GST Compliance Service

1,500 - 2,500 Per Company

1 Company (MOQ)

Our GST Compliance Service ensures that your business remains fully compliant with Goods and Services Tax (GST) regulations. We handle all aspects of GST filing, from preparing and submitting GST returns to managing input tax credits and reconciling records. Our team stays updated with the latest tax laws and amendments to help you avoid penalties and maximize tax savings. We also provide guidance on GST registration, tax invoicing, and maintaining proper documentation. With our tailored solutions, you can focus on your business while we take care of your GST compliance needs. Contact us today for hassle-free tax management!

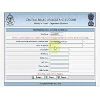

TAN Registration Service

500 - 500 Per Qty

For making Tax deduction or Tax collection at source, remittance of TDS payments and issuance of TDS certificate, Tan registration is required. Tax Deduction and Collection Account Number(TAN) is mandatory for all individuals who either deal in Tax collection at Source(TCS) or are responsible for Tax Deduction at Source(TDS). Our company 21MS Financial Service, Maharashtra provides customers and clients with the best TAN registration services at an affordable price. We are the best legal service platform offering varieties of registration services. We help you in TAN registration from the comfort of your home, offering you services that are very technical and as per individual needs. Get amazing services from our company today. Call us to know more about our registration services.

Looking for Indirect Tax Services Providers

central excise consultancy

100,000 Per Number

Central Excise is an act to consolidate and amend the law relating to central duties of excise on goods manufactured or produced in certain parts of India. Our Central Excise Consultancy Aids In Obtaining Of B1-Bond For Without Payment Of DutyForm CT1 Under B1-BondProof Of ExportsRebate Claims (Refund Of Excise Duty claims)

GST Registration service

1,000 - 2,500 Per per

1 per certificate (MOQ)

"Empower your business with seamless compliance through our GST Registration Service. We simplify the process of obtaining your Goods and Services Tax (GST) registration, ensuring adherence to tax regulations and facilitating smooth operations. Our expert team guides you through the registration process efficiently, handling all paperwork and formalities. Gain access to the vast GST network, unlock input tax credit benefits, and streamline your tax filing procedures. Let us pave the way for your business success with hassle-free GST registration." Documents for Proprietor / Partnership LLP Firm Pan Card of all Directors/Partners/Proprietor/Executive Members of Society/Trust. Aadhar Card of Directors/Partners/Proprietor/Executive Members of Society/Trust Partnership Deed/ Memorandum & Articles of Association Lease Agreement (If Office is Rented) No Objection Certificate (NOC) form Landlord Electricity Bill if Owned Passport Size Photograph Directors/Partners/Proprietor/Executive Members of Society/Trust Bank Statement of Organisation. Mobile No. Directors/Partners/Proprietor/Executive Members of Society/Trust Email Id of Directors/Partners/Proprietor/Executive Members of Society/Trust. Digital Signature Certificate (DSC) of Authorised Signatory Approx. Time: 15 to 30 Working Day.

gst return filing service

Get Price Quote

Our GST Return Filing Service simplifies the process of compliance for businesses. We provide expert assistance in preparing and filing your Goods and Services Tax returns accurately and on time. Our experienced team ensures that all necessary documentation is complete, minimizing the risk of errors and penalties. We offer personalized support tailored to your business needs, helping you navigate complex GST regulations. With our service, you can focus on growing your business while we handle the intricacies of tax filing. Trust us to keep your GST filings in order and compliant with the latest regulations.

professional tax registration

Get Price Quote

Professional Tax Registration Services – LEGAL DALAL At LEGAL DALAL, we offer expert assistance in obtaining Professional Tax Registration, a mandatory requirement for professionals and businesses in India. Ensuring compliance with professional tax regulations is essential for smooth business operations and to avoid penalties. Our Offerings: Consultation Services: We assess your business structure and guide you through the Professional Tax Registration process to ensure compliance. Documentation Assistance: Support in gathering and preparing all necessary documents, including identity proofs, business registration, and employee details. Application Filing: Our team ensures accurate and timely submission of your Professional Tax Registration application, minimizing the risk of delays. Compliance Advisory: Expert guidance on ongoing professional tax obligations, helping you understand your responsibilities as a taxpayer. Timely Updates: Proactive reminders for renewal and filing deadlines to ensure you remain compliant throughout the year. Why Choose LEGAL DALAL? Affordable Pricing: Competitive rates designed to fit your business budget without compromising service quality. Experienced Professionals: In-depth knowledge of professional tax regulations across various states, ensuring a smooth registration process. PAN India Services: Our services are available across all states and union territories. Customer Satisfaction: Trusted by thousands, we maintain a 4.5-star rating on major platforms.

service tax registration services

Get Price Quote

We are one of the leading providers of Service Tax Registration Services. We carry out our operations from Mumbai, Maharashtra, India. These services are precisely rendered by our meritorious professionals, who are well-versed with the latest service tax norms and standards. We thoroughly guide our clients regarding the submission of forms and other related aspects. Our offered services are known for their reliability and timely execution. We offer our Service Tax Registration Services at a pocket-friendly rate.

Professional Tax Registration Services

Get Price Quote

We have carved a niche as a trustworthy Professional Tax Registration Services provider sited in Maharashtra, India. We are equipped with a team of consultants who work in close association with our patrons and aware them with the tricks & deadlines for Professional Tax Registration. With the nominal pricing and timely services, we are highly acknowledged in the market. Clients can feel free to ask their queries anytime. Rely on us and avail our Professional Tax Registration Services.

gst registration

Get Price Quote

What is GST Registration? In the GST regime, businesses whose turnover is more than Rs. 40 lakh* (Rs.10 lakh for North-East and hill states) is required to register as a normal taxable person. This process of registration is called GST registration. For some businesses, registration under GST is mandatory.

Tax Audit services

Get Price Quote

Headquartered in Mumbai (Maharashtra), our firm is engaged in providing excellent tax audit services to the clients. We offer the following tax audit services: Tax Audit as per section 44AB of Income Tax Act, 1961 The chartered accountant conducting the tax audit is required to give his findings, observation, etc., in the form of audit report. The report of tax audit is to be given by the chartered accountant in Form Nos. 3CA/3CB and 3CD. � VAT Audit (Audit as per VAT law) Audit as per Service Tax law GST Audit (Audit as per GST law) Service Tax Audit (Audit as per other tax laws)

income tax returns services

Get Price Quote

Our services with respect to the section of Income Tax Returns Services include Professional Preparation of Taxes Returns, Application of advanced tax planning strategies with timely paper filing reminders of tax returns. Also, we offer the service of tax representation in front of the statutory authorities and designated concierge for corporate groups. Our trained tax professionals offer the most effective service.

gst consultant

Get Price Quote

We are dedicated and professional team to providing Income Tax Return Filing Services in Mumbai and GST Return Filing Solutions help our customers to become profitable. we at Taxcom provide accounting & bookkeeping services as well as, Company formation, outsourcing payroll services in Mumbai

Online GST Registration

Get Price Quote

GST Registration All you need to know about GST Registration GST Registration is applicable on all goods and services except Petroleum products as of now. Goods & Service Tax (GST) is a consolidated tax, meaning that State and Central Indirect taxes have been merged. The entire country currently operates under a uniform tax system. It now replaces service tax, excise, VAT, entertainment tax, luxury tax, octroi, CST, etc. GST Registration Process in India is entirely online. It requires no manual intervention or physical paper submissions. An effortless procedure has been prescribed for GST Registration. Aadhaar Card is mandatory to get GST registration: A new system for new GST registration has been introduced and activated from 21st August 2020, where the Aadhaar card is now mandatory for GST registration. That means the applicant seeking GST registration currently will be given an option to select if he wishes to authenticate Aadhaar or opt for physical verification. If the applicant opts for Aadhaar authentication for his GST registration, they will get their GST registration in just three days.

Tax Audit services

Get Price Quote

Tax auditing is the process of verifying the books of assesses to validate the income tax computation and compliance with income tax laws. Based in Mumbai (Maharashtra, India), we are proficiently providing top-class tax audit services to the clients. Our accountants and auditors make sure that they make proper calculations of your accounts and ensure that it is matching with all the set industry norms. Many clients in Mumbai have taken advantage of our tax audit services. Our Services Include: Audit u/s 44AB of the Income Tax Act, 1961 Compliance with the Income Tax Act and various Rules Preparation of Tax Audit Report

Tax Audit services

Get Price Quote

With a plan to stand tall on all the prospects of our esteemed patrons, we are readily engrossed in offering to our prestigious clients highly reliable Tax Audit Services.These provided services are delivered by some of the skillful, brilliant and most qualified employees in conformism with the defined rules and regulations of service tax. Additionally, these services could be availed from us at hugely reasonable costs as per our clients changed desires.

tax registration services

Get Price Quote

We are the most famous Service Provider of Tax Registration Services from Mumbai, Maharashtra, India. Our organization is engaged in offering premium quality services to the clients. Appreciated for their preciseness, timeliness, and accuracy, our Tax Registration Services are availed by individuals and corporates all over the country. The Tax Registration Services are offered to the esteemed clients at market leading prices.

gst registration

Get Price Quote

GST Registration - If you are in Manufacturing Sector and your annual income is above 40 lakhs, or you are shipping your products from one state to another state, your Ecommerce (Amazon, Flipkart etc) business, Or if you are in the service sector and the annual income is above 20 lakhs, or Input Tax Credit means that you pay GST on the goods or services you buy (Purchase), you want to take Input Tax Credit. basis) means Gst Registration is needed for business, even if the client (customer) is asking for Gst Bill, we can do Gst Registration.

Income Tax Audit services

Get Price Quote

We have a team of experts capable of handling documentation, filling of tax returns and managing diverse taxation needs of clients. Being an Income Tax Audit Service Provider, we understand the need to meet client expectations and work tirelessly to help them through crucial steps. We are reliable and our huge client base can vouch for it. Whoever deems us worthy enough to choose our service, we guarantee not to let them down.

Online GST Registration Services

Get Price Quote

tax audit service

Get Price Quote

We have gained proficiency by providing a superior range of Tax Audit Services. We hire a team of experienced professionals who are experienced in delivering these services. Our zero mistake performance translates into high satisfaction among our clients. All day round, we make our services available. We conduct our services making it hassle free for the clients. Our clients cherish these services for the timely execution of services. For providing our services, we make use of modern techniques and methods.

gst consultant

5,000 - 50,000 Per Per Task

All GST compliances

income tax filing

Get Price Quote

income tax filing, Income Tax Consultants, gst services

Professional Tax PTRC/PTEC

500 Per Bag

1 Pair (MOQ)

A Professional Tax Registration Certificate (PTRC) is a legal document issued by the respective State Government in India to individuals or entities who are liable to pay professional tax. Professional tax is a tax levied by state governments in India on individuals and organizations engaged in certain professions, trades, and employment. It's a form of direct tax that is collected by state governments to fund local government activities and welfare programs. The PTRC is essentially a registration certificate that serves as evidence of a person or entity's liability to pay professional tax. This certificate is typically required to be displayed at the place of business or employment. The rules, rates, and procedures for professional tax registration and payment vary from state to state in India, as professional tax is a state subject.

income tax returns services

Get Price Quote

We are renowned Income Tax Returns Services Service Provider based in Maharashtra, India. The offered Income Tax Returns Services are rendered by skilled and well-qualified financial consultants who are adept in catering to the requirements of our credible clients. In addition, for every certified and officially registered corporation, we provide Filing of Income Tax Returns services to our clients. We work in close coordination with our patrons that helps to attain maximum client satisfaction, thus uphold our market credibility.

audit taxation service

Get Price Quote

Statutory Audit Internal Audit Due Diligience Stock and Debt Audit GST Audit Income Tax Audit Return Filing Income Tax Assessment GST Registration and Filings GST Assessments and Appeals Other Compliances Issues and Resolutions

Vat Registration Services

Get Price Quote

Hemanshu J. Kamdar And Associates is a leading chartered accountancy firm rendering comprehensive professional accounting & vat registration services in India.

gst registration

Get Price Quote

The Goods and Services Tax or GST is an tax which has replaced most of the indirect taxes in India like the VAT, excise duty, services tax, etc. the products and repair Tax Act came into effect on 1st July 2017. GST is levied on the availability of products and services. it’s a comprehensive, multi-stage, destination-based tax that’s levied on every value addition. The GST law is applicable all across India.

GST Compliance

Get Price Quote

GST Registration GST Return Filing Guidance on whether to opt for QRMP scheme or Monthly Return for GST Application for Revocation of GST Registration Submission of Response to Notice by GST Department Maintenance of Books , Registers and Records as per GST Act, 2017

Tax Audit services

Get Price Quote

Tax audit is a crucial part of finance. So, if you are looking for reliable tax audit services then get in touch with C.K.Ghosh & Co. We are supported by a team of chartered accountants, who are backed by years of experience in their jobs. They assist the clients in every possible way and make sure that they stay far from financial troubles. The tax audit service emphasizes on protecting the client’s business from getting harmed by non-compliance, over payments. Our services are reliable and information discretion is promised.

Tax Audit Services

Get Price Quote

Recruitment Agency, Recruitment Service, Corporate Training