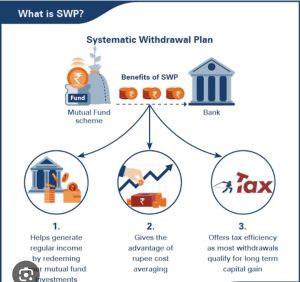

Systematic Withdrawal Plan Services

Get Price Quote

What is SWP (Systematic Withdrawal Plan)? When it comes to liquidating mutual funds, most investors tend to either redeem all the units or simply just a part of their holdings. However, there’s another redemption method that many investors are not aware of - SWP or Systematic Withdrawal Plan. Wondering what the meaning of the Systematic Withdrawal Plan is? Here’s a comprehensive guide explaining the concept, how it works and the various advantages it offers. What Is SWP in a Mutual Fund? Systematic Withdrawal Plan (SWP) is a unique mutual fund redemption method that allows you to withdraw a fixed predetermined amount at specified intervals. Think of it as a Systematic Investment Plan (SIP) but for mutual fund redemption. Investors often use SWP as a way to receive regular income from their mutual fund investments without redeeming them entirely. How Does a SWP Work? Now that you’re aware of what SWP in a mutual fund means, let’s try to understand how it works with the help of a hypothetical example. Assume you invested a lump sum amount of Rs. 5 lakhs in an equity-oriented mutual fund 5 years ago. Currently, the value of your investment is Rs. 7 lakhs. Since you wish to create a steady income stream from your mutual fund investment, you decide to set up a Systematic Withdrawal Plan where you withdraw Rs. 20,000 each month until you completely redeem all of your mutual fund units. On the first day of each month, the SWP determines the number of units that need to be redeemed to fulfill your withdrawal request. The number of units to be redeemed is determined by dividing Rs. 20,000 by the Net Asset Value (NAV) of the mutual fund on the first day of each month. Now, if the NAV of the fund is Rs. 200 on the first day of a month. The SWP will redeem 100 units (Rs. 20,000 ÷ Rs. 200). And if the NAV of the fund rises to Rs. 205 in the subsequent month, the Systematic Withdrawal Plan will redeem 98 units. This process is repeated each month until there are sufficient mutual fund units to redeem. Who Should Consider SWPs? Systematic Withdrawal Plans can be particularly advantageous for the following category of investors. Investors looking to create a steady stream of income to cover their living expenses. Investors who wish to distribute their mutual fund investments to their beneficiaries in a systematic manner. Investors who wish to save tax can use SWP to reduce their overall liability. Investors with specific financial goals like funding a home purchase or their child’s education expenses. Advantages of Systematic Withdrawal Plans As an investor, you not only need to know the meaning of SWP in mutual funds but also be aware of its various benefits. Here’s a quick overview of some crucial benefits Systematic Withdrawal Plans offer. Regular Income Stream By setting up a SWP, you can effectively create a consistent, predictable and regular income stream for yourself irrespective of how the market moves. If you’re fast approaching retirement or are simply looking to supplement your main source of income, opting for a Systematic Withdrawal Plan can be hugely beneficial. Flexibility Another major benefit of SWP is that it is completely flexible and customizable. You get the freedom to choose the redemption amount and the frequency according to your requirements. Most mutual funds offer monthly, quarterly, semi-annual and annual withdrawal frequencies. Tax Savings The gains from your mutual fund investments are subject to either long-term or short-term capital gains tax depending on how long you hold them for. In the case of long-term mutual fund investments, only gains above Rs. 1 lakh are taxed at 10%. By setting up a Systematic Withdrawal Plan, you can ensure that the total amount of gains you get during a year is below the taxable threshold limit of Rs. 1 lakh. This will allow you to bypass long-term capital gains tax entirely. You don’t get such a benefit if you redeem all your mutual fund units at once. Elimination of Market-Timing Timing the market can be very tough and risky due to the unpredictable nature of the stock market. Since Systematic Withdrawal Plans automatically redeem your mutual fund units at predetermined intervals, the need to time your market exit doesn’t arise.

stock sip service

Get Price Quote

Learn the Advantages of Algo Trading at Bigul and its purpose. Execute Algorithmic Strategies to achieve your efficiently customized trading goals at Bigul

Looking for Investment Planning Services Providers

Affordable Investment Plan Service

Get Price Quote

We are the leading service provider in Mumbai, Maharashtra, India and providing Affordable Investment Plan Service to our valuable customers. A survey usually originates when an individual or institution is confronted with a business problem and the existing data are insufficient. At this point, it is important to consider if the required information can be collected by a survey. If you need input from a number of people, must get results quickly, and need specific information to support business decisions, then a survey is the most appropriate technique.Many studies start with a general hope that something interesting will emerge, and often end in frustration. A careful survey plan will help you focus your project, while guiding your implementation and analysis so the survey research is finished quicker. You can then concentrate on implementing well-supported decisions. A well-designed plan answers the following questions: QuestionsBenefits What will be learned?Generate data that answers the business questions you have How long will it take?Keep the survey project focused and on schedule How much will it cost?Anticipate direct and indirect project costs You can only answer these questions if you draft a plan prior to implementing your survey. Hence, an integral part of a well executed and a successful survey is the "planning quality."

investment planning services

Get Price Quote

You are unique, and so is your wealth. For quite some time, we have been by your side as one of the renowned investment companies in Mumbai & Delhi, protecting what you have and developing it. We offer our experience and expertise in to help you unearth quality stocks, which are uniquely positioned for growth. Position your wealth for growth with us. The expertise and in-depth research of our team gives us a profound edge over our competitors when it comes to identifying those few stocks which have the potential for unparalleled growth over the next few years. Our team tracks the fundamental factors of the entire universe of NSE & BSE for stocks investments, strives to generate 4-6 'Wealth Multiplier' stocks ideas over 18-month period. We also aspire to provide you services in portfolio management as one of the best investment companies in Delhi & Mumbai. We understand that your wealth deserves special attention. We are here to deliver. 100% target return call in 1.5 - 2 years 4-6 multi-bagger stocks ideas in a year Full guidance regarding entry and exit on every call. Recommendations via SMS & Email both on real-time. Research reports and updates via email Support on your invested portfolio. Global market update

investment insurance plans

Get Price Quote

investment insurance plans, term insurance, term insurance

investment planning

Get Price Quote

investment planning, Finance Services, investment advisory

investment planning services

Get Price Quote

investment planning services, Finance Administration Services

investment planning

Get Price Quote

investment planning

investment planning services

Get Price Quote

investment planning services, sales tax services, Registration Services

investment planning

Get Price Quote

investment planning

Systematic Investment Plan

Get Price Quote

Systematic Investment Plan, Mutual Fund Schemes Service

investment planning services

Get Price Quote

investment planning services

investment planning

Get Price Quote

investment planning, Financial Consultant, Financial Services

investment planning

Get Price Quote

investment planning, finance planning, tax planning service

investment planning services

Get Price Quote

investment planning services, financial planning service

Gold Investment Plan

Get Price Quote

Gold Investment Plan, Nri Services

investment planning services

Get Price Quote

investment planning services, services tax, tax preparation services

investment planning services

Get Price Quote

investment planning services, Financial Services, Income Tax Consultant