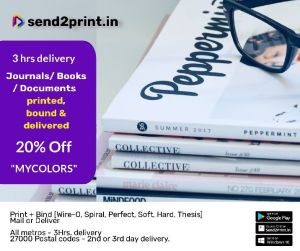

Hard Case Books Printing Services

Get Price Quote

Fixed Deposits And Bond Service

Get Price Quote

What are Governments bonds? When you lend money to the government in exchange for an agreed-upon interest rate, the transaction is known as a government bond or G-sec. They are frequently thought of as one of the safest asset classes. How do they operate, though? When you purchase a government bond, you are lending money to the government, which will utilize the funds raised to finance infrastructure or project development. The bond coupon specifies the frequency of the government’s fixed interest rate payments in return. The bond will keep making these payments until its maturity date, at which point it will expire and you will receive your initial investment back. From one year to 30 years or more, there are several maturities. Types of Government Bonds Indian Government issues several bonds in order to execute various projects. What is the Difference Between Corporate Bond and Government Bond? a. Treasury Bills (T-bills) The central government of India issues treasury bills, often known as T-bills, which are short-term government securities with a maturity of less than a year. Short-term financial instruments known as Treasury Bills come in three varieties: 1) 91 days 2) 182 days 3) 364 days Treasury bills are zero coupon securities and do not pay interest, although a number of financial instruments do. They are instead issued at a discount and redeemed at face value when they reach maturity. For instance, a 91-day Treasury bill would normally cost Rs. 100, but an investor can get it for Rs. 98.20, saving them Rs. 1.80. The investor will receive the returns after 91 days, computed on the basis of Rs. 100, the actual price. Investors will receive a total amount = Rs.721 Treasury Bills b. Cash Management Bills (CMBs) In the Indian financial sector, cash management bills are new securities. This security was first made available in 2010 by the Indian government and the Reserve Bank of India. Cash management bills are issued to cover short-term inconsistencies in the government of India’s financial flow. The RBI issues the bills on behalf of the government. Treasury bills and cash management bills are both short-term securities that are issued when necessary. However, the main distinction between the two is the maturity period CMBs are an extremely short-term investment option because they are issued with maturity duration of fewer than 91 days. For instance, if a Cash management bill has a face value of Rs.50, we can purchase it for Rs. 45 and receive Rs. 50 at end of the maturity period, which is typically 60 days. Due to the short maturity period, there is no interest payment in this case. However, a discount is received as payment for purchasing the Cash Management bill. c. Dated G-Secs Dated Government Securities are a distinct class of securities since they can carry a fixed or fluctuating interest rate, generally known as the coupon rate. They are first issued at face value, which remains constant until redemption. Government securities, as opposed to Treasury and Cash Management Bills, offer a wide variety of tenure ranging from 5 years to 40 years, making them known as long-term market vehicles. Those who are investing in dated government securities are called primary dealers. There are different types of dated government securities issued by the Government of India 1) Fixed Rate Bonds 2) Floating Rate Bonds 3) Capital Indexed Bonds 4) Inflation Indexed Bonds 5) Bonds with Call/Put Options 6) Special Securities 7) STRIPS – Separate Trading of Registered Interest and Principal of Securities 8) Sovereign Gold Bonds (SGB) 9) Zero Coupon Bonds Let us understand what are those 10 types of Government securities. 1. Fixed Rate Bonds Fixed rate bond’s coupon rate is constant for its entire life as a government obligation. In other words, regardless of changes in market rates, the interest rate stays the same throughout the investment period. For instance, an investor might purchase a fixed-rate bond from the government with a face value of Rs. 1000 and a coupon rate of 10%. The bond’s term is 10 years, and the payment schedule is either semi-annual or annual. Following that, the investor would get Rs. 50 (5%) every six months and Rs. 100 (10%) every year for the following ten years. While the market rate may fluctuate greatly, the coupon rate on this bond will not change at all. 2. Floating Rate Bonds Bonds usually have a specified coupon rate or interest rate. However, a floating rate bond, on the other hand, is a type of debt obligation without a fixed coupon rate and instead has an interest rate that changes according to the benchmark from which it is taken. Benchmarks are tools of the market that have an impact on the national economy. Examples of benchmarks for a floating rate bond are the repo rate and the reverse repo rate. You might have got confused now, about how this is going to work out – don’t worry let us illustrate with an example. Bond Price Rs. 1000 Quoted margin – 4% (It will not change the entire tenure of the bonds) Liable – 6 months Liable rate – 1% Tenure – 2 years Then the investor gets the following after the six months 4% (quoted margin) + 1% liable rate at the time of purchase = Rs.50 Since every six months’ the liable rate changes, if it increases to 2% Then the investor will receive it after one year – 4% (quoted margin) + 2% liable rate since it is reversed = Rs.60 Most of the bonds also will come up CAP which means – the coupon rate can go a maximum of 6%, not beyond that. For example, Coupon rate is 5 % and the liable rate is 1.5 % then it is 6.5%. It cannot be paid to the investors because the CAP rate is 6%, it should not go beyond. Therefore, the investors will only receive 6% irrespective of the liable rate changes. 3. Capital Indexed Bonds Bonds known as “Capital Indexed Bonds” (CIBs) have periodic adjustments made to their capital value and interest payments to account for fluctuations in the Consumer Price Index (CPI). Typically, a fixed rate of interest is charged on the recalculated face value. Investors receive the bond’s adjusted face value along with the final coupon calculated from the modified face value when the bond matures. 4. Inflation Indexed Bonds Inflation Index bonds (IIBs) are where the principal amount and the interest payment are linked to an inflation index. The Consumer Price Index (CPI) or the Wholesale Price Index may be used as an indicator of inflation. Investing in these bonds ensures steady real profits. Additionally, it might protect the investor’s portfolio from inflation rates. For example. Governments issue Inflation Index bonds Bond price – R.1000 The interest rate or coupon rate – CPI (The consumer Price Index) + 5% Here the interest rate of 5% would remain constant and CPI may change based on inflation. Tenure – 5 years Payment – Semi-Annually At the end of the 6 months if the inflation is 8 % then the investor would be receiving = 8 % + 5 % = 13% = Rs.130 At the end of the year if the inflation is 6% then the investors would be receiving = 6 % + 5 % = 11 % = Rs.110 How does Inflation Affect Bond Price? 5. Bonds with Call or Put Option These bonds include a call option that gives the issuer the opportunity to repurchase the bond or a sell option that gives the investor the option to sell the bond to the issuer (put option). Only five years after the date of issue will the investor or issuer be able to exercise their rights. Example Bond Price – Rs. 1000 Tenure – 10 years Government can buy back the same bond at the same price Rs. after the completion of 5 years before the maturity period (10 years). If only the government wants to re-purchase the bond. In the same way, the investors can sell the bond to the government at the same price which they had purchased five years before. 6.. Special Securities The Government of India also occasionally issues special securities to companies like Oil Marketing Companies, Fertilizer Companies, the Food Corporation of India, etc. under the market borrowing program as payment in place of cash subsidies. These securities are known as oil bonds, fertilizer bonds, and food bonds, respectively. These securities are often long-dated and have a little larger coupon than the yield of similarly dated assets with a similar maturity. Example companies – Indian Oil, Hindustan Fertiliser Corporate limited, 7. STRIPS – Separate Trading of Registered Interest and Principal of Securities Separate Trading of Registered Interest and Principal of Securities is referred to as STRIPS. Here, a fixed-rate bond’s cash flow is transformed into separate security. The secondary market is where they are traded after that. Additionally, they resemble zero-coupon bonds in many ways. They are made from the securities that already exist, though. I’m sure you might be confused with the definition of STRIPS. Let us understand with an example. Bond price Rs.1000 Coupon rate – 10 % Tenure – 5 years Payment mode- Semi-Annually Now let’s apply the STRIPS concept- since it’s a 5-year bond and the payment period is semiannual; the bonds will be stripped into 10 semiannual coupons and each coupon will be treated as a standalone coupon bond. The final payment of the principal payment also will be treated as a standalone zero-coupon bond. Here the investor either can trade the coupon rate or principal amount separately 8. Sovereign Gold Bonds (SGB) We are so dramatically attached to its physical gold, but Sovereign Gold bond (SGB) online issued by the government. The best part is the interest on these bonds falls under tax exemption for individual taxation. Minimum investment in the Bonds shall be one gram with a maximum limit of subscription per fiscal year of 4 kg for individuals, the nominal value of the bonds will be determined in Indian Rupees using the three last working days of the week before the subscription period’s simple average closing price of gold with a purity of 999.9, as announced by the India Bullion and Jewelers Association Limited. For investors applying online and making a payment in response to their application via digital means, the issue price of the Gold Bonds will be Rs. 50 per gram less than the nominal value. The Bonds will accrue interest at a fixed rate of 2.50 percent (annually) on the nominal value. The last interest payment will be due along with the principal at maturity and will be made in half-yearly installments. What is Sovereign Gold Bond? 9. Zero Coupon Bonds The majority of bonds give monthly, quarterly, semiannual, or annual interest based on the coupon rate; but zero-coupon bonds do not have any such interest. With a zero bond, you purchase the bond at a discount from its face value and are paid the face amount when the bond expires rather than receiving interest payments. Let us take an example. The actual face value –Rs. 10000 You buy it at a discount price – Rs 7000 Tenure or lock-in period – 5 years At the end of the five years, you will receive Rs. 10000 (which was the face value of the bond while you were purchasing) This situation can vary if the market fluctuates, and the face value can be lesser than the purchase price. Let us take an example. The actual face value –Rs. 10000 You buy at a discount price – Rs 7000 Tenure or lock-in period – 5 years At the end of the five years, if the same bond is trading at Rs. 6500 then you will receive only Rs. 6500 due to the market fluctuation. You can also sell the same bond before maturity in the secondary market. The face value can depend on the again the market condition. It can be sold at a discount price or a higher price. Closing Thoughts It’s significant to have a better option for your portfolio because Government issues a wide variety of government securities. You can select the G-Sec that best fits your investment timeline because tenure is one of the key distinctions from other instruments. Government bonds or G-sec not only provide assurance of better returns and comes with less risker than other types of bonds. FAQ’S ON Government Bonds Can government bonds be redeemed before maturity? Callable bond can be redeemed by the issuer before it’s maturity date. They are typically issued with a face value and a maturity date, at which point the bonds can be redeemed for the face value What is the minimum amount to invest in bond? The minimum amount to invest in savings bons is Rs 1000 and in multiples thereof. Are govt bonds tax free? Government bonds in India are not tax free. However, the interest earned on these bonds is exempt from tax. This means that you will not have to pay any tax on the interest you earn from investing in government bonds. For example, interest on certain municipal bonds may be exempt from federal and state taxes. Capital gains from the sale of government bonds are also generally taxable.

Looking for Book Printing Service Providers

Book Printing Services

Get Price Quote

We are specialised in printing books as per clients requirment.

Bonds Investment Service

Get Price Quote

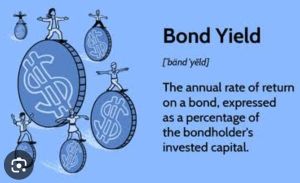

A bond is a fixed income instrument in which investor loans money to an entity (Corporate or Government) which borrows the funds for a defined period of time at a variable or fixed interest rate. Bonds are used by Corporate or Government to raise money and finance a variety of projects or activities. It is a market meant for trading (i.e. buying or selling) fixed income instruments. Fixed income instruments could be securities issued by Central and State Governments, Municipal Corporations, Govt. Bodies or by Private entities like Financial institutions, Banks, Corporate, etc. Why invest in Bonds? · Regular fixed income · Higher interest rate · No TDS on GSec, SDL, SGS · Portfolio diversification · Tradable publicly

College Notebook Printing Services

Get Price Quote

We are counted amid the well-known names that are involved in offering quality college notebook printing services. For the clear printing of the notebooks, we make use of quality inks and advanced printing machines. Our inks do not get smudged or do not penetrate the substrate. Moreover, you can customize the prints as per your own requirements in terms of designs, colors, texts, etc. Contact us to obtain our services. We are based in Ulhasnagar (Maharashtra, India).

Book Printing Services

Get Price Quote

100 Piece(s) (MOQ)

Karotra International is one of the best firms providing book printing services in Mumbai, Maharashtra. Their nominal costs and prompt completion are extremely appreciated on the market. We provide these services in different terms and ways because of high demand. We also offer these services to our customers at nominal rates. As the leading suppliers of book printers in the industry, we have earned our eminence. With the support of cutting-edge printing technologies, the services provided are delivered that help us achieve exquisite results for our clients. The books offered are strictly printed according to customers\' specifications and the entire process is completed within the specified time period.

Books Printing

30 Per Piece

500 Piece(s) (MOQ)

We print all types of books, novels, magazines as per your custom requirement. vegetarian cook book, story books, education gk books and many more books we print n supply.

bond services

Get Price Quote

We are one of the leading service providers of Bond Services. Bond is the security issued by a Company, Financial Institution or Government and it usually offers regular or fixed payment of interest in return for borrowed money for a stipulated period of time. The various Bond Services we cover are GOI, Bonds, Capital Gain Bonds and Tax Free Bonds. Our skilled professionals have a good experience in working with all types of companies.

bonds

Get Price Quote

B BondMaterial - Gunmetal / Brass / Aluminium These are used for bonding tape to steel structures.

Education books printing Services

Get Price Quote

We are the largest India-based producer of education books. We produce: Primary school books, Secondary school books, Supplementary books, Teacher's guides, Management books, Distance learning books, Higher education books, Technology manuals, Training manuals, Courseware and lab guides, among others. Our education books are customized for the markets our publishers serve. To learn more on the other print formats we produce, visit www.reproindialtd.commarketsformats. Visit www.reproindialtd.comsolutionsprint-solutions to learn about our print solutions. Visit www.reproindialtd.comsolutions to learn about our other solutions. www.reproindialtd.com

Cable Connections

Get Price Quote

Our domain expertise has enabled us to come up with an excellent collection of Cable Connections. Designed by our expert professionals using premium quality raw material, these connectors are used for connecting one or more cable to each other. Further, these are provided with an excellent rubber coating, these are able to withstand extreme weather conditions. The range of Cable Connections offered by our organization is demanded in the market for their compact design and perfect finish.

Education Book Printing Services

Get Price Quote

We are service providers of education book printing services. Voice your thoughts and let the pen do the speak books for school education or a novel or information or a journals are magazines are a periodical containing a collection of articles, stories, pictures, or other features.

School books printing service

Get Price Quote

School books printing service, Printed Sign plates

bonds

Get Price Quote

Fabricated using top-grade material, our Bonds are robust, excellently finished, dimensionally accurate, corrosion resistant and durable. They guarantee long service life. Furthermore, available in various specifications, our Bonds can be customized as per requirement. Customers can place a bulk order as well. We are one of the prominent Manufacturers, Exporters and Suppliers of Bonds.

notebooks printing services

Get Price Quote

50000 Piece(s) (MOQ)

We are manufacturers for all types of notebooks and exercise books. We sell to local and international clients and are interested in selling to distributors all over the world. For more details you mail email us at snehacreation{at}gmail{dot}com or call us on nine eight two zero seven nine one one five five

Book Printing Services

Get Price Quote

Book Printing

coffee table books printing services

Get Price Quote

We are providing Coffee Table Books Printing Services.

binding services

Get Price Quote

We are also providing Binding Services.

Book Printing Services

Get Price Quote

We are providing best BOOK PRINTING SERVICES.

Books Printing Service

Get Price Quote

We are offering books printing service.

Book Printing Services

Get Price Quote

we are offering Book Printing Services

web services connection

Get Price Quote

We are providing many types of services at affordable prices such as web services connection

Printing Services, Binding Service

Get Price Quote

We provide Printing Services, Binding Service etc. colour lazer print out between printouts on banner's brochures pemphlets

hose connections

Get Price Quote

hose connections, Dairy equipments, Pipes, mixer extruders

Book Printing

Get Price Quote

Book Printing, Magazine Printing, Online Printing Services

Book Printing Services

Get Price Quote

Book Printing Services, COATED PAPER BOARD, Note Book, hard bound note book

bill book printing services

Get Price Quote

bill book printing services, Digital Printing, invoice book

Hair Bonding Services

Get Price Quote

Hair Bonding Services, Hair Patches, hair weaving system, octagon hair patch

Bill Books

Get Price Quote

Bill Books, Envelopes, File Folders, Offset Printing Services

hose connections

Get Price Quote

hose connections, Stainless Steel Elbow, Stainless Steel Threaded Elbow