Industrial Safety Audit Services

25,000 - 35,000 Per Piece

1 Piece (MOQ)

CDG Inspection Ltd, in Gurgaon, Haryana, offers a proven approach that can help you enhance safety, minimize occurrences and injuries, and boost confidence amongst your team, whether you choose to understand how serious your workers take the protection and just want to understand how protected they experience in your workplace. We'll conduct a thorough safety audit to assess the effectiveness of your program, discover compliance issues, and recommend solutions. Our industrial safety audit services would be tailored to your individual activities, allowing you to take action, eliminate hazards, and establish the next steps to meet your safety objectives. You'll have the data you need to make important decisions, as well as a benchmark against which future safety measures can be measured. 5 Important Steps to an Effective Safety Audit An effective Safety audit is one that has been proven to ensure that the business has a safety program in place to reduce incidents and mitigate safety risks to their workers. Most importantly, “in place” means policies and procedures that have been tested, trained, and demonstrated in practice, as evidenced by the audit program. The 5-step safety audit steps below outline provide a management summary and structured approach toward the development of an effective safety audit. Step #1: Audit Planning worker in safety vest at job site safety audit is a form of test, and therefore, a test plan needs to be established prior to test execution. The key components of an Audit Plan are the basic documentation of the: “who, what, and where.”The planning step is the key to the entire process since the audit plan defines the procedures and sets the safety test baseline. Step #2: Audit Execution With a trained team identified, scope and baseline documentation defined, the next step is to conduct the audit as planned. The baseline documentation is used to effectively compare written procedures to activity in the workplace. Variations from established safety procedures are documented, along with observations of the actual work conditions, and any important input from the workers involved. Step #3: Compile the Audit Report safety leader conducting safety audit After conducting the audit, the audit team will integrate test results and information into a concise audit report. Part of the team’s training is to ensure a well-documented report that details any variances to the audit baseline and important audit findings and describes things that are working well in addition to any problem areas. Problem areas or negative findings are addressed in the recommended actions section of the audit report to start the process improvement efforts needed. Step #4: Set Corrective Action Plans and Process Improvements in Motion The audit execution and report go beyond a simple pass/fail approach. The findings should contribute to the continuous process improvement effort towards optimal workplace safety. Audit findings may identify significant corrective actions that need to be immediately set in place for worker safety, but most often baseline variations and input from the workforce are addressed as part of continual improvement activity. Process improvement follow-up would include prioritizing tasks, with assignments and suspense dates. Step #5: Communicate Results assessing the site during a safety audit. An effective workplace safety audit is essential to business continuity, employee protection, and morale, along with the requirement to demonstrate compliance with all guidelines. It is important that all employees have a transparent understanding of the audit, and their safety status. Workers have been trained in safety procedures and adherence to those procedures is essential in reducing workplace incidents.

Internal Auditor Training Program

Get Price Quote

An excellent instrument for improvement is internal auditing of the Quality Management System, which evaluates the level of execution. This internal auditor course will include training sessions, activities, and group discussions in addition to instruction on how to accomplish its goals. Course Objectives Ensure delegates are aware of the key principles involved in inspecting the quality management system To teach/improve practical auditing abilities so that one can earn an internal auditor certification To give the delegates the skills necessary to organize, manage, and perform internal QMS audits in conformity with ISO 19011’s guidelines and principles. Benefits To comprehend the obligations and duties of an internal auditor. The audit’s planning, execution, and reporting. To comprehend how the ISO standard is interpreted. To comprehend auditing guiding principles and procedures. Exercises and case studies for education. Training Outline Context, Leadership, Support, Operation, Performance, and Improvement: QMS Requirements. Auditing standards. Auditor responsibilities and roles. Setting up an internal audit. Carrying out an audit. Presenting audit findings. Who Should Attend Top management. QMS managers and officers. QMS internal auditors. Management system professionals and consultants. Anyone interested in Quality management system.

Looking for Auditing Services Providers

fire safety audit

Get Price Quote

School Audit Income Tax Return Services

Get Price Quote

Fully-Compliant School Audit Income Tax Return Services Our friendly and highly-skilled accountants at Raj Taxation Consultancy Services based in Bhopal can complete your school audit income tax return services, irrespective of how complex and tricky it seems way before the deadline, after which the penalty is levied. Though school audit income tax returns can be done by your in-house experts, the process is quite tedious. This is why we are here to help you with our team of tax advisors. Accurate and Fast School Audit Income Tax Return Services Our advisors, consultants, and CA’s have years of experience in the field and can guide you through every step of audit income tax return solution to make the process less complicated and quick for you. We will ensure that your school audit income return is done on time, and we also keep a tab on whether you are paying in excess. We can also help you get a tax rebate and ensure your school audit income return is done accurately and in the correct format.

GST Audit Service

25,000 - 30,000 Per Company

1 Company (MOQ)

Our GST Audit Service ensures that your business remains fully compliant with Goods and Services Tax (GST) regulations. We conduct detailed audits of your GST returns, invoices, and financial records to verify accuracy and ensure proper tax filing. Our experienced team helps identify discrepancies, recover input tax credits, and rectify any errors to avoid penalties. We also provide valuable insights into optimizing your GST processes and improving compliance efficiency. Whether you’re a small business or a large enterprise, our GST audit service helps minimize risks and ensures that your tax filings are accurate and timely. Contact us today for expert support.

Internal Auditor Training Courses

Get Price Quote

Eligibility to attend the course: Any degree holder .This course is designed to make a person capable of conducting Internal audit of any organization. Certificate would be provided to participant to give evidence for qualification as Internal auditor.Participant would understand the requirements of standard by undergoing this course and would get a general checklist for auditing an organization. Exercise would be provided to train the participants. On completion of the course a test paper would appear online for completion or this would be sent by e mail to participant for completion and return.The above is course content according to standards (I.E. ISP 9001:2015/ISO 14001:2015/ISO 45001:2018/ ISO 50001: 2018 either as a single topic or in combination as described in the course topic)Next step Register for the course by filling up following details. Attend course Attend examination Course pass when marks obtained is 75% and above - Download certificate Repeat exam when marks obtained in below 75%. Course Fee Per personSeparate standard ₹ 900 / US $ 12.5(for each topic, For combination of two topics ₹1700/ US $ 22 ; Combination of three standards ₹2360 / US $ 31

SEDEX Audit service

Get Price Quote

Smeta is designed to improve audit standards and promote mutual acceptance of audit reports. It helps in reducing duplication of effort in ethical trade auditing; benefitting retailers, consumer brands, and their suppliers. We are a reputed agency who assists organizations in getting smeta audit done. Our experienced auditors conduct insightful audits and share them through supplier ethical data exchange (sedex) system.

Social Compliance Audit

Get Price Quote

Sedex BSCI C-TAT GOTS GRS ICS WRAP FEM SLCP HIGGS Consultany services all over India. We are located in Mumbai, Maharashtra. More than 200 customers already complied

statutory audit services

Get Price Quote

By the meaning of word the statutory audit in India is the audit which is prescribed by statute. There is many audit in India which is prescribed by the different statute like Income Tax Act require audit as per him similarly VAT Act require audit as per him so a CA need to conduct many audit as per different statute requirement. But known and popular terms used as a statutory audit is not an audit as required under Income Tax Act or VAT Act. It is similar different thing and it is required under the law of incorporating act like if company then audit required under Companies Act and if other body then body incorporated under that act. In India mainly statutory audit means audit under Companies Act in which auditor reports to the member of the company i.e. shareholders.How we do? Statutory Audit Execution General Process Our firm is well equipped and well experienced in Statutory Audit and we perform it as per the Audit Program designed for the company after assessment of their Internal Control. Steps generally we follow Getting Appointment Letter & Board Resolution Copy Getting NOC from Previous Auditor Filing our no disqualification status to the company Filing of Form 23B to ROC Getting Letter of Engagement Assessment of Internal Control Formulation of Internal Audit Program Action Plan and Calendar Conduction Audit as per IGAAP Companies Act ICAI Accounting Standards and Auditing Standards Forming an opinion on financial statement prepared by the company Reporting to Shareholders Attending AGM

Auditing Services

Get Price Quote

Audit is an official inspection of an organization accounts by an independent body. It is a systematic and independent examination of books, accounts, statutory records, documents and vouchers of an organization to ascertain how far the financial statements as well as non-financial disclosures present a true and fair view of the concern. It also attempts to ensure that the books of accounts are properly maintained by the concern as required by law. Auditing has become such a ubiquitous phenomenon in the corporate and the public sector that academics started identifying an "Audit Society". The auditor perceives and recognizes the propositions before them for examination, obtains evidence, evaluates the same and formulates an opinion based on his judgement which is communicated through their audit report.Broadly, an Audit involves : In-depth study of existing systems, procedures and controls for proper understanding and give suggestions for improvement and strengthening. Ensuring compliance with policies, procedures and statutes. Comprehensive review to ensure that the accounts are prepared in accordance with Generally Accepted Accounting Policies and applicable Accounting Standards/IFRS. Checking the genuineness of the expenses booked in accounts. Reporting inefficiencies at any operational level. Detection and prevention of leakages of income and suggesting corrective measures to prevent recurrence. Certification of the books of account agreeing with the Balance Sheet and Profit and Loss Account. Issue of Audit Reports under various laws. Audit At a Glance : We conduct following types of audit : Statutory Audit of CompaniesTax Audit under section 44AB of Income Tax Act, 1961 Audit under any other provisions of Income Tax Act, 1961 Internal Audit Branch Audit of Companies, whether in India or Outside India Stock Audit Audit of Public or Private Trust Audit of Co-operative Societies Audit of Government NGO’s Audit of Schools, Hospitals, etc.

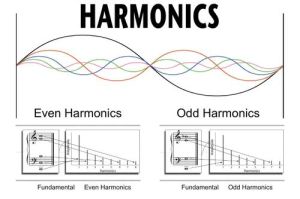

Harmonics Audit Services

Get Price Quote

Our Harmonics Audit Services offer a thorough analysis of your electrical systems to identify and mitigate harmonics-related issues. Our specialized team assesses equipment, measures harmonic levels, and recommends tailored solutions. By addressing harmonic distortions, we enhance power quality, improve equipment lifespan, and prevent disruptions. With our services, you can ensure a more stable and efficient electrical environment, minimizing downtime and maximizing productivity.

energy audit

Get Price Quote

1 Piece (MOQ)

Energy is often the single largest controllable cost in manufacturing. Proper management of energy has a direct positive impact on a company’s bottom line. Energy audit is the first step in knowing the potential energy savings. It identifies area where the energy is being wasted by taking measurements at the key energy consumption points and the systematic study. It determines existing level of energy usage and recommends possible measures that would result in energy savings.

Energy Audit Services

15,000 - 20,000 Per Day

1 Service (MOQ)

Energy Audit Services/Power Quality Services in Chennai, Tamil Nadu. Today industry is highly conscious of the need for energy management and power quality improvement to save energy costs, reduce failures and improve productivity. To enable such customers who would like to get immediate benefit of measurement at various power flow points at their works. We are now offering Energy Audit Services and offer sophisticated Load Managers, Instruments along with experienced personnel to measure power, energy and power quality parameters and submit a report on the same to help them in their endeavor to manage energy costs & improve power quality. Scope of Auditing: To Create a baseline of Energy Consumption & GHG Emission. To Study Energy Conservation potential in Air conditioning & lighting load. To study the site for Generating Solar Energy. To Study the Boiler operation, Steam Consumption. To Study the potential for Waste Heat recovery management To propose measures to realize the potential for Energy Conservation. Study at capacitor banks and various feeder points for PF improvement potential Study at feeders & loads for harmonics and power quality problems Study at incomer to cross check EB meter and analyzer demand and energy billing patterns

Documentation Audit Service

Get Price Quote

Documentation audit services involve a thorough review and assessment of a company’s legal, financial, and operational documents to ensure accuracy, compliance, and proper record-keeping. These audits help identify gaps, errors, or risks in contracts, corporate records, agreements, and other critical documentation. By examining the consistency, completeness, and adherence to regulatory standards, audit professionals provide insights for improving documentation practices. Regular audits safeguard organizations from potential legal or financial liabilities and ensure compliance with laws and industry regulations. Documentation audit services enhance transparency, reduce risks, and support better decision-making, helping businesses maintain their operational integrity and legal standing.

Kiln Audit Services

Get Price Quote

Acquire the best kiln audit services in Thane (Maharashtra) by approaching Allan Smith Engineering. We are backed by a professional staff that holds expertise in kiln auditing. We make sure that no client faces the slightest inconvenience after acquiring our kiln audit service. As per the client requirement, the data is maintained for clinker and cement used. For further queries, feel free to get in touch with us now.

Auditing Services

Get Price Quote

We are a Chartered Accountants registered firm, under Rules 190 of Chartered Accountant Act, 1949 since 2002. We are based at Kolkata. H Saraogi & Associates caters to the needs of its customers to ensure that its customers keep pace with the rapid changing times. Based at Kolkata (West Bengal, India), we stand among dependable Auditing Services providers. We consider that providing Professional Auditing Services are top priority and that the firm does not view such services as a commodity. We do this by emphasizing the importance of audit quality in training programs and annual performance reviews. Types of Auditing Services made by us : Statutory AuditsWe perform Statutory Audits of Public/Private Limited Companies in the Manufacturing/ Trading/ Assistance Areas, IT Companies, Nationalized Lenders, Economical Organizations, Non-Banking Finance Companies, Community Industry Venture (PSU), Non-profit Organizations, NGO, Resorts, Medical centers, Supportive Organizations and other little and medium-sized companies. Tax AuditsEvery company, Firm or Businesses whose income surpasses Rs.100 Lakhs or total claims from any occupation surpasses Rs.25 Lakhs in any previous year, is necessary to get its records precisely & punctually audited and obtain a review under the area 44AB of the Earnings Tax Act. We have a group of calm tax experts to perform such type of audits. Internal & Management AuditThe improving problem is to make sure awesome inner & handling management techniques to avoid unique or structured faults and omissions. Apart from, Protecting of valuable resources, sufficient department of power over key management places and strict conformity with the inner operating policies and corporate governance.

Internal Audit Service

Get Price Quote

AMA is specialized in Internal/Management Audits which are primarily conducted in order to provide the client’s management a clear, comprehensive and unbiased analysis of the functional efficiency of the organization and to suggest possible areas for improvements. We Ashish Mahajan & Associates strongly believe in Internal Audits being a value addition exercise rather than a mere compliance exercise.

Factory Audit Services

Get Price Quote

Transfer Pricing Audit Service

Get Price Quote

In Transfer Pricing Audit (TPA) we examine the pricing of transactions between related two or more associates. By applying and documenting various test methods, it is determined whether the transactions are conducted under market conditions and survive the scrutiny of the IRS and other tax authorities. Section 92E of Income Tax Act, 1961 is applicable on the TPA. The TPA is applicable on every person who has entered into an international transaction and aggregate value of such transactions exceeds Rs. 1 crore and specified domestic transactions exceed INR 20 crore in a financial year. In case the aggregate value of such transactions does not exceed its prescribed limited then it is not mandatory to maintain the aforesaid information and documents

Auditing Services

Get Price Quote

We are a trusted name, when it comes to reliable Internal Support Services for Auditing. Backed by a team of expert professionals, we offer perfect solution for assessing, designing, developing and implementing cost effective auditing process for corporate and business houses. We are preferred by clients because of the effective internal controls that guarantee smooth and efficient working of the organization. As part of our Auditing Services, we offer : Stock Verification Cost Control Audits System Designing Management Audit Due Diligenge Investigations Surprise Checks Why Us? Support Services for Auditing Auditing under various enactments as Income Tax, GST, and Company Tax etc. Online Library of forms, statements and declarations formats Compliances with Indian accounting and auditing standards and IFRS Auditing tutorials guidelines standards and information library