investment management service

Get Price Quote

Whenever you think of making investment, three things should come on top of your mind – Risk Profiling, Products and Asset Allocation. Along with these – cash-flow situations, investments already made, net-worth and are equally important to consider before deciding where should your hard-earned money get invested into. RISK PROFILING – Knowing ourselves well is more important than choosing products first. Risk Profiling helps in doing that. By carefully answering a well-researched set of questionnaires, your risk appetite can be known. This may not remain constant forever with changing dynamics of micro and macro-economic factors. Hence, it is important to go back and re-assess after regular interval. PRODUCTS – There are many investment products available in the market. The first check should always be that the product must be regulated by a govt. appointed regulatory body. Next, you must consider the suitability. All products are good in their own context and with a certain section of investors. Whether the same suits you or not, depends on your risk profile, investment horizon, liquidity needs and taxation aspect. Also, there are certain products which cater only to a particular section of society, e.g. resident individuals, senior citizens, girl child etc. ASSET ALLOCATION – We should not put all eggs in one basket i.e. not all our money in one single investment product or category. Distributing our investments into poorly correlated asset classes often saves us from big losses and is expected to generate a steady return. Asset allocation must be re-aligned or re-allocated at regular intervals. There are investment products available which aim to inculcate this very principle of asset allocation in the way they are managed. Otherwise, custom asset allocation can always be done.

Affordable Investment Plan Service

Get Price Quote

We are the leading service provider in Mumbai, Maharashtra, India and providing Affordable Investment Plan Service to our valuable customers. A survey usually originates when an individual or institution is confronted with a business problem and the existing data are insufficient. At this point, it is important to consider if the required information can be collected by a survey. If you need input from a number of people, must get results quickly, and need specific information to support business decisions, then a survey is the most appropriate technique.Many studies start with a general hope that something interesting will emerge, and often end in frustration. A careful survey plan will help you focus your project, while guiding your implementation and analysis so the survey research is finished quicker. You can then concentrate on implementing well-supported decisions. A well-designed plan answers the following questions: QuestionsBenefits What will be learned?Generate data that answers the business questions you have How long will it take?Keep the survey project focused and on schedule How much will it cost?Anticipate direct and indirect project costs You can only answer these questions if you draft a plan prior to implementing your survey. Hence, an integral part of a well executed and a successful survey is the "planning quality."

Looking for Investment Service Providers

National Pension System Service

Get Price Quote

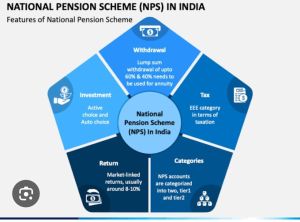

NPS INVESTMENT--- The National Pension System (NPS) is a retirement savings plan that allows individuals to contribute to their pension account while they are working. The goal is to build a pension fund that can provide a regular income after retirement. Here are some things to know about NPS: Eligibility NPS is available to all Indian citizens between the ages of 18 and 70, including those living abroad. It is mandatory for Central Government employees who started working on or after January 1, 2004, with some exceptions. Many State Governments have also adopted NPS for their employees. Contributions Individuals can contribute to their NPS account, and their employer can also contribute on their behalf. Account opening When an individual opens an NPS account, they receive a unique Permanent Retirement Account Number (PRAN). Withdrawals Individuals can make partial withdrawals from their NPS account up to three times during the account's lifetime. They can withdraw up to 25% of their contributions at any time, excluding employer contributions. Phased withdrawals Subscribers can choose to withdraw their lump sum amount in phases over a period from age 60 to 75. Tax efficiency NPS is a tax-efficient way to save for retirement. Risk tolerance NPS may be a good option for people who are willing to take moderate risks and seek higher returns.

National Pension System Service

Get Price Quote

Recruitment Agency, Corporate Training

Investment Services

Get Price Quote

Investment Services, Income Tax Services, sales tax consultants services

investment insurance plans

Get Price Quote

investment insurance plans, term insurance, term insurance

Pre -Investment

Get Price Quote

Pre -Investment, Fund Syndication, Investigation And Special Audit

Finance Investment

Get Price Quote

Finance Investment, India Market Entry Strategy, executive search

Real Estate Investments

Get Price Quote

Real Estate Investments, commercial real estate services, Real Estate Rental

Investment Services

Get Price Quote

Investment Services, Barbed Wire, chain link wirerazor barbed wire

Investment Services

Get Price Quote

Investment Services, Life Insurance Services

investment consultant services

Get Price Quote

investment consultant services

Smallcase, Liquiloans

Get Price Quote

Smallcase, Liquiloans, Insurance Life & General, Bonds, Fixed Deposits

investments

Get Price Quote

investments

investment advisory services

Get Price Quote

investment advisory services

Commercial Investment Service

Get Price Quote

Commercial Investment Service

Investment Grade Energy Audit Services

Get Price Quote

Investment Grade Energy Audit Services, Cable Insulation Kits, Light Socket

Gold Investments Service

Get Price Quote

Gold Investments Service