Systematic Withdrawal Plan Services

Get Price Quote

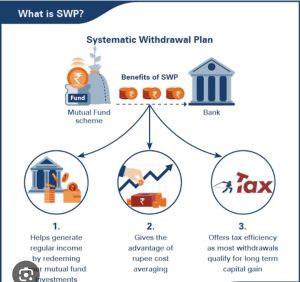

What is SWP (Systematic Withdrawal Plan)? When it comes to liquidating mutual funds, most investors tend to either redeem all the units or simply just a part of their holdings. However, there’s another redemption method that many investors are not aware of - SWP or Systematic Withdrawal Plan. Wondering what the meaning of the Systematic Withdrawal Plan is? Here’s a comprehensive guide explaining the concept, how it works and the various advantages it offers. What Is SWP in a Mutual Fund? Systematic Withdrawal Plan (SWP) is a unique mutual fund redemption method that allows you to withdraw a fixed predetermined amount at specified intervals. Think of it as a Systematic Investment Plan (SIP) but for mutual fund redemption. Investors often use SWP as a way to receive regular income from their mutual fund investments without redeeming them entirely. How Does a SWP Work? Now that you’re aware of what SWP in a mutual fund means, let’s try to understand how it works with the help of a hypothetical example. Assume you invested a lump sum amount of Rs. 5 lakhs in an equity-oriented mutual fund 5 years ago. Currently, the value of your investment is Rs. 7 lakhs. Since you wish to create a steady income stream from your mutual fund investment, you decide to set up a Systematic Withdrawal Plan where you withdraw Rs. 20,000 each month until you completely redeem all of your mutual fund units. On the first day of each month, the SWP determines the number of units that need to be redeemed to fulfill your withdrawal request. The number of units to be redeemed is determined by dividing Rs. 20,000 by the Net Asset Value (NAV) of the mutual fund on the first day of each month. Now, if the NAV of the fund is Rs. 200 on the first day of a month. The SWP will redeem 100 units (Rs. 20,000 ÷ Rs. 200). And if the NAV of the fund rises to Rs. 205 in the subsequent month, the Systematic Withdrawal Plan will redeem 98 units. This process is repeated each month until there are sufficient mutual fund units to redeem. Who Should Consider SWPs? Systematic Withdrawal Plans can be particularly advantageous for the following category of investors. Investors looking to create a steady stream of income to cover their living expenses. Investors who wish to distribute their mutual fund investments to their beneficiaries in a systematic manner. Investors who wish to save tax can use SWP to reduce their overall liability. Investors with specific financial goals like funding a home purchase or their child’s education expenses. Advantages of Systematic Withdrawal Plans As an investor, you not only need to know the meaning of SWP in mutual funds but also be aware of its various benefits. Here’s a quick overview of some crucial benefits Systematic Withdrawal Plans offer. Regular Income Stream By setting up a SWP, you can effectively create a consistent, predictable and regular income stream for yourself irrespective of how the market moves. If you’re fast approaching retirement or are simply looking to supplement your main source of income, opting for a Systematic Withdrawal Plan can be hugely beneficial. Flexibility Another major benefit of SWP is that it is completely flexible and customizable. You get the freedom to choose the redemption amount and the frequency according to your requirements. Most mutual funds offer monthly, quarterly, semi-annual and annual withdrawal frequencies. Tax Savings The gains from your mutual fund investments are subject to either long-term or short-term capital gains tax depending on how long you hold them for. In the case of long-term mutual fund investments, only gains above Rs. 1 lakh are taxed at 10%. By setting up a Systematic Withdrawal Plan, you can ensure that the total amount of gains you get during a year is below the taxable threshold limit of Rs. 1 lakh. This will allow you to bypass long-term capital gains tax entirely. You don’t get such a benefit if you redeem all your mutual fund units at once. Elimination of Market-Timing Timing the market can be very tough and risky due to the unpredictable nature of the stock market. Since Systematic Withdrawal Plans automatically redeem your mutual fund units at predetermined intervals, the need to time your market exit doesn’t arise.

investment planning

Get Price Quote

Investment planning can be done for anything you want or need it. Investment management is probably the most complicated area of financial planning and is therefore where many of us procrastinate. But it doesn’t need to be so difficult: incorporate simple money truths into your financial strategies so you can make decisions with confidence and understand the potential risks and benefits of investing by Investment planningWe all have different goals – buying a house, giving the best education to the kids, see them building family, retirement and a lot more. Many of us also hope to achieve a level of wealth while providing for other goals. But the ultimate goal for anyone would be achieve the freedom from financial worries. This freedom is possible with smart goal-based investments.Just as people have different goals, there are investments to help achieve these objectives. Smartly investing your hard-earned money ensures that the right amount of funds are available in the right time.Investment planning is the process of matching your financial goals and objectives with your financial resources. Investment planning is a core component of financial planning. It is impossible to have one without the other.Investment PhilosophyOur objective is to invest your portfolio so that it will yield the return you seek with the lowest possible risk. The best way to achieve this is through diversification, in other words, the allocation of your portfolio among different asset classes. Simply stated, depending on your situation, your money is invested in a variety of stocks, bonds, commodities, natural resources, precious metals, and cash, and then rebalanced periodically.Investment Decision-MakingBeing diversified among asset classes does not mean living with low returns; rather, it delivers better volatility-adjusted returns. In addition, we believe: that portfolios should be rebalanced periodically in order to maintain a long-term chosen asset allocation (that can change when financial objectives change over time); that over the long-term common stocks outpace income investments (their higher expected returns are coupled with compounding interest); and that reasonable expenses and tax efficiency are important to total return.Types of Investments Stocks. A stock is an investment in a specific company. … Bonds. A bond is a loan you make to a company or government. … Mutual funds. If the idea of picking and choosing individual bonds and stocks isn’t your bag, you’re not alone. … Index funds. … Exchange-traded funds. … Options. Define Your GoalsInvesting begins with the determination of your ultimate goals. Knowing the results you want will help you more easily choose the right avenues and strategies to reach them.Defining your goals, such as earning money for a big purchase or growing your retirement fund, is an important part of investment planning that allows you to look at the big picture when creating your investment plan

Looking for Investment Planning Services Providers

investment planning

0 - 35 Per percent of investment

guide in all types of financial investments. price depends on service as per govt. regulations.

investment planning services

Get Price Quote

Company profile: import export of agricultural products, textile & handicraft products and much more. Providing investment opportunities to enhance your source of income. Vision: our vision is to provide quality products and services that exceeds the expectations of our esteemed customers, we lenity believe that our customers are the reason for our existence and greatly respect the trust that they place in us, we grow through creativity and innovation, we integrate honesty, integrity and business ethics into all aspects of our business functioning our mission is to build long term relationship with our customers, with these goals in mind, we will work together to assess your total financial planning needs. We will consider important milestones such as major purcha es, marriage, children, education, dreams and retirement. Benefit of trades: trade1: mass investment: from 50000 up to 1cr benefit of mass: 3% monthly returns i.e. 36% yearly returns lock in: 1 year trade 2: class investment: from 50000 up to no limit benefits of class: 40% yearly returns (this is a yearly plan*) lock in: 1 year trade 3: executive investment: from 200000 up to no limit benefit of executive: 100% returns (this is a 2 years plan in which youll get 50% for each respective year*) lock in: 2 years legal documentations: we dont compromise when it comes to legal work, stamp paper agreement will be processed at the time of investment you made with the company along with the cheque of principal amount in respect to maturity of your investment. Terms: registration fees : rs. 300 per trade (non refundable) get back your capital investment by giving us a 40 days prior notice for refund (t&c*) let us work for you.

SYSTEMATIC INVESTMENT PLAN(SIP)

Get Price Quote

A Systematic Investment Plan or SIP is a smart and hassle free mode for investing money in mutual funds. SIP allows you to invest a certain pre-determined amount at a regular interval (weekly, monthly, quarterly, etc.). A SIP is a planned approach towards investments and helps you inculcate the habit of saving and building wealth for the future. SIP is not a financial instrument, but a way of investing in mutual funds, some people confuse SIP with PPF,NSC, and mutual funds. They think they can invest in SIP. SIP is not an investment its just a mode of investment How to Start SYSTEMATIC INVESTMENT PLAN (SIP) a>Pick any date of a month, then fill out an SIP form and an application form. b>Draw post-dated monthly quarterly cheques , adding up to at least minimum investment of scheme. c>Monthly - Start on any date of any month, and stick to the same date of every month. d>Quarterly - Start on any date of any month, and stick to the same date of every third month. e>If in any month the chosen date is not a Working Day, the transaction will be completed on the next Working Day.

investment planning services

Get Price Quote

Money is a very interesting commodity. All you need to know is how to use it for your benefit. Investments can be of various kinds, and it is hard to decide which way to go. A bit of expert advice will help you to understand where your money fits better and the return on investment that you can expect. At Abhimanyu Singhal & Co. you can certainly take assistance from our investment experts as they have designed tailored Investment Planning Services to fit your needs. With so many options out in the market to invest your money, you need to understand before deciding as it is all about your hard-earned money. Calculating the risks and benefits of the investment is the smart way to make your money work for you while you keep your focus on other important things.

Retirement Planning Investment services

Get Price Quote

undefined undefined (MOQ)

Are You About To Retire or Will Retire After Some time? Have You Made Any Retirement Planning Yet? If Not Plan Now With Our Mutual Fund Retirement Planning. It Is Well Crafted With Considering All Requirements, Emergencies & Goals For Elderly People.

investment planning services

Get Price Quote

we are offring ally type of invesment planning lic real estate child planing education planning saving plan private pfo gov. bond tax planing private fd post investment bank fd mutual funds

daily earning investment plan

Get Price Quote

earn daily income with angel one referral program! looking to make some extra money? look no further! angel one, the leading online trading and investment platform, has introduced an exciting referral program that lets you earn inr 1000 per day for every successful referral. get your referral link here:

Investment Plan MLM Software Development Service

350,000 - 850,000 Per Bag

With rich industry experience and knowledge, we are providing an excellent quality Investment Plan MLM Software Development ServiceThe provided service is carried out under the supervision of our experts using optimum grade machines and modern technology. This service is performed as per the requirements of our valuable clients within the scheduled time-frame. The offered service is highly acknowledged by our clients owing to its high reliability and cost effectiveness features. Further, the provided service is performed as per the clients’ specific needs with respect to their budgetary constraints. Taksh IT Solutions offers cutting-edge MLM software development services tailored for Investment Plan schemes. Our expertise ensures seamless integration of investment features like ROI, bonuses, and referral rewards. With a focus on user-friendly interfaces and robust security, we deliver customized solutions that meet your unique business needs. Partner with us to create a dynamic and scalable Investment Plan MLM platform that drives growth and maximizes returns. Contact Taksh IT Solutions today to explore our comprehensive MLM software development services. Taksh IT Solutions offers cutting-edge MLM software development services tailored to your investment plan needs. Our expertise lies in crafting customized solutions that streamline operations and maximize returns. From robust investment tracking to seamless payout management, we provide comprehensive MLM software solutions. Partner with us to elevate your investment plan MLM business with reliable, scalable, and innovative technology. Contact Taksh IT Solutions today to explore how our services can propel your business forward."

investment planning services

Get Price Quote

Being a well-reputed name in the market, we are engaged in offering Investment Planning Services. We carry out our operations from Delhi, India. These services are customised for every client according to the risk bearing capacity, financial stability, and other related aspects. We offer the best plant to the clients for a better utilisation of their saved money. We are well-equipped with the advanced techniques and software required for rendering a reliable and transparent service. Details : Investments can cater to a few of your needs if this is well planned. Our objective of Investment Management offering is to help you explaining the best plan of your investment by which you can get good benefits. People should have saved for a rainy day. Once you crave to save money for future emergencies you start thinking about investment so that it makes your money grow. Investment Planning is a good element of a growing business. Our expert MBAs having experience in investment field will assist you in planned investment, tax saving scheme, Mutual fund, and share Scheme. Saving every day a single coin can help you plan your investments so that you can reap adequate benefits and achieve your financial goals. We are providing best insurance plan, tax saving scheme, facility for companies business loan, plan of business management, tax management service and of course financial risk management service. The path of your benefit scheme of investment will stop at Ask Commercial Solutions which will be the only one shop for you to plan, detail and execute your investment decisions. Your investment Plan would be :- Customised According to Your Goals, Financial Situation, Life Stage and Time Horizon. Getting Digital Signature of Directors. Analysis of Goals: Attainability and Savings/ Investments Required. Customised Risk Management Including Financial Risk Management. Designed to Meet Your Goals After Matching Your Risk Tolerance Level. Designed to Meet Your Needs of Liquidity. Expense Protection/ Better Insurance Plan. Use Tax Efficient Investment Avenues. Taking in to Account Effects of Income and Wealth Tax. Based On Proven Asset Allocation Strategies and Required Diversification. Monitored and Rebalanced On Regular Basis to Keep It Fresh.

smart investment plan services

199 Per Pack

ICICI Prudential Gift Plan Rs.199/- Per day after 10yrs will get Rs.15,70,394/- + Rs.12,12,171/- #guranteedreturns

Systematic Investment Plan

Get Price Quote

Being a prominent player in the industry, we take it upon ourselves to meet clients demands with perfection. Continuing in the same vein, we, being a Service Provider, present you Systematic Investment Plan in a wide variety. Under this plan, the money of clients is invested for long-term in a systematic manner. It fetches a good return to the investors. We hire a team of highly qualified finance and investment professionals to manage the wealth of our clients. Contact us to avail the services for an economical fee.Details :The Systematic Investment Plan we offer range from Debt to Equity and are drawn from renowned Asset Management Companies with a strong track record. Dedicated Relationship Manager to recommend the funds as per your investment objectives – short term and long term strategies Assistance at every step of the investment process An experienced research team to analyze and research the Mutual Funds available in the market A consolidated investment account to give you a snapshot of your entire mutual fund investments made through us and a lot more! Comprehensive recommendations that take into account all relevant factors including the investment philosophy of the Asset Management Company, portfolio quality, risk-adjusted returns and market trends. Recommendation Process : The recommended list of Mutual Funds is released on a half yearly basis. The selection criteria are based on a unique "Three Tier process" where factors like the consistency, alpha generation, risk management and Fund Manager skills are considered. The last 24 month performance of the funds is taken and various statistical tools are applied to arrive at the final set of recommended funds across various categories.

Retirement Planning Investment Advisory

Get Price Quote

With increase in life expectancy at birth increases the period of retirement. Consequently, it adds to the value of suitable retirement planning. Additionally, changing family systems (from joint to nuclear families), demand for more financial freedom in retirement rather than being dependent on children, there comes the need for retirement planning to enjoy higher inflation adjusted living expenses. Retirement planning is about ensuring that there is adequate income to meet the expenses in the retirement age of an individual’s lifecycle.

Affordable Investment Plan Service

Get Price Quote

We are the leading service provider in Mumbai, Maharashtra, India and providing Affordable Investment Plan Service to our valuable customers. A survey usually originates when an individual or institution is confronted with a business problem and the existing data are insufficient. At this point, it is important to consider if the required information can be collected by a survey. If you need input from a number of people, must get results quickly, and need specific information to support business decisions, then a survey is the most appropriate technique.Many studies start with a general hope that something interesting will emerge, and often end in frustration. A careful survey plan will help you focus your project, while guiding your implementation and analysis so the survey research is finished quicker. You can then concentrate on implementing well-supported decisions. A well-designed plan answers the following questions: QuestionsBenefits What will be learned?Generate data that answers the business questions you have How long will it take?Keep the survey project focused and on schedule How much will it cost?Anticipate direct and indirect project costs You can only answer these questions if you draft a plan prior to implementing your survey. Hence, an integral part of a well executed and a successful survey is the "planning quality."

investment planning

Get Price Quote

“In investing, what is comfortable is rarely profitable.” Investment planning can be done for anything you want or need it. Investment management is probably the most complicated area of financial planning and is therefore where many of us procrastinate. But it doesn’t need to be so difficult: incorporate simple money truths into your financial strategies so you can make decisions with confidence and understand the potential risks and benefits of investing by Investment . “A banker is a fellow who lends you his umbrella when the sun is shining and wants it back the minute it begins to rain.” Mark Twain What is it that you are trying to achieve financially in the near future or short term? Do you want to take a car..? Do you want to accumulate money for your flat..? The purpose of our life could be summed up into one right word — Happiness. Finding and unlocking the secret to lasting happiness is a duty we all owe ourselves. One way to bring happiness into our lives is fulfilling our ‘Life Goals’. We all have different goals – buying a house, giving the best education to the kids, see them building family, retirement and a lot more. Many of us also hope to achieve a level of wealth while providing for other goals. But the ultimate goal for anyone would be achieve the freedom from financial worries. This freedom is possible with smart goal-based investments. Just as people have different goals, there are investments to help achieve these objectives. Smartly investing your hard-earned money ensures that the right amount of funds are available in the right time. Investment planning is the process of matching your financial goals and objectives with your financial resources. Investment planning is a core component of financial planning. It is impossible to have one without the other.

investment planning services

1 Per

Sanbun Investments has been delivering consistent returns over years and helped thousands of students achieve their aspiration of becoming full-time traders. We offer our services through online sessions and also provide personal assistance. The training is reliable, effective, and helpful for those who see Stock Market as a career option.

investment planning

Get Price Quote

investment planning, financial planning service

Investment Plan

Get Price Quote

we are providing Investment Plan. AIA aims to help you find an investment approach that fits your financial goal and risk appetite by combining innovative products with expert advice. AIA understands that each of you have unique financial goals, therefore AIA has designed a line of investment linked plans that offer you smart solutions to satisfy your portfolio needs by delivering consistent performance. Investment linked plans offer you the opportunity to participate in investment opportunities while ensuring you have financial protection through life insurance. You can benefit from investment opportunities in developed and emerging markets, and in different ranges of riskreturn profiles.

investment planning

Get Price Quote

You want to make sure you purchase as much as you need. If a more expensive permanent policy means you can only afford to buy less, it’s probably not a good idea. After all, the whole point of insurance is to make sure your family has enough to be taken care of financially if something were to happen to you. Likewise, you don’t want to buy insurance that you don’t need either. That’s because on average, you’re likely to spend more on it than you or your family will ever receive. Think about it for a moment. The insurance company has to collect enough in premiums not only to pay out benefits but also to cover their expenses and make a profit. In fancy business lingo, your expected return on those premium rupees is negative.What are the Benefits? For those who are looking forward to save on taxes, building a strong business portfolio and for enhancing the overall future wealth, the Investment Planning alone would turn out to be the best option. If gone through the overall steps well, Investment Planning can in no way lead you towards absolute financial instability. By creating an overall budget, paying off all your outstanding as well as existing debts, one can start thinking about their rainy days straightaway. Designing a well disciplined saving program either by investing in education or in the various pension schemes, one can prosper in saving huge for their upcoming years. Keep in mind; good Investment Planning completely turns your dream goals into reality. Every once in a while we get a call on our Financial Helpline from someone whose financial adviser recommended that they invest in a permanent life insurance policy (including whole, universal, or variable universal life). The adviser’s pitch can sound compelling. Why purchase temporary term life insurance that you’ll likely never use? Isn’t that like throwing money away? With permanent life insurance, part of your premiums are invested and some of it can be borrowed tax-free for retirement, or your children’s college education, or anything else you’d like and your heirs will get a nice death benefit when you pass away. We are a preeminent Investment Planning Service Provider based in India.

Investments Planning

Get Price Quote

We are offering 360 degrees exclusive personal financial planning.

investment planning services

Get Price Quote

We are providnig m & a advisory solutions to our valuable clients. These services are available at reasonable market prices. We assist our clients in analyzing the target company’s characteristics, financial parameters, physical and intangible assets. Driven by an intense desire to achieve perfection, our employees assure effective and timely delivery of our services to our valuable customers. Our services are based on effective research conducted by our experienced professionals. the advisory task involves the identification, negotiation and closing of national as well as international transactions. We assist our clients with the help of the network of international associates scatter all over the world

investment planning services

Get Price Quote

One of the leading services company, providing many types of services like Investment Planning Services.

investment plans

Get Price Quote

An investment plan helps you to create wealth for a better future by providing various investment options. It also offers comprehensive life cover along with investment opportunities. What Are Investment Plans? Investment Plans Are The Financial Security That Lasts for a Lifetime! To put in simple words, Investment Plans are the financial instruments one creates to secure the future financially and build a substantial amount to cater to unforeseen circumstances. Thus, Life Insurance products are often used as investment plans, because they not only secure life, but also help to create wealth for future. There are other forms of investment plans which are discussed in a separate section on this website. No matter what the event or phase, Investment Plans work for you at all times! Be it funding your child’s education, commemorating a special occasion like marriage, battling an unexpected injury, or gaining access to a steady flow of income at retirement! Well-structured investment plans assist you in accumulating wealth and creating a corpus, so that you are always ready to meet life’s key milestones and daunting challenges, without having to give up on your financial stability! Investment Plans Key Features & Advantages Investment Plans are a boon for those who believe in systematic savings and want a corpus of funds to be available at the time of need. The whole magic lies in the returns over the term of investments.

Investment Insurance Plan

Get Price Quote

An investment plan is the process of creating or purchasing assets in order to grow your money over time. Investments, in addition to having the ability to solve future financial issues, can aid in the creation of exponential financial backing if made at the correct time and in the proper asset.

SIP (Systematic Investment Plan)

Get Price Quote

An SIP enables you to invest in mutual funds in a systematic, automated fashion. If you’re new to investing, it’s a good idea to stick to a monthly SIP since you probably get your salary paid on a monthly basis.

investment planning

Get Price Quote

IndiaOne Consultants provide Indian Investments Planning Services Related to Investments Planning (Indian resident) :Portfolio Management To help for Investment in Life Insurance (Selection of suitable policy according your income or for maximum benefit)To help for Investment in Post office schemes (How to open a PPF A/C, How to invest in NSC, How to start a Monthly Income Scheme i.e MIS) Infrastructure Bonds Companies Deposits Mutual Funds Shares Investment of Capital Gain money

investment planning services

Get Price Quote

You are unique, and so is your wealth. For quite some time, we have been by your side as one of the renowned investment companies in Mumbai & Delhi, protecting what you have and developing it. We offer our experience and expertise in to help you unearth quality stocks, which are uniquely positioned for growth. Position your wealth for growth with us. The expertise and in-depth research of our team gives us a profound edge over our competitors when it comes to identifying those few stocks which have the potential for unparalleled growth over the next few years. Our team tracks the fundamental factors of the entire universe of NSE & BSE for stocks investments, strives to generate 4-6 'Wealth Multiplier' stocks ideas over 18-month period. We also aspire to provide you services in portfolio management as one of the best investment companies in Delhi & Mumbai. We understand that your wealth deserves special attention. We are here to deliver. 100% target return call in 1.5 - 2 years 4-6 multi-bagger stocks ideas in a year Full guidance regarding entry and exit on every call. Recommendations via SMS & Email both on real-time. Research reports and updates via email Support on your invested portfolio. Global market update

Mutual Fund Ipo Investment Planning

Get Price Quote

Ambrain Capital strength is research based customer centric approach and impeccable service. Our Mutual Fund advisory services are for potential investors who requires qualitative advice. Our dedicated team of experts demonstrates how you can meet your financial aspiration in most easy way and by just having correct matrix of permutation and combination of mutual funds outlines in your portfolio. Mutual funds are an attractive financial instrument of diversified investment portfolio and saving taxes. Investors can have mutual fund scheme with an aim of getting a continuous revenue over a long period. Ambrain Capital offers MF service to suit all your investment requirements. We have wide range of MF schemes from all top MF house. Our expert analyst provides performance analysis, mutual fund advice, mutual fund rating, and other related services that you are looking for to meet your investment goals. Key Advantages: Full client support Current Mutual Fund news, schemes, and offers In-depth research on all mutual fund aspects IPO or Initial Public Offering by a company to a public is a first issue of shares in order to raise funds. A company can have diverse reason to raise funds from public such as for new project, repayment of high cost of debt, expansion of existing capacities, or divesting segment of promoter holding in company. Investing in equity shares of these corporates is termed as Initial Public Offering investment. There are firmintegralbenefits when it comes to capitalizing in IPO’s for investors. One of Ambrain Capital special features is in providing IPO funding at a very interesting interest rate. Our clients can avail these services when they want to apply in great amount in IPO. For an investor, those have trading account with our company, we offer the facility of investing in IPO in a paperless manner.

investment planning services

Get Price Quote

investment planning services, Finance Administration Services