation team visits business place of applicants Bank verifying track records of applicants with common information sharing bureau (CIBIL) In fresh projects, bank analyses back ground of applicants and technical feasibility/financial viability of projects based on different parameters and existing market conditions Depending on size of projects, file is put up for sanction to appropriate level of authority Sanction and disbursement : On sanction, sanction letter issued specifying terms and conditions for disbursement of loans Acceptance to terms of sanction taken from Applicants Processing charges as specified by banks paid to proceed further with disbursement procedure Documentation procedure takes place ding to terms of sanction of loan of bank are executed All necessary documents as specified by legal dept., accor Disbursement of loan takes place after Legal Dept. Certifies Correctness of execution documents

unsecured business loans

Get Price Quote

Unsecured Business Loans are loans taken by the borrower to start or enhance a business without any collateral. The borrower need not pledge any of his property or asset. There are many banks like HDFC, SBI, Shriram City finance etc. that provide you unsecured business loan in India and of course many financial services too like karvy financial services, cholamandalam financial services, indiabulls financial services etc.

Bank Investment Services

Get Price Quote

• Protection at affordable cost. • Value for money. • Easy enrollment through simplified proposal form.

unsecured corporate loans service

Get Price Quote

unsecured corporate loans service, All subsidy loan in government services

unsecured business loans

Get Price Quote

We are main supplier of this product.

Inter Corporate Deposit Funding Services

Get Price Quote

We have ICD loans available now for unlistedlisted companies: 1. NBFC offering through ICD route. 2. ROI will range from 18 to 22% p.a. Reducing depending upon the financials background of the Company 3. Tenor will be maximum 3 years 4. Repayment can be structured quarterlyhalf yearly annual or bullet. 5. Security can be pledge of shares with PGs of Directors and PDCs. 6. Personal discussion is a must Documents needed to process: 1. Mandate Letter 2. 2 page executive summary with financial snapshot of the Company with background promoters background nature of product existing financing arrangement 3. Financials of the past 3 years with estimates of FY 12. 4. Contact person mail id and mobile no. May also be furnished on the 2 pager. Further documents after in-principle approval.

Unsecured Corporate Loans

Get Price Quote

Unsecured Corporate Loans, financial management, Bill Discounting Services

Investment Banks

Get Price Quote

Investment Banks, investor relations services