Income Tax Consultant

Get Price Quote

We have emerged as a highly reliable Income Tax Consultant in Kolkata. Providing complete assistance for the Income Tax related issues of the clients, we deliver all-round assistance to the clients through the Income Tax Consultancy Services. The Income Tax Consultancy Services, which we are offering, are widely appreciated for their in-depth analysis of the clients’ needs and we offer highly customized solutions to the clients. The timely and efficient Income Tax Consultancy Services are delivered at cost-effective prices. Tax AssistanceWe take a holistic view, combining industry insight with the technical skills of financial and tax professionals, economists, lawyers and our other in-house resources as necessary, to develop comprehensive integrated solutions. Our tax services include : Getting Permanent Account Number (PAN) Filing of Income Tax Returns E-filing of TDS Returns Consultancy on Income Tax Matters Faster process of Income Tax Refunds Consultancy on Tax Planning & Savings Maintenance of Income Tax Records Liaison with Income Tax Authorities Tax deduction account numbers Services related to withholding taxes

Sales Tax Digital Signature Certificate

Get Price Quote

If you are in need of reliable assistance for sales tax digital signature certificate requirements, then it is advised to contact us at E- Filling Infotech Private Limited. We are based in Kolkata (West Bengal, India) and we render solutions & services for obtaining class 2 digital signature certificate. Our focus on details and commitment towards delivering on-time solutions has made us a favorite choice of the clients. So, contact us anytime.

Looking for Tax Consultancy Service Providers

GST Registration service

Get Price Quote

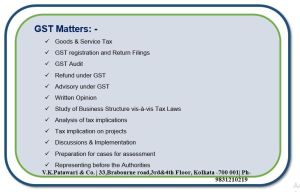

Chirag Group Of Company is a prominent name in the service sector of Kolkata (West Bengal, India). We can be approached to provide the best GST registration services to the clients. Whether you are a company owner or a proprietor, we have the facilities for everything to make you register under the GST. Ours is a group of deft GST registration experts, who will guide in filling various GST forms to make you register under the goods & services tax law.

Income Tax Services

3,000 - 5,000 Per

I PROVIDE INCOME TAX RETURN FILING SERVICES AT ALL OVER THE WEST BENGAL. PLEASE CALL AT 9831914390.

Service & Central Excise Tax Consultancy

Get Price Quote

Based in Kolkata (West Bengal, India), we are involved in providing consultancy solutions for service & central excise tax. Ours is a team of qualified individuals, who work together and advise on different tax-related matters, new registration, paperwork completion, amendment of the RC, etc. Ours is a licensed firm and provides services as per the governing rules & regulations. Our service charges are reasonable; clients can approach us anytime for further discussion.

Professional Tax Registration Services

Get Price Quote

We have been able to offer our clients the highest calibre Professional Tax Registration Service since we are a customer-oriented company. We provide this service in a timely manner and with great quality. Our highly skilled personnel carry out the provided service using top-notch equipment and cutting-edge technologies. This service is provided by our professionals in accordance with the needs of our clients. Additionally, our esteemed clients may take advantage of the offered service at the most affordable price.

TDS Return Filling

Get Price Quote

tds return is required to be filed by the assessee who has deducted the tds. tds returns are required to be filed after specified intervals and details to be furnished in these returns include fields like tan no., tds payment, amount deducted, type of payment, pan no. etc. tds returns which are required to be submitted electronically are prepared with the help of return preparation utility. to facilitate easy preparation of returns, the govt has also launched a tds return preparation utility (rpu). this utility can be downloaded free of cost from here. the return can also be furnished directly at the nsdl tin website. in case the deductor opts for submission of return online, he would be required to sign the return through his digital signatures. at the time of submission of return, if your return is complete in all aspects, a provisional receipt/token no. would be issued. the provisional receipt/token no. is an acknowledgement of the fact that the return has been filed. in case of non-acceptance of your return, a non-acceptance memo would be issued stating the reasons for rejection. price: 800-1200.

Taxation Services

Get Price Quote

For making any business profitable or to be free from any legal inconveniences, it’s important to know all the departments of taxation well and accurately.Hence it’s always advisable to appoint professional taxation services to prevent any major liabilities. When it comes to the matter of profitable taxation services,AbhijitKundu& Associates is the best name. AbhijitKundu& Associates is a highly credible and prominent name in the trend of taxation services. Our company is readied with highly apt and skilled tax and other professionals who are especially capable of satisfying all the requirements of our clients If you are worried about the proper taxation of your company, do contact us for getting smooth, secure and hurdle-free services with the best offersand discounts.

Taxation Services

Get Price Quote

Our organization is instrumental in providing simplified and efficient taxation services to the clients across Barrack pore (West Bengal). We have resourceful agents who provide effective tax planning and strategies for the clients’ convenience. We maintain a healthy relationship with our clients in order to understand their requirements, accurately. Our services are available for all types of taxation purposes such as international tax, employment tax, corporate tax, private tax, expatriate tax, and many more.

Service Tax Registration

Get Price Quote

Service tax is a tax on services provided in India. Service tax is levied under the Finance Act, 1994 on certain services as specified by the Government. Service tax registration is a mandatory registration for service providers who have taxable service of value exceeding Rs.9 lakhs, in the previous financial year. Service tax registration facilitates in the identification of assesse, payment of service tax and filing of service tax returns. Any person who has provided taxable service of value exceeding Rs.9 lakhs in the preceding financial year is required to obtain service tax registration. When a person commences a new business, he/she is required to obtain service tax registration within 30 days of commencement, if the business will have taxable service in excess of Rs.9 lakhs.

NRI Tax Consultancy

Get Price Quote

We are provide service of NRI Tax Consultancy. Services For NRI's Planning and implementing appropriate strategy for investing in India Regulatory compliance's in relation to investment in India under Foreign Exchange Management Act (FEMA), Reserve Bank of India (RBI and other concerned bodies. Advising on best business structure, tax planning and various tax incentives available in India. Formation of Business Entity in India Incorporation of Company Incorporation of Limited Liability Partnership Setting up Branch officeLiaison officeSubsidiaryJoint venture in India Acquiring existing Indian companiesOther legal entities Setting up in Special economic zones (SEZs), Export oriented Units (EOUs) and Software technology Parks (STPs) Opening of Bank Account in India Obtaining Permanent Account Number under Indian Income Tax Law Advising on matters relating to trademark, Patent, copyright etc. Apply for registration under various tax laws Service Tax Sales TaxValue Added Tax Excise Duty Accounting, Audit, legal and Taxation services.

basic accounting taxation service

Get Price Quote

Our fundamental accounting and taxation courses are designed to provide students with a hands-on grasp of accounting and taxation basics such as financial statements, bookkeeping, tax laws, and regulations. Our courses are taught by seasoned professionals who are enthusiastic about sharing their expertise with students and assisting them in succeeding in their jobs. To fit your schedule and learning preferences, we offer our courses in a number of formats, including online and offline classes. We recognise that everyone’s demands and learning methods vary, which is why we provide adaptable solutions to meet your requirements.

Professional Tax Return Filing Services

250 Per month

We Can Provide Professional Tax Return Filing Services at Lowest rate. Call us to Avail this Service

Income Tax Consultant

1,500 - 50,000 Per Number

We would like to inform you that we are a Tax Consultancy dealing with WBRERA, Income Tax, GST, TDS & TCS, Trade License , Dot License, MSME, Shop & Establishment, Food License, Professional Tax, PF, ESI, Import Export Code, Trade Mark, company bookkeeping & annual compliances. After the formation of your company you need to apply for Professional Tax, Trade License, GST (if not applied at the time of incorporation), and other licenses as mentioned above as per your business requirement and also you need to get audited your company books of accounts once a year

Income Tax Consultant

Get Price Quote

We are experts in income tax filing. We provide personalized tax filing our solutions to our clients. We also help in doing income tax computation and getting them income tax refund if any. We execute our services within time and pre-determined fixed fees. Please give us an opportunity to serve you. Thank you!

Taxation Services

Get Price Quote

We are B. Pramanik & Associates is a Kolkata based law firm providing services in all over India, our practice areas Corporate, Criminal & Civil suits with responsibility, honesty and dignity. We are one stop solution. B. Pramanik & Associates is also popularly known as “Banshi International Law Firm” providing services in all over world.

gst registration

Get Price Quote

GST Registration and Migration service done by experienced professionals. Accurate details. Minimum documentation. Delivery within 7 days in most cases.

Taxation Service

Get Price Quote

Direct Tax , Indirect Tax or future implementation of GST; EaccountsPro offers complete tax consultation, computation and secured data storage. Without having to spend on tax experts you can now take the easy way to outsource tax calculation and preparation work to EaccountsPro.

GST Filling

Get Price Quote

1 Piece(s) (MOQ)

dear sir, greetings from b. Pramanik & associates! we are kolkata based law firm at dumdum providing legal services in all over india. Our focus on to provide one stop legal solutions at this same place. our specialization: a) ngo & trust registration b) niti ayog (ngo darpan) registration c) 12aa & 80g registration d) fcra registration e) 35ac registration f) ngo website g) fundraising h) ngo itr & audit reports i) property searching, property valuation & property registration j) court cases (civil, criminal & corporate) k) legal notice l) ngo / trust / society / shg registration m) partnership deed registration n) legal advice o) deed drafting & deed registration p) agreement q) affidavit & notary other services: a) accounting & taxation b) itr & auditing c) gst filling d) company registration (pvt. Ltd./ltd./llp/opc) e) roc compliance f) iso certification g) msme registration h) trademark registration i) copyright registration j) food licence (fssai registration) k) digital signature certificate (dsc) we provide our services against a very low cost. We are passionate about our work . So, please visit to our office and start your business with us ! if you require any above-mentioned services please contact us. thanks for your business with us ! contact us: b. Pramanik & associates manaswi maity 158, dumdum road, kolkata – 700 074

GST Filling

Get Price Quote

1 service (MOQ)

implementation of gst is the significant taxation reform in india which emerged with a mission of “one nation one tax” in the year 2017. gst has simplified the tax return filing process by integrating the sellers’ and buyers’ information about goods & services. Gst council along with finance ministry came up with a mechanism of gstn (goods and services tax network) where all the details about invoices, buying, selling, date, location are duly reported by the taxpayers. this serves a smooth platform to taxpayers registered under gst to get interlinked and easily avail and file the gst return form, claim itc and so on, all in accordance to the taxpayers’ category they fall under.

Income Tax Return & Filling

Get Price Quote

We are b.pramanik & associates for all kinds providing trust, ngo, society, club, educational trust, charitable trust,nursing college registration,msme, ngo darpon, trademark registration, copyright registration, iso certification, digital signature certificate(dsc), micro-finance registration, private limited company registration, public limited company registration, one person company(opc) registration, llp registration, income tax filling & audit, gst filling & audit, 80g application, 12aa application, deed drafting, agreement for sale, notary & others legal service.

Tax Preparation and Tax Planning

Get Price Quote

We are providing tax preparation and tax planning. Our clients rely on our professional tax advice to ensure that they are optimizing their situation. Significant partner involvement in the process ensures that our clients get the full benefit of our training and expertise.

Taxation Services

Get Price Quote

We are B. Pramanik & Associates is a Kolkata based law firm providing services in all over India, our practice areas Corporate, Criminal & Civil suits with responsibility, honesty and dignity. We are one stop solution. B. Pramanik & Associates is also popularly known as “Banshi International Law Firm” providing services in all over world.

Taxation Services

Get Price Quote

The company has an expertise in rendering reliable Taxation Services across the country. Our Taxation Services include E-Filing, Direct and Indirect Tax/VAT/ Tax Saving Plans / Investment Plans. Our proficient team members are well-versed with the latest amendments made in the taxation laws and others rules and regulations. Our Taxation Services are available at the market leading rates. We are specialized in : Preparation & Filing of Income Tax, e-TDS, FBT, Sales Tax/VAT (Local & Central), Service Tax Returns on monthly, quarterly, half yearly & annual basis and issue of various formsTax planning for new, existing & reorganized businessesTax compliance and representation before various tax authorities including filing of appeals before Appellate AuthoritiesRegistration of the various type of firms & companies with Sales Tax/VAT, Service Tax, Income Tax Authorities

Indirect Tax Services

Get Price Quote

Indirect taxation matters are handled carefully by incorporating the latest amendments.Services provided include return filing, online payment of taxes, handling of assessments and appeals in various Indirect Tax Forums.

Gst Consultant Service

Get Price Quote

Gst Consultant Service, audits assurance services

GST Filling

Get Price Quote

Importance of GST Return Filing Services:Filing Goods and Services Tax (GST) returns is mandatory for most businesses registered under GST in India. It's a statutory requirement imposed by the government for entities exceeding the threshold turnover limit or falling under specific categories, regardless of whether the business has made any sales or transactions during the return period. GST return filing services relieve businesses of the burden of understanding the intricate GST framework and spare them the complexities involved in preparing and filing returns, allowing them to focus on core operations.

legal taxation service

1,000 Per un

legal taxation service, Business Registration, ngo registration

Income Tax Consultants

Get Price Quote

Tax Compliances and Assessments Preparation and filing of Income Tax Returns of Individual, HUFs, Companies, Partnership Firms, Trusts etc. Filing of Revised Returns and Rectification Procedures TDS related compliances and returns Advance Tax calculation Annual Infomation Returns Getting tax refunds PAN, TAN Registration Preparation and filing of appeals before Income Tax Authorities International Taxation Tansfer Pricing International holding company structures Tax treaty issues, DTAA etc. Taxation of foreign citizens and foreign corporations

Service Tax Consultants

Get Price Quote

We provide compliance, advisory and litigation support. which includes but is not limited to any activities like representation before authorities, drafting of appeals, monthly computation of liabilities etc.