mutual fund service

Get Price Quote

A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds or other asset classes. Mutual funds give small or individual investors access to diversified, professionally managed portfolios at a low price. Mutual funds are divided into several kinds of categories, representing the kinds of securities they invest in, their investment objectives, and the type of returns they seek. Facts that you must know before investing in mutual fund: 1. Mutual Fund is not necessarily all about equity or stocks. Mutual funds also deal into debt instruments like Certificate of Deposits (CDs), Bonds, Govt. Securities (G-Sec.), Non-convertible Debentures (NCDs) etc. This means that a mutual fund scheme can also have all or some of these debt instruments in its portfolio. MF schemes that are having debt papers of very small duration are least risky. Similarly, carefully chosen debt MF schemes can be as safe as fixed deposits along with better tax-adjusted return. Contact MF Distributor and start investing in equity, debt, hybrid or multi asset allocation schemes as per your need and investment horizon. 2. Starting your investment in Mutual Fund is easy. All you need is to be KYC compliant and have an active bank account. That’s it. At FundzBazar (check the login section of this site to register or sign-in to trade instantly in mutual fund schemes) you can even invest completely online and instantly that too without having any demat a/c!. 3. Investment in Mutual Fund can be made in lump sum or systematically. a. Through Systematic Investment Plans ( SIP ) you can invest a fixed amount at regular intervals for any number of years. This way your investments will reap the benefit of rupee cost averaging i.e. buying more units when price is low and buying lesser units when price is high. b. If you need regular withdrawals from your Mutual Fund investment, then Systematic Withdrawal Plan ( SWP ) is the best option. Here a fixed amount (set by you) will be automatically withdrawn for preset number of years. Depending on the fund available and withdrawal amount, this will continue. c. If you are concerned about short term volatility while making a lump sum investment, then go for Systematic Transfer Plan ( STP ). Here, the lump sum money will be first invested in a liquid scheme (low risk debt fund) and then from there, a fixed amount will be transferred to a chosen equity scheme of the same fund house. This way, exposure in equity scheme will be made on a staggered basis and hence risk is minimized in case of volatile market movements. 4. How are your Mutual Fund investments taxed? If in portfolio of a MF scheme, percentage of exposure into equity type of instruments is more than or equal to 65%, then such schemes are known as equity schemes, otherwise those would be considered as debt schemes for taxation purpose. Equity schemes and debt schemes are taxed differently. Taxing also depends on how long you hold the investment before you sell. If gain from equity scheme is booked before 1 year is completed then such gain would be taxed at flat 15% rate. If equity schemes are sold after holding for more than a year – then 10% tax is to be paid on gain made over and above Rs. 1 lakh. If debt schemes are held for more than three years then 20% tax is to be paid on indexed (i.e. inflation adjusted) capital gain. If investments in debt schemes are held for shorter-term then tax is to be paid on booked gain amount as per one’s tax slab.

mutual fund service

Get Price Quote

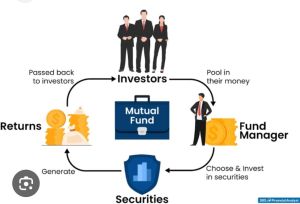

A mutual fund is a pool of money collected from many individual investors and companies in order to invest in various types of assets. A professional portfolio manager is hired to invest the capital in a portfolio of securities. In the end, any gains are passed down to the investors on a pro-rata basis. Unlike stocks, mutual funds represent an investment in many different stocks instead of just one holding. It can be compared to buying a part of a portfolio’s value.

Looking for Mutual Fund Services Providers

mutual fund service

Get Price Quote

Our Mutual Fund Service offers you a pathway to build wealth and achieve your financial goals. We provide a diverse range of mutual fund options, catering to various risk appetites and investment horizons. Our expert advisors are committed to guiding you towards the right investment choices, ensuring that your money works harder for you. With a focus on transparency, security, and excellent returns, we aim to create a rewarding investment experience for our clients. Invest in our Mutual Fund Service and pave the way to a financially secure future.

Mutual Fund Services

Get Price Quote

We are a reputed Service Provider of Mutual Fund Services. Being a good means to increase available amount of wealth on long-terms, Mutual Funds are highly preferred by all types of investors. Mutual Funds are even considered a starting step to enter equity market. With the help of our experienced team, we provide various Mutual Fund Services to meet varying financial goals of the clients. Various Mutual Funds possible are Equity Funds, Debt Funds, Gilt Funds, ETF (Exchange Traded Funds), Liquid Funds, Equity (Tax Planning), Equity (Diversified), Equity (Sector Fund), Equity (Index Fund) and Debt (Short Term/Income/MIP) Balanced Funds

Mutual Fund Services

Get Price Quote

Mutual funds pool money from multiple investors to invest in diversified portfolios of stocks, bonds, or other securities managed by professional fund managers. Investors buy shares, gaining proportional ownership in the fund's assets. These funds offer diversification, professional management, and liquidity, making them accessible for individual investors with varied risk appetites. With options ranging from equity to fixed-income funds, investors can tailor their portfolios. Mutual funds suit both novice and experienced investors, providing a cost-effective and convenient way to access diversified investments, fostering long-term wealth growth while spreading risk across various assets and industries.

Mutual Fund Services

Get Price Quote

A mutual fund is a company that pools money from many investors and invests the money in securities such as stocks, bonds, and short-term debt.

Proof of Funds Service

Get Price Quote

The Proof of Funds Service earns a solid 5/5 rating for its instrumental role in validating the financial capabilities of individuals or businesses. This service provides a credible and verifiable documentation demonstrating the availability of funds, instilling confidence in transactions, investments, or financial agreements. One of the key strengths lies in the rapid turnaround time, ensuring timely verification of funds to meet the demands of time-sensitive transactions. The platform offers a streamlined and secure process, maintaining the confidentiality of financial information while providing a robust proof of liquidity. Customer support is exemplary, guiding users through the proof of funds process and addressing inquiries with professionalism. The service demonstrates flexibility by accommodating various fund sources and currencies, catering to the diverse needs of users across different financial scenarios. Moreover, the platform's user-friendly interface simplifies the submission and verification process, making it accessible for users of varying technical proficiency. Transparent documentation and clear communication further contribute to the overall positive user experience. In summary, the Proof of Funds Service stands out for its efficiency, security, flexibility, and customer-centric approach, earning its top rating as a valuable tool for establishing financial credibility in various transactions and agreements.

Mutual Fund Distribution Service

5,000 - 500,000 Per piece

1 piece (MOQ)

Rare Wealth is a wealth management agency dedicated to assisting individuals in investing in a diverse range of mutual funds and fixed-income securities through India's top-performing fund houses.

Mutual Fund Distribution Service

Get Price Quote

Paisalogy: The Best Mutual Fund Distribution Service in Pune for Expert Guidance, Diverse Investment Options, and Personalized Support to Help You Achieve Your Financial Goals Effortlessly.If you’re looking for a reliable mutual fund distribution service in Pune, look no further than Paisalogy. We specialize in helping investors navigate the world of mutual funds, providing expert guidance and personalized solutions to meet your financial goals. What We Do At Paisalogy, we offer a wide range of services that make investing in mutual funds easy and accessible. Our team of experienced professionals understands the complexities of the financial market and is dedicated to helping you make informed investment decisions. Why Choose Paisalogy? 1. Expert Advice: Our knowledgeable advisors are here to guide you through the mutual fund selection process. We take the time to understand your financial situation and risk tolerance to recommend the best funds for you.2. Wide Selection: We provide access to a diverse range of mutual funds from top asset management companies. Whether you are looking for equity funds, debt funds, or hybrid funds, we have options that cater to all types of investors.3. Personalized Service: At Paisalogy, we believe in a customer-centric approach. We focus on your individual needs and tailor our services accordingly. Our goal is to help you achieve your investment objectives effectively.4. Transparency: We pride ourselves on maintaining transparency in all our dealings. You will always be informed about fees, charges, and potential risks associated with your investments.5. Easy Online Access: With our user-friendly online platform, you can manage your investments anytime, anywhere. You can track your portfolio, invest in new funds, and stay updated on market trends with just a few clicks. Benefits of Investing with Paisalogy- Wealth Growth: Investing in mutual funds can help grow your wealth over time. Our experts will guide you on the best strategies to maximize your returns.- Risk Management: We help you understand the risks involved in mutual fund investing and create a balanced portfolio that aligns with your risk tolerance.- Regular Updates: We keep you informed with regular updates on your investments, market trends, and performance reports, so you’re always in the loop. How to Get StartedGetting started with Paisalogy is simple. Just follow these steps: 1. Consultation: Schedule a consultation with our experts. We’ll discuss your financial goals and investment preferences.2. Fund Selection: Based on your needs, we will recommend suitable mutual funds for you.3. Investment: Once you choose your funds, we will assist you with the investment process, making it quick and hassle-free.4. Ongoing Support: Our support doesn’t end after the investment. We provide ongoing assistance and advice to help you adjust your portfolio as needed. ConclusionPaisalogy is your trusted partner for mutual fund distribution in Pune. With our expert advice, personalized services, and a wide range of investment options, we help you take control of your financial future. Start your investment journey with us today and experience the benefits of working with the best in the business.For more information or to schedule a consultation, visit our website or contact us directly. Let Paisalogy guide you towards smarter investing and better financial outcomes!

mutual fund

Get Price Quote

We are AMFI Certified Mutual Fund Distributor, We do research based Financial Planning,

Loan Against Mutual Fund Service

Get Price Quote

Leverage your investments with our Loan Against Mutual Fund Service. Tailored for financial flexibility, we facilitate loans against your mutual fund holdings. Our streamlined process ensures quick approvals, enabling you to access liquidity without liquidating your investments. Enjoy competitive interest rates and flexible repayment plans. Choose our service for a convenient and efficient way to meet your financial needs, leveraging the value of your mutual funds while retaining the potential for future market growth. Empower your financial journey with us.

Mutual Fund Services

Get Price Quote

Invest in mutual funds for any type of finacial goals. Mutualfundwala as a mutual fund advisor and distributor provide all types of mutual funds in India. We have more than 4500 investors in Delhi/NCR.

Mutual Fund Services

Get Price Quote

Global Financial Services From Kalyan is an evolving in Financial services business from 2008, Known for its transparent and ethical business practices. We have created wealth for investors and gained reputation of an expert in years of working. Our basic aim is to provide all financial solutions under one umbrella, we are Providing services like financial planning, wealth management, stock broking, commodity broking, depository services & third party product distribution. ``

sip mutual fund services

Get Price Quote

Mutual funds systematic investment plans (SIPs) are a popular and effective way for individuals of all ages to invest and combat inflation over time. SIPs allow investors to contribute a fixed amount regularly into mutual funds, thereby benefiting from the power of compounding and rupee cost averaging. This disciplined approach helps mitigate market volatility by investing consistently, regardless of market conditions, which can significantly reduce the risk of making poor investment decisions due to market fluctuations. For all investors, SIPs offer the advantage of long-term wealth creation. By starting early, they can take advantage of compounding, which significantly grows their investments over time. For those in mid-career, SIPs provide a systematic way to accumulate wealth for future goals such as buying a house or funding children’s education. For retirees, SIPs help maintain the value of their savings by investing in inflation-beating assets, providing a stable source of income while ensuring capital appreciation.

Mutual Fund Services

Get Price Quote

Mutual fund research can be made easier with a good online research tool to help investors analyze and compare funds. Whether you are a beginner or a pro, and if you are looking to buy the best mutual funds VRJ International Way to Wealth is always happy to acheive your financial goals like 1. Wealth creation 2. Tax saving under 80c(elss) 3. Children education and marriage 4. Retirement planning 5. Financial freedom. Whether you want to save systematically for two decades for your retirement plan, invest your money for just a couple of weeks to earn better returns, benefit from the growth potential of a particular sector, or invest your newly received bonus with moderate risk to achieve inflation-beating returns, you can be sure that there’s a Mutual Fund available for your needs! In fact, there’s a Mutual Fund for every need.

Mutual Fund Distribution Service

Get Price Quote

Mutual funds havens pool savings from a number of investors under certain scheme that is managed by an asset management company. The pooled money is then invested in securities that may include bonds, equity shares, etc., depending on investment scheme’s objective. If you seek professional assistance for making decisions concerning mutual fund distribution, then contact only Swastik Investments. The agency is based in Chandausi (Uttar Pradesh, India) and we have been serving clients across different sectors since 2010. A team of individuals is entrusted to coordinate with clients and provide professional support as per their requirements. So, contact us anytime to schedule an appointment.

Mutual Fund Distribution

Get Price Quote

Providing Mutual Fund advise and managing client portfolio and investments. Also providing investment related advise to my client to generate more returns on investments time to time. I only track best companies and best funds.

mutual fund

Get Price Quote

Directus Investments the friendliest online mutual fund platform brings with itself an experience of nearly 14 years and an insight of some of the best stalwarts of the industry.

Mutual Fund Services

Get Price Quote

1000 Bag(s) (MOQ)

Are you searching for a very Genuine Loan? The good news is here ! ! ! We Offer LOANS ranging from $5000.00 to $5, 000, 000.00Max. at 3% interest rate per annual. LOANS for developing business We are certified, trustworthy, ? reliable, efficient, Fast and dynamic.contact? usBorrowers Information Needed Fill And Return.Full Names:Contact Address:Country:Amount Needed:Loan Duration:Purpose Of Loan:Occupation:Sex:Age:Phone Number:Marital Status:Best Wishes,

mutual fund investment

Get Price Quote

Unlock the power of consistent investing with our Systematic Investment Plan (SIP). With SIP, you can effortlessly grow your wealth by investing small amounts regularly over time. Say goodbye to market timing worries and hello to disciplined wealth accumulation. Start your journey towards financial freedom today! Discover the key to a worry-free future with our comprehensive insurance solutions. From life insurance to protect your loved ones' financial security to health insurance ensuring your well-being, we've got you covered. Our tailored policies offer peace of mind, safeguarding what matters most to you. Explore our range of insurance options today and take the first step towards a more secure tomorrow. Don't leave your future to chance – trust in our expertise and commitment to providing reliable insurance coverage. Secure your peace of mind with us. #Insurance #PeaceOfMind #FinancialSecurity

fund mobilization service

Get Price Quote

Fund Mobilization Services: Expert Solutions for Raising Capital As a trusted service provider in fund mobilization, we specialize in helping businesses raise the capital they need to fuel growth, expansion, and strategic initiatives. Our tailored solutions are designed to connect businesses with the right investors, ensuring efficient access to both equity and debt funding. We offer comprehensive fund mobilization services, including market analysis, investor outreach, and strategic advisory. Whether you are looking to raise funds through private equity, venture capital, or public markets, our experienced team provides expert guidance throughout the process. Our goal is to help your business secure the financial resources it needs to thrive, while navigating the complexities of funding options and ensuring regulatory compliance. With our deep industry knowledge and robust network, we help you unlock the capital that drives success. Partner with us for reliable and efficient fund mobilization solutions, and take your business to the next level.

Mutual Fund Services

Get Price Quote

Are you seeking financial stability and growth? Look no further than Gayatri Wealth Management's Loan Consultant Services. Our team of experienced consultants will provide you with the necessary tools and support to reach your financial goals. Trust us to guide you towards a brighter and more secure financial future.

Mutual Fund Advisory Service

Get Price Quote

Our Mutual Fund Advisory Service offers expert guidance and consultation on mutual fund investments. We provide comprehensive assistance in understanding various mutual fund schemes, risk profiles, and investment strategies. Our service evaluates individual financial goals, risk tolerance, and market trends to offer tailored investment advice. With a focus on optimizing returns and managing risks, we provide insights, portfolio diversification strategies, and ongoing monitoring, ensuring informed investment decisions aligned with clients' financial objectives in the dynamic market scenario.

mutual fund invest service

Get Price Quote

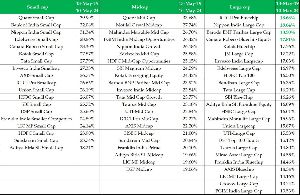

please see fund value of your sip start in 2014 to 2014

Mutual Fund Distribution

Get Price Quote

50 units (MOQ)

Mutual Funds are subject to Market Risk. Mutual Fund Investment should be with medium to Long Term Horizan. One should consistently remain with the Investment for a period of 3 to 5 years . It cultivates the Saving Habits.

Mutual Fund Services

Get Price Quote

Mutual Fund Services, financial management, Equity Advisory

Mutual Fund Watch India - Jetrade.in

Get Price Quote

Now a day, Customer becomes a Smart that’s why we should support them smartly. We launched our Mutual fund watch Systems that enables more information for Users. Our Online Mutual funds is applicable for everyone but those who want to invest for long time they will surly get better growth. Subscribe our SMS Alert plan and Get more updates via trading application like MF Online, Trade on Move, Trade Velocity and Trade Insta.

tata ethical mutual fund

Get Price Quote

500 Rupees (MOQ)

tata ethical mutual fund, taurus ethical fund investment service

mutual fund

Get Price Quote

Vision Money Mantra –Best Investment Advisory-8481868686 About us Since last 8 years, Vision Money Mantra has been providing Best investment guidance. Vision Money Mantra guides you to make financial investments (MUTUAL FUND) in a planned manner. We use our expertise for Market updates, Portfolio rebalancing & Monitoring, Research & Analysis & Performance review. We have more than 5000+ clients and 150+ NRI clients. Vision Money Mantra is one stop solutions for all your needs. If any query Please contact on given Number: Contact Information, Vision Money Mantra 8481868686 0231-2656520

Mutual Fund Distribution Service

Get Price Quote

Mutual Fund Distrubution and Insurance Services