Edelweiss Tokio Life Pension Plan Services

Get Price Quote

An Annuity plan offering immediate and deferred annuity options which provides you with guaranteed¹ income in your golden years toindulge in life's necessities without any compromises. A plan which takes away your concern of generating regular income and how you would spend your retirement years. Option to customise your plan to suit your financial needs Select your desired annuity option from a range of annuity options (immediate or deferred) available in the plan. Immediate Annuity - Under this Annuity Benefit type, the Annuitant receives regular income in arrears as an annuity Deferred Annuity - Under this Annuity Benefit type, the Annuitant receives regular income in arrears as annuity after the end of deferment period. The deferment period can be chosen between 1 to 10 years at inception Opt for Return of Purchase Price or Balance Purchase price Under Return of Purchase Price receive annuity at a constant rate throughout the life of the Annuitant. On death of the Annuitant, Purchase Price along with the Accrued Paid-up Additions, if any, will be paid in lump sum to the nominee and policy will terminate without any further benefit. Under Return of Balance Purchase Price receive the annuity at a constant rate throughout the life of the Annuitant. On the death of the Annuitant, the Balance Purchase Price (i.e. Purchase Price less total annuity amount paid till the date of death) along with the Accrued Paid-up Additions, if any, will be paid in lump sum to the nominee and policy will terminate without any further benefit. This option is available on Single Life basis. Opt for Return of Purchase Price on Critical Illness or Accidental Total and Permanent Disability or Death Under this option, Annuitant receives annuity at a constant rate till the date of diagnosis of any of the covered CIs before attaining age 80 years (Age Last Birthday) or occurrence of ATPD before attaining age 70years (Age Last Birthday) or death, whichever is earlier. On diagnosis of any of the covered CIs or occurrence of ATPD or death, whichever is earlier, annuity ceases immediately and Purchase Price along with the Accrued Paid-up Additions, if any, will be paid in lump sum to the Annuitant/nominee and policy will terminate without any further benefit. This option is available on Single Life basis. Option to cover a second life under the same annuity plan Under this option, annuity is payable on a joint life basis. The Primary Annuitant will be the primary person entitled to receive the payouts, while the Secondary Annuitant will be entitled to receive the annuities, in the event of death of the Primary Annuitant. In a Joint Life annuity, the Secondary Annuitant can be the spouse/major child/parent/major grandchild/grandparents or sibling of the Primary Annuitant. Option to convert annuity amount into the Paid-up Additions Under this Additional Benefit, the Annuitant will have option to convert an annuity amount into the Paid-up Additions. The Annuitant can choose the benefit at the inception of policy or at any subsequent policy anniversary. At any point of time during the policy term, the Annuitant also have an option to opt out from Paid-up Additions Benefit. Once opted out, the Annuitant will start receiving annuity as per the original schedule. Higher annuity instalment for higher purchase price You enjoy higher annuity rates for higher purchase price. As a result you get higher annuity payouts.

National Pension System Service

Get Price Quote

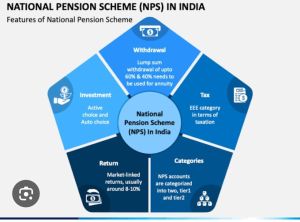

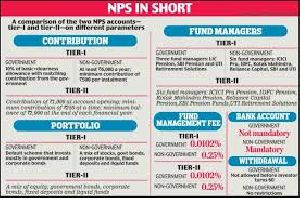

NPS INVESTMENT--- The National Pension System (NPS) is a retirement savings plan that allows individuals to contribute to their pension account while they are working. The goal is to build a pension fund that can provide a regular income after retirement. Here are some things to know about NPS: Eligibility NPS is available to all Indian citizens between the ages of 18 and 70, including those living abroad. It is mandatory for Central Government employees who started working on or after January 1, 2004, with some exceptions. Many State Governments have also adopted NPS for their employees. Contributions Individuals can contribute to their NPS account, and their employer can also contribute on their behalf. Account opening When an individual opens an NPS account, they receive a unique Permanent Retirement Account Number (PRAN). Withdrawals Individuals can make partial withdrawals from their NPS account up to three times during the account's lifetime. They can withdraw up to 25% of their contributions at any time, excluding employer contributions. Phased withdrawals Subscribers can choose to withdraw their lump sum amount in phases over a period from age 60 to 75. Tax efficiency NPS is a tax-efficient way to save for retirement. Risk tolerance NPS may be a good option for people who are willing to take moderate risks and seek higher returns.

Looking for Pension Plans Service Providers

pension plans services

Get Price Quote

Prepare for a secure future with our Pension Plans Services. We offer a range of tailored pension solutions designed to meet your retirement needs. Our dedicated team provides expert advice and personalized guidance to help you build a solid financial foundation for your retirement years. Whether you're just starting to plan or nearing retirement age, we're here to support you every step of the way. Invest in your peace of mind with our reliable pension plans and enjoy a worry-free retirement.

New Pension Scheme Plan

Get Price Quote

Pension plans provide security in terms of finance during old age when people don’t have any regular source of income. If you want to know more about any such plan and seeking professional assistance, look no further than D CA. Ours is a New Delhi, India based service provider company and can be useful for acquiring information related to pension scheme plans. We are backed by a team of qualified professionals, who work together and provide solutions as per the stated industry norms.

wood planing services

Get Price Quote

Based in Mudaliarpet (Pondicherry, India), SLSM has been operating as a single window solution provider for all sorts of wood planing and scaling needs. Ours is a crew of industrious individuals, who work in unison to render high-quality solutions. We process wood unto 4’’ thick and 24’’ wide. Besides, we undertake bespoke requirements of clients. The company has adopted modern work methods and processing techniques thus, precise planing and scaling are assured. For further discussion, feel free to connect with us.

Sbi Life - Saral Pension

Get Price Quote

Presenting you the best pension plan available in the market by sbi life insurance. Start getting pension from 41st year of age. SINGLE AND REGULAR (10 YEARS) PREMIUM PAYMENT OPTIONS.

Pension Plan

Get Price Quote

Ours is a well-recognized firm engaged in providing such Pension Plans that gazes into the future and foresee the financial stability during the old age of the clients. Pension Plan is suitable for senior citizens or for those who are planning for a secured future. We are based in Uttar Pradesh (India). We provide such plans that have benefits of both investment and savings by offering you the most reliable income source after retirement. The amount of the money invested depends upon the monthly income requirement during your post retirement years.

Sbi Life - Saral Pension

Get Price Quote

• Guaranteed Bonus: Guaranteed simple reversionary Bonuses for first 5 years; @ 2.50% for first three years and @2.75% for the next two years, of the Sum Assured. Guaranteed bonus will be applicable only to in-force policies. • Vesting (Maturity) benefit: Sum Assured plus vested simple reversionary bonuses plus terminal bonus, if any. The sum assured carries an implicit guaranteed interest rate of at least 0.25% p.a. compounding annually on the total premiums. • Death Benefit: Higher of total premiums paid accumulated at an interest rate of 0.25% p.a. compounded annually plus vested reversionary bonus plus terminal bonuses, if any or 105% of total premiums paid. • Life Cover: Option of additional life cover through SBI Life - Preferred Term Rider (UIN: 111B014V02). • On Vesting, you can buy immediate annuity from your entire proceeds or commute upto one-third of the policy proceeds and buy annuity with the rest. • Flexibility: You can defer the vesting date upto age of 70 years or extend the accumulation deferment* period of your policy * If age at vesting is below 55 years.

pension plans

Get Price Quote

pension plans, pension plans service

pension plans

Get Price Quote

Pension Plans are Individual Plans that gaze into your future and foresee financial stability during your old age. These Pension Plans are most suited for senior citizens and those planning a secure future, so that you never give up on the best things in life. Your Life is precious and we make efforts to reduce risks in the best manner we can. In many ways, a pension plan is a method in which an employee transfers part of his or her current income stream toward retirement income. Types Of Pension Plans Defined-benefit plans : In a defined-benefit plan, the employer guarantees that the employee will receive a definite amount of benefit upon retirement, regardless of the performance of the underlying investment pool.Defined-contribution plans : In a defined-contribution plan the employer makes predefined contributions for the employee, but the final amount of benefit received by the employee depends on the investment's performance. Benefits Of Pension Plans It allows you to manage your investments as per your risk preferenceYou can opt to invest the Premiums amongst the Funds offered i.e. Pension Debt, Pension Equity or Pension LiquidYou can choose the Life Stage Investment Program which automatically adjusts your Fund allocation to secure your investments as your retirement age approachesIt ensures financial protection and enables maintenance of the same lifestyle even after the unfortunate demise of a loved oneThe beneficiaries can utilize the money to replace the income one would have earned or help pay off debts or other expenses. Download

pension plans

Get Price Quote

pension plans, pension plans

Pension Plan

Get Price Quote

Pension Plan, IT Service Management, gardening manpower services

pension plans

Get Price Quote

pension plans, lic agent, Term Insurance Plans, Health Insurance

pension plans

Get Price Quote

pension plans, money bank, Educational Services, insurance broker

pension plans

Get Price Quote

pension plans, Education policy, Sip plan, Term Insurance Plans

pension plans

Get Price Quote

pension plans, term assurance plans

pension plans

Get Price Quote

pension plans, Life Insurance, pension plans, child insurance plan

pension plans service

Get Price Quote

pension plans service, LIC Life Insurance, LIC Policies services

pension plan services

Get Price Quote

pension plan services, Insurance Services, Health Insurance Services

pension plans service

Get Price Quote

pension plans service, Life Insurance Services, Insurance Service