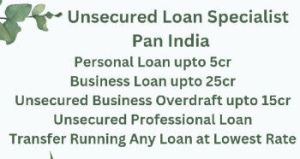

Unsecured Business Loan Service

Get Price Quote

Our Unsecured Business Loan Service offers fast and flexible financial solutions without requiring any collateral. Ideal for businesses seeking quick capital for expansion, working capital, or operational needs, we provide competitive interest rates and easy eligibility criteria. With a simple application process, minimal documentation, and quick approval, you can access funds when needed most. Our tailored repayment plans ensure your loan fits your business’s cash flow. Whether you're a startup or an established enterprise, our unsecured business loan helps you seize growth opportunities without the burden of securing assets. Trust us to fuel your business’s success with ease and reliability.

Loan Service

Get Price Quote

Loan servicing refers to the administrative aspects of a loan from the time the proceeds are dispersed to the borrower until the loan is paid off. Loan servicing includes sending monthly payment statements, collecting monthly payments, maintaining records of balanced and payments, collecting and paying taxes and insurance, remitting funds to the note holder and following up any delinquencies. 21MS Financing Services, Maharashtra provides you with a loan service. Our loan servicing can be carried out by the bank and financial institution that issued the loans, a non-bank entity specialising in loan servicing, or a third party vendor for the lending institution. Loan servicing may also refer to the borrower’s obligation to make timely payments of interest and principal on a loan. Therefore choose us and get our services.

Looking for Business Loan Service Providers

Unsecured Business Loan Service

Get Price Quote

Our Unsecured Business Loan Service provides quick and easy access to funds without the need for collateral. Ideal for small and medium enterprises, this service features competitive interest rates, flexible repayment options, and a straightforward application process. Use the funds for expansion, inventory, marketing, or working capital. Our dedicated team offers personalized support to help you meet your business goals. Get the financial boost your business needs with our hassle-free Unsecured Business Loan Service.

Business Loan Services

Get Price Quote

Unsecured business loan are available to small and medium enterprises for all your working capital needs. Capital is a vital component for the success of commerce today. Irrespective of whether a firm is in proprietorship or big organization, finance holds the key to its development, and managing finance is certainly not a child's play. Keeping all in this mind several institution have come up with unsecured business loan to help budding and existing entrepreneurs. If one is not having the finances at that time, he might well opt for a unsecured business loan which is designed specifically to fulfill urgent business requirements. These loans not only help in expanding a business, but also play a vital role in modernizing and improving small as well as medium scale business. Unsecured business loan is similar to a personal loan, but is specifically designed for business use. With unsecured business loan, you are lent a certain sum of money over a period of years, and the interest rate and monthly payments are fixed over the term. Some unsecured business loan providers offers to short-term finance. In addition, some providers specialize in unsecured business loans, while others focus on start-up business loans for new businesses. Unsecured business loans can help with cash flow, and help to tide you over when times are tough by offering access to short-term finance. Other loans can help you borrow over a longer period - if, for example, you need to pay for one-off business expenses, or to fund expansion plans. Unsecured business loans can prove vital when managing the demands of employees, clients and cash flow for a smaller business. With some types of unsecured business loans, you can set out how much you want to borrow and for how long. Some offer flexible repayment options, while others come with no early repayment fees.

business loan

Get Price Quote

Aleya Financial offers hassle-free business loans with competitive interest rates, quick approvals, and flexible repayment options to empower your business growth.

business loan

Get Price Quote

In need of finance for your business? don’t worry! http:www.ruloans.com is here to solve all your loan related problems. We work with the top banks in mumbai closely and help you find the best business loan interest rates possible. For easy business loan in mumbai choose our services and you will certainly not regret. We take care of everything from checking your business loan eligibility finding the cheapest loans with lowest interest rates and processing fee. We will even help you with the paper work involved in your business loan application process.

business loan

Get Price Quote

Business Loan in Mumbai: Secure Your Venture with Flexible Financing Options.

business loan

Get Price Quote

We’ll help give your business that edge! We are here to provide our precious clients with superb Business Loan solutions. We are a coveted Business Loan Services provider in Maharashtra, India. Whether big or small Business entity, to fuel future growth or to make buoyant projects capital funds are requisite. We will help you decide which type of Business Loan either secure, unsecure, with, or without collateral is suitable for your business. As it is a challenging task, our expert consultation will help you out for sure. We can consult quick Business Loans ranging from Rs. 5 Lakhs to Rs. 50 Lakhs for a possession varying from one to five years. The Interest Rate : Business loans against property in India are provided by banks and NBFC both. In general, the rate of interest charged by banks is relatively lower than that charged by NBFC. These business loans against property are generally taken for the purpose of working capital needs of the business. In some of the cases, the entrepreneur's immovable assets can be offered as collateral against a bank loan for capital expenditure, such as construction of a plant or purchase of new tools and machinery.The Eligibility : Self employed businessmen with an annual turnover of Rs. 2 crore Manufacturers with an annual turnover of Rs. 1 crore Service Providers with an annual turnover of Rs. 50 lakhs If you have been in the business for last three years, without break, showing a cash profit for the past two years. How to Apply : Try a commercial bank, or one you already bank with. You can also apply through the Small Business Administration (SBA). The lender will demand complete documentation of your personal and business financial status, so sit with your CA and put your finances in order before you apply for your loan.Equated Monthly Instalment : EMIs are set on various parameters and you have to sit down and carefully figure out which lender is offering you the best deal, and with what riders and conditions. Should you require it, Creditfina advisers would be happy to assist you in making sense of Creditfina's comparative loan chart for this purpose.The List of Documents : The must-have documents include : I.T.R. of the company for the past two years, company's Balance Sheet and Profit & Loss Account Proof of ownership of Residential or Commercial Property (including Parental Property) in select locations Latest six months current account statement of your firm. Proof of Identity and address proof of yours and the business establishment The Sanctioning Process : If the bank is not convinced about your credentials, your application may get summarily rejected. On the contrary, if your documentation is complete in all respects and satisfactory, it may sanction you the loan, although it may be slightly lower than the amount you have applied for, or what your business may be currently eligible for. The firm's/your repayment capacity will be judged on the basis of your current income, age, qualifications, experience, type of establishment, nature of business (if self employed), to cite a few selection criteria.

business loan

700 - 80,000 Per piece

12 Gram (MOQ)

Excellent news! You have the opportunity to secure a $5,000 and $100 million loan With Broadlands Finance, you may be able to qualify for a personal loan and have it deposited in your account as soon as the next business day. Congrats! Get Started HERE All credit types are considered.

Business Loan Services

Get Price Quote

Doing Business Loan : Digital payments in India are undergoing a revolution. A combination of factors are disrupting the payments landscape, as India.

term loan

Get Price Quote

Secured term loans are loans supported by a collateral. They are available in the form of external commercial borrowings (foreign currency) as well as in indian rupees.

business loan

Get Price Quote

Secured and Unsecured Business loan,Home Loan,Personal Loan, Loan Against Property,NPA Funding

business quick Cash Loan

Get Price Quote

do you need a loan? do you have dreams of setting up a business? do you need money for a business idea you have but need huge funding? do you own a business and want to expand? i am a broker with a linked to high profile investors who are interested and willing to granting loan as debt to fund any projects and to all viable and lucrative sectors with up to 15 years repayment plan with 1 year grace period and also can fund projects from $5 million u.s dollars to $5 billion u.s dollars. if you are looking for personal loan, large investment projects, commercial real estate, small business enterprises and government contracts, etc or if you have a project that needs funding. For details and information, kindly revert to me via e-mail: dariotezon@gmail.com regards. dario montez.

Unsecured Corporate Loans

Get Price Quote

We are Specialised to Arrange Unsecured Loan at Best rate of Interest and Tenure. Quickly Sanction Fast Disbursement.

Business Project Loan Service

Get Price Quote

Our company is rendering Business Project Loan Service. To implement this service, we have selected a skillful team of professionals who hold prosperous acquaintance of this area. Furthermore, we render this service as per the details provided by our honored consumers.

Business Loan / Small Business Loan

Get Price Quote

We manufacture business loan services.

Affordable Business Loans

Get Price Quote

Get an easy commercial business loan (https://www.myfundbucket.com/Business-Loan) in India with MyFundBucket. We provide business loan online.

Business Loan Services

1 - 2 Per metric ton

Business Loan Services, Capital Gain Tax Service

Business Loan Services

Get Price Quote

Recruitment Agency, Recruitment Service, Corporate Training