Auditing & Assurance Services

Get Price Quote

We have developed knack of providing a superior range of Auditing & Assurance Services in compliance with Accounting & Auditing Standards (AAS) and IFRS. We hire a team of experienced professionals who are experienced in delivering these services. Our zero error performance translates into high satisfaction among our clients. All day round, we make our services available. We conduct our services making it hassle free for the clients. For providing our services, we make use of modern approaches and techniques. Details : We are counted amongst the prominent providers of Audit & Assurance Service. Our entity is based in Delhi, India. We offer these services in complete adherence to the Accounting & Auditing Standards (AAS) and IFRS. We are well acquainted with the latest amendment in the laws and standards, which enable us to render a highly authentic and reliable service. Under this, we offer various related services like internal audit, due diligence report, statutory audit, stock audit, etc. Our offered services are well-known for their excellence and timely execution. We offer our clients a comprehensive range of Audit & Assurance Services that ensures efficient management of risks within organization in various operational activities. Our professional members and CAs endeavour to follow the Accounting & Auditing Standards, IFRS and related laws. Our services are destined to achieve desired business objectives of our valued clients and also help in finding out accurate and fair view of financial statements of the organization. Our audit & assurance services include Internal Audit and Management Audit. Stock Audit and Reporting. Accounting Compliance and Reporting. Statutory Audit or Audit Required By Any Law. Financial Statement Audit. Sustainability Reporting. Systems and Controls Assessment. IFRS Reporting. Independent Controls & Systems Process Assurance. Regulatory Compliance and Reporting. Corporate Reporting Improvement. Due Diligence Reporting. Investigations.

Workplace Inspection and Audit in India

25,000 - 35,000 Per piece

CIL provides workplace safety audit services in Noida, Uttar Pradesh, India. CIL is an ISO 17020 accredited inspection agency. Safety Audits vs. Safety Inspections: What’s the Difference? Safety audits and safety inspections are not the same things. Yes, they’re similar in that both involve an examination of an organization’s EHS program, and yes, the two terms are often used interchangeably. That said, each term has a specific meaning, and mixing them up could get you in trouble. An audit is distinct from an inspection in 2 fundamental ways: 1. Safety audits are more in-depth than safety inspections. 2. Safety audits and safety inspections are typically performed by different people. What Does a Safety Audit Look Like? Whoever performs it, a safety audit usually involves the same basic steps: 1. Preparation. An organization decides that it’s time for an audit, and selects a safety auditor. Many companies have access to auditors through their EHS solution providers; others need to look within their networks or search for the right individual or firm to hire. The parties then get in touch and plan for the audit, determining scope, timeline, and objectives. At this point, the auditor may request some initial documentation and information from the organization, or simply set a date to visit the company’s facilities. 2. Conducting the audit. One or more safety auditors investigate the organization’s premises, procedures, people, and programs, paying close attention to any clear or potential hazards, safety issues, and regulatory violations. Many aspects of the process can occur electronically, but most audits necessitate a physical visit. Depending on the style and type of audit being conducted, an auditor may use a checklist, grade the organization in various categories, and/or jot down qualitative thoughts and observations. Auditors often take pictures, interview employees and organizational leadership, and collect other forms of evidence. This information is confidential—it stays between the auditor and the company getting audited. 3. Reporting. Once the audit is completed, the auditor creates a report detailing their findings. This report typically summarizes what is and isn’t working, indicating the relative priority and severity of different safety issues with various forms of data, charts, and graphs. Good safety auditors also provide recommendations for safety program improvements. 4. Corrective and preventive actions. Either on their own or with the help of the safety auditor, the organization’s internal team gets to work addressing the audit findings. Effective follow-through involves taking both corrective and preventive actions—correcting existing problems and preventing future sources of risk from developing further. What are the Benefits of Performing a Safety Audit? Regularly-occurring safety audits offer myriad benefits to organizations, as well as their employees, contractors, and customers: improved workforce safety fewer accidents, injuries, and illnesses lower workers’ compensation costs fewer legal claims less regulatory uncertainty and compliance risk less turnover greater productivity improved employee morale improved efficiency improved publicity and reputation better decision-making Workplace Health & Safety Services CDG’s on-site or virtual workplace health and safety consulting services help you develop and execute safety programs that reduce injury and illness rates, decrease workers’ compensation costs, increase productivity, and improve morale across your workforce. CDG consultants work with you to develop the required written programs for compliance with federal and state safety regulations. Depending on the program, CDG will provide policies, customized guidelines, online and on-site training, and regularly scheduled follow-up visits to ensure you are in regulatory compliance.

Looking for Auditing Services Providers

ICS Initiative for Compliance and Sustainability audit consultancy

100,000 - 150,000 Per Bag

1 Bag (MOQ)

ICS is an international sectoral initiative with the aim to enhance working conditions along global supply chains of its member retailers and brands. ICS is composed of multinational retailers and brands in the sectors of textile, retail, footwear, electronics and furniture. ICS members collaborate with common tools, to mutualize audits, contributing to the reduction of the ‘audit fatigue’ and share knowledge and best practices. ICS actions are based on a common methodology applied by all ICS members and securing a complete control of the audit process by brands. ICS audits are mandated and managed by member companies. Audit launch is a member prerogative, which ensures a total control of the use of ICS tools. Audits are only performed by third party ICS-accredited audit companies. ICS audits are neither certificates nor labels. ICS members share common monitoring rules when critical non-conformities are identified in the factories. The vast majority of ICS audits are semi announced or unannounced. The ICS members promote the ICS scheme and follow the established rules. Basic information is shared in order to jointly monitor the audit conclusions and to initiate the continual improvement of working conditions in the source countries.

Factory Auditing & Compliance Services

Get Price Quote

We conduct Technical Auditing of the manufacturing units for the customers to verify whether the supplier/exporter they engaged is technically capable of manufacturing their orders. Our Factory Audit Reports are comprehensive with texts, photographs and video representations. This way an overseas customer can save a lot of time and money and most importantly peace of mind!We report back within 24 hours of conducting the Factory Audit

C-TPAT Compliance Audit

Get Price Quote

C-TPAT Compliance Audit, that we offer, basically stands for Customs Trade Partnership Against Terrorism. C-TPAT Compliance Audit helps the government to reduce terrorism and protect the borders of the nation. C-TPAT Compliance Audit is a pact between private organizations and the government of USA to minimize the risk of terrorism that hampers growth in business. Within our C-TPAT Compliance Audit services, we cover administrative security, inspection, assessment, certification and consultancy of C-TPAT. Through C-TPAT Compliance Audit, we ensure that organization complies with US customs and standards and has appropriate procedural & physical security, efficient access control, C-TPAT compliant auditor, etc. Within C-TPAT Compliance Audit services, we conduct trainings on procedures of handling C-TPAT application effectively. C-TPAT Audit helps the government to reduce terrorism and protect the borders of the nation. C-TPAT Audit is a pact between private organizations and the government of USA to minimize the risk of terrorism that hampers growth in business. Our Customs-Trade Partnership Against Terrorism (C-TPAT) auditing services helps to reduce the impact of supply chain security potential threats. Constraarch conducts a Supply Chain Security monitoring assessment that is based on custom trade and partnership against terrorism (C-TPAT) Requirements for Security. Our experienced and knowledgeable auditors conduct assessment of supplier organization ensure to protect potential security threat, audit helps to identify corrective , preventive measures and establish improvement plans. We regularly monitor your compliance with C-TPAT requirement through periodic auditing. We also evaluate the compliance of security systems of your prospective or contracted suppliers, manufacturers, transporter, freight forwarders and other service providers, based on a risk assessment of the entire supply chain. Through C-TPAT Audit services, we ensure that organization complies with US customs and standards and has appropriate procedural security, physical security, efficient access control, personnel security, administration security, container security, supply chain control, information security etc. Our supply chain security assessment process typically consists of following steps :On-site C-TPAT assessment based on our checklist and the document defined by US customOn completion of the assessment, we provide you with a complete assessment report with observed risk level. Report includes corrective action and area of improvement . This report is reviewed by our technical reviewers before it is sent to all relevant client.We conduct follow up or regular periodic monitoring of C-TPAT compliance of organization i.e subject to our agreement with client

ROC Audit service

7,000 - 10,000 Per Others

ROC audit services help businesses ensure compliance with the regulations under the Companies Act, 2013. This audit involves a comprehensive review of a company's records, financial statements, and corporate filings with the Registrar of Companies (ROC) to verify that all statutory requirements are met. Professionals conducting ROC audits check the accuracy of filings such as annual returns, financial disclosures, and other forms like AOC-4 and MGT-7. The service also identifies any discrepancies or non-compliance, helping businesses avoid penalties. Regular ROC audits promote good corporate governance, enhance transparency, and ensure that a company’s operations are in line with legal requirements.

Auditing Services

Get Price Quote

Auditors and accountants are responsible for deterring and detecting fraud by evaluating accounting systems for designing, weaknesses and monitoring internal controls, determining the degree of organizational fraud risk, interpreting financial data for unusual trends and following up on fraud indicators. 21MS Financial Service, Maharashtra provides you with the best auditing services. Our services help companies ensure their accounting records are an accurate representation of the transactions that they have made. We have professionals who assist companies with constructing compliant financial statements and communicating with investors or shareholders, banks and other financial partners that their finances are in order. Therefore choose us and get our service for your company. For more details call us and speak to our executives.

Company Income Tax Audit Services

Get Price Quote

Specialised Company Income Tax Audit Services To offer reliable company income tax audit services, we at Raj Taxation Consultancy Services, maintain a dedicated and a personalised approach blended with detailed advice. We are credited as the prominent company involved in company income tax audit and our company is constantly striving to become the most trusted name in the world of consultancy service that offers unparalleled service to all our clients. Excellent Services We work predominantly with companies both in the charitable and voluntary domains as partners to assist them in achieving their desired results. Our team is committed to making way for a sustainable and long-term relationship that is based on our experience and skill to help our clients obtain real success.

due diligence audit service

Get Price Quote

Before starting any project we discuss with the Client the issues that are of main concern. At the end the Client receives a due diligence report containing all findings. Our approach is to save time, money and effort as well as to help in influencing the price at the outset of the deal. We assist clients in conducting financial, legal and accounting reviews in case of mergers, acquisitions and investments. A sound understanding of local laws, regulations and accounting practices enables us to vet all critical issues in detail.

Auditing Services

Get Price Quote

Audit is an official inspection of an organization accounts by an independent body. It is a systematic and independent examination of books, accounts, statutory records, documents and vouchers of an organization to ascertain how far the financial statements as well as non-financial disclosures present a true and fair view of the concern. It also attempts to ensure that the books of accounts are properly maintained by the concern as required by law. Auditing has become such a ubiquitous phenomenon in the corporate and the public sector that academics started identifying an "Audit Society". The auditor perceives and recognizes the propositions before them for examination, obtains evidence, evaluates the same and formulates an opinion based on his judgement which is communicated through their audit report.Broadly, an Audit involves : In-depth study of existing systems, procedures and controls for proper understanding and give suggestions for improvement and strengthening. Ensuring compliance with policies, procedures and statutes. Comprehensive review to ensure that the accounts are prepared in accordance with Generally Accepted Accounting Policies and applicable Accounting Standards/IFRS. Checking the genuineness of the expenses booked in accounts. Reporting inefficiencies at any operational level. Detection and prevention of leakages of income and suggesting corrective measures to prevent recurrence. Certification of the books of account agreeing with the Balance Sheet and Profit and Loss Account. Issue of Audit Reports under various laws. Audit At a Glance : We conduct following types of audit : Statutory Audit of CompaniesTax Audit under section 44AB of Income Tax Act, 1961 Audit under any other provisions of Income Tax Act, 1961 Internal Audit Branch Audit of Companies, whether in India or Outside India Stock Audit Audit of Public or Private Trust Audit of Co-operative Societies Audit of Government NGO’s Audit of Schools, Hospitals, etc.

Safety Audit Service

50,000 - 150,000 Per UNIT

Social Compliance Audit

Get Price Quote

Sedex BSCI C-TAT GOTS GRS ICS WRAP FEM SLCP HIGGS Consultany services all over India. We are located in Mumbai, Maharashtra. More than 200 customers already complied

Fire Safety Auditing Services

Get Price Quote

We are engaged in rendering our quality Fire Safety Auditing Services that is widely demanded in several sectors. We are backed by experienced professionals who are capable of identifying the pressure points of fire in a territory and providing valuable insights on how to deal with it. We are proficient in timely covering all the aspects of the auditing services. Because of our prompt service and reasonable charges, we are regarded as a reliable Fire Safety Audits Service provider from Hyderabad.

Auditing Services

Get Price Quote

We are a Chartered Accountants registered firm, under Rules 190 of Chartered Accountant Act, 1949 since 2002. We are based at Kolkata. H Saraogi & Associates caters to the needs of its customers to ensure that its customers keep pace with the rapid changing times. Based at Kolkata (West Bengal, India), we stand among dependable Auditing Services providers. We consider that providing Professional Auditing Services are top priority and that the firm does not view such services as a commodity. We do this by emphasizing the importance of audit quality in training programs and annual performance reviews. Types of Auditing Services made by us : Statutory AuditsWe perform Statutory Audits of Public/Private Limited Companies in the Manufacturing/ Trading/ Assistance Areas, IT Companies, Nationalized Lenders, Economical Organizations, Non-Banking Finance Companies, Community Industry Venture (PSU), Non-profit Organizations, NGO, Resorts, Medical centers, Supportive Organizations and other little and medium-sized companies. Tax AuditsEvery company, Firm or Businesses whose income surpasses Rs.100 Lakhs or total claims from any occupation surpasses Rs.25 Lakhs in any previous year, is necessary to get its records precisely & punctually audited and obtain a review under the area 44AB of the Earnings Tax Act. We have a group of calm tax experts to perform such type of audits. Internal & Management AuditThe improving problem is to make sure awesome inner & handling management techniques to avoid unique or structured faults and omissions. Apart from, Protecting of valuable resources, sufficient department of power over key management places and strict conformity with the inner operating policies and corporate governance.

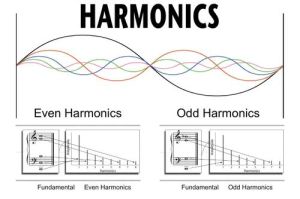

Harmonics Audit Services

Get Price Quote

Our Harmonics Audit Services offer a thorough analysis of your electrical systems to identify and mitigate harmonics-related issues. Our specialized team assesses equipment, measures harmonic levels, and recommends tailored solutions. By addressing harmonic distortions, we enhance power quality, improve equipment lifespan, and prevent disruptions. With our services, you can ensure a more stable and efficient electrical environment, minimizing downtime and maximizing productivity.

Tax Audit Services

Get Price Quote

Tax Audit comes under the purview of Section 44AB of the Act which specifies the persons who are required to get audit of their books of accounts. This section specifies particularly that except for the persons coming under the purview of the sections mentioned in the text of Section 44AB , all other have to get their accounts audited under Section 44AB. The object of audit under section 44AB is only to assist the Assessing Officer in computing the total income of an assessee in accordance with different provisions of the Act.This Audit effectively curbs tax Evasion and ensure tax compliance. Therefore, Even though the income of a person is below the taxable limit, he will have to get his accounts audited and if his turnover in business exceeds the prescribed limit. If Assessing Officer wants the assessee to get his accounts audited in cases where the figures of turnover as appearing in the books of account of the assessee do not exceed the prescribed limits, he has no option but to pass an order under section 142(2A) directing the assessee to get his accounts audited from a chartered accountant as may be nominated by the Commissioner of Income-tax or the Chief Commissioner of Income-tax Hence, it must also be understood that the issue whether the turnover/gross receipt exceeds the prescribed limit is to be determined in each year independent of the results obtained in the preceding year or years. This section applies only if turnover/gross receipt exceeds the prescribed limit according to the accounts maintained by the assessee. It would be advisable to maintain basic records to support the turnover/gross receipt for declare audit required or not. Analysis of Section 44AB: Applicability: This section is applicable to every person: Carrying on business shall, if his total sales, turnover or gross receipts, as the case may be, in business exceed or exceeds one crore rupees in any previous year; or Carrying on profession shall, if his gross receipts in profession exceed fifty lakh rupees in any previous year; or Carrying on business as specified under Section(s) 44AE, 44BB, 44BBB and declared profit less then as specified in the respective sections Carrying on business/profession as specified under Section 44AD, 44ADA and income exceeds the limits as specified in the respective sections Deriving income under Sections 44B, 44BBA and declared profit less than the limits specified Penalty for failure to get accounts audited:If any person who is required to get his accounts audited by an Accountant as compliance provision of 44AB, before the specified date fails to do so shall be liable for penalty under section 271B. The amount of penalty shall be one-half percent of turnover / gross receipts or Rs.150000/- whichever is lower. This penalty shows the seriousness that the Government affixes towards Tax Audit under section 44AB.

Cost Audit Services

Get Price Quote

undefined undefined (MOQ)

We are service providers of Cost Audit Services, Cost Accounting Records Services etc.

Auditing Services

Get Price Quote

With globalization, accounting rules & regulation and audit standards are changing very frequently. Successfully filling this role since incorporation. Our audit procedures are designed to ensure compliance with relevant statutory laws and specialization. Our approach focuses on ensuring that internal controls are effective and disclosure requirements of the accounting standards and applicable regulations are met with. Our team of result-oriented professionals has considerable expertise in the field of Financial Auditing Services, professional auditing services etc. MPA considers that providing Professional Auditing Services are top priority and that the firm does not view such services as a commodity. MPA do this by emphasizing the importance of audit quality in training programs and annual performance reviews. We stand among the dependable providers of Auditing Services based in India. Clientele across sectors such as manufacturing, textiles, energy, food processing, telecommunications, Information technology enabled services. System cum Transaction audit methodology with well defined audit planning and execution procedures Additional inputs on : System and efficiency improvement Internal control review Statutory compliances Note : Empanelled with C&AG from many years

Air Audit Services

15,000 Per Day

We provide following service in compressorand Compressed air network, FAD Checking Energy Audit Leak Detection Efficiency check

Energy Audit Services

15,000 - 20,000 Per Day

1 Service (MOQ)

Energy Audit Services/Power Quality Services in Chennai, Tamil Nadu. Today industry is highly conscious of the need for energy management and power quality improvement to save energy costs, reduce failures and improve productivity. To enable such customers who would like to get immediate benefit of measurement at various power flow points at their works. We are now offering Energy Audit Services and offer sophisticated Load Managers, Instruments along with experienced personnel to measure power, energy and power quality parameters and submit a report on the same to help them in their endeavor to manage energy costs & improve power quality. Scope of Auditing: To Create a baseline of Energy Consumption & GHG Emission. To Study Energy Conservation potential in Air conditioning & lighting load. To study the site for Generating Solar Energy. To Study the Boiler operation, Steam Consumption. To Study the potential for Waste Heat recovery management To propose measures to realize the potential for Energy Conservation. Study at capacitor banks and various feeder points for PF improvement potential Study at feeders & loads for harmonics and power quality problems Study at incomer to cross check EB meter and analyzer demand and energy billing patterns