Majic Toilet Cleaner

100 Bottle (MOQ)

Brand Name : Majic

Color : Blue

Form : Liquid

Usage : Cleaning Toilet

Packaging Type : Plastic Bottle

Packaging Size : 1ltr

Country of Origin : India

Speaciality : Removes Hard Stains, Keeps Clean & Fresh

...more

Majic Surface Cleaner

100 Bottle (MOQ)

Brand Name : Majic

Color : Pink

Form : Liquid

Application : Cleaning Use

Feature : Remove Tough Stain

Packaging Type : Plastic Bottle

Packaging Size : 1ltr

Type : Surface Cleaner

Country of Origin : India

...more

majic organic liquid detergent

100 Bottle (MOQ)

Brand Name : Majic

Form : Liquid

Application : Cleaning Use

Feature : Eco-friendly, Remove Hard Stains

Packaging Type : Plastic Bottle

Country of Origin : India

...more

Majic Organic Multi Surface Cleaner

Brand Name : Majic

Form : Liquid

Application : Cleaning Use

Packaging Type : Plastic Bottle

Country of Origin : India

Feature : Remove Tough Stain

...more

Majic Neemly Floor Cleaner

100 Bottle (MOQ)

Brand Name : Majic

Form : Liquid

Application : Floor Cleaning

Feature : Gives Shining, Remove Germs

Packaging Type : Plastic Bottle

Type : Floor Cleaner

Country of Origin : India

...more

Majic Hand Wash Liquid

100 Bottle (MOQ)

Fragrance : Lavender

Packaging Size : 250ml

Brand Name : Majic

Packaging Type : Plastic Bottle

Form : Liquid

Country of Origin : India

...more

Majic Glass Cleaner

100 Bottle (MOQ)

Brand Name : Majic

Color : Blue

Form : Liquid

Application : Glass Clening

Packaging Type : Plastic Bottle

Packaging Size : 500ml

Country of Origin : India

...more

Majic Dishwash Gel

100 Bottle (MOQ)

Brand Name : Majic

Color : Orange

Form : Gel

Packaging Type : Plastic Bottle

Country of Origin : India

...more

Majic Car Wash Gel

100 Bottle (MOQ)

Brand Name : Majic

Form : Gel

Application : Car Use

Feature : Nice Fragrance, Shining

Packaging Type : Plastic Bottle

Country of Origin : India

...more

Majic Car Dashboard Polish

100 Bottle (MOQ)

Brand Name : Majic

Form : Liquid

Application : Car Polishing

Feature : Easy To Use, Shiny

Packaging Type : Plastic Bottle

Country of Origin : India

...more

Magic Organic Air Surface Spray

100 Bottle (MOQ)

Application : Hospitals, Gym and corporate offices

Country of Origin : India

Packaging Type : Bottle

...more

Majic Neel Detergent Liquid

100 Bottle (MOQ)

Brand Name : Majic

Color : Blue

Form : Liquid

Application : Cleaning Use

Feature : Remove Hard Stains, Skin Friendly

Packaging Type : Plastic Bottle

Packaging Size : 400ml

Country of Origin : India

...more

term insurance plan service

Term insurance is a type of life insurance that offers financial protection for specific period of time, or term, in exchange for a fixed premium. If the insured dies during the policy term, the benefit is paid to the beneficiary. Here are some things to consider about term insurance: Policy term Term insurance policies can be for 10, 20, or 30 years. Premium payment Premiums can be paid at once or regularly for the entire policy term or for a limited period. Policy types There are different types of term insurance plans, including level, increasing, and decreasing term plans. Policy benefits Some policies offer benefits like terminal illness benefit and permanent disability waiver. Tax benefits Some policies offer tax benefits on premiums paid and tax-free claims payout and returns. Policy renewal If a policyholder renews their policy after the initial term, the premiums will be higher based on their current age. Guaranteed re-insurability Some policies offer guaranteed re-insurability, but these features may cost more.

...more

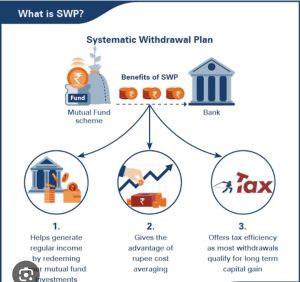

Systematic Withdrawal Plan Services

What is SWP (Systematic Withdrawal Plan)? When it comes to liquidating mutual funds, most investors tend to either redeem all the units or simply just a part of their holdings. However, there’s another redemption method that many investors are not aware of - SWP or Systematic Withdrawal Plan. Wondering what the meaning of the Systematic Withdrawal Plan is? Here’s a comprehensive guide explaining the concept, how it works and the various advantages it offers. What Is SWP in a Mutual Fund? Systematic Withdrawal Plan (SWP) is a unique mutual fund redemption method that allows you to withdraw a fixed predetermined amount at specified intervals. Think of it as a Systematic Investment Plan (SIP) but for mutual fund redemption. Investors often use SWP as a way to receive regular income from their mutual fund investments without redeeming them entirely. How Does a SWP Work? Now that you’re aware of what SWP in a mutual fund means, let’s try to understand how it works with the help of a hypothetical example. Assume you invested a lump sum amount of Rs. 5 lakhs in an equity-oriented mutual fund 5 years ago. Currently, the value of your investment is Rs. 7 lakhs. Since you wish to create a steady income stream from your mutual fund investment, you decide to set up a Systematic Withdrawal Plan where you withdraw Rs. 20,000 each month until you completely redeem all of your mutual fund units. On the first day of each month, the SWP determines the number of units that need to be redeemed to fulfill your withdrawal request. The number of units to be redeemed is determined by dividing Rs. 20,000 by the Net Asset Value (NAV) of the mutual fund on the first day of each month. Now, if the NAV of the fund is Rs. 200 on the first day of a month. The SWP will redeem 100 units (Rs. 20,000 ÷ Rs. 200). And if the NAV of the fund rises to Rs. 205 in the subsequent month, the Systematic Withdrawal Plan will redeem 98 units. This process is repeated each month until there are sufficient mutual fund units to redeem. Who Should Consider SWPs? Systematic Withdrawal Plans can be particularly advantageous for the following category of investors. Investors looking to create a steady stream of income to cover their living expenses. Investors who wish to distribute their mutual fund investments to their beneficiaries in a systematic manner. Investors who wish to save tax can use SWP to reduce their overall liability. Investors with specific financial goals like funding a home purchase or their child’s education expenses. Advantages of Systematic Withdrawal Plans As an investor, you not only need to know the meaning of SWP in mutual funds but also be aware of its various benefits. Here’s a quick overview of some crucial benefits Systematic Withdrawal Plans offer. Regular Income Stream By setting up a SWP, you can effectively create a consistent, predictable and regular income stream for yourself irrespective of how the market moves. If you’re fast approaching retirement or are simply looking to supplement your main source of income, opting for a Systematic Withdrawal Plan can be hugely beneficial. Flexibility Another major benefit of SWP is that it is completely flexible and customizable. You get the freedom to choose the redemption amount and the frequency according to your requirements. Most mutual funds offer monthly, quarterly, semi-annual and annual withdrawal frequencies. Tax Savings The gains from your mutual fund investments are subject to either long-term or short-term capital gains tax depending on how long you hold them for. In the case of long-term mutual fund investments, only gains above Rs. 1 lakh are taxed at 10%. By setting up a Systematic Withdrawal Plan, you can ensure that the total amount of gains you get during a year is below the taxable threshold limit of Rs. 1 lakh. This will allow you to bypass long-term capital gains tax entirely. You don’t get such a benefit if you redeem all your mutual fund units at once. Elimination of Market-Timing Timing the market can be very tough and risky due to the unpredictable nature of the stock market. Since Systematic Withdrawal Plans automatically redeem your mutual fund units at predetermined intervals, the need to time your market exit doesn’t arise.

...more

sip investment service

What is SIP (Systematic Investment Plan) ? Systematic Investment Plan, commonly known as SIP is an investing channel initiated by Mutual Funds, under which one can invest a fixed amount at predetermined time intervals in Mutual Fund Scheme. Such an amount is generally invested every month, but it could be invested once a week, once in a quarter, half-yearly, or even annually. The system of SIP can be easily understood as a recurring deposit under which a certain fixed amount is deposited on a specific date for a predetermined time period.

...more

portfolio management service

Portfolio Management Services (PMS) involve professional management of investment portfolios tailored to individual client goals and risk tolerance. These services include asset allocation, security selection, and ongoing portfolio monitoring, ensuring that investments align with the client's financial objectives. PMS can be actively or passively managed, providing flexibility in strategy and execution. Clients benefit from expert insights and personalized strategies, allowing for potential enhanced returns and risk mitigation. Overall, PMS aims to optimize investment performance while aligning with the client’s long-term financial aspirations.

...more

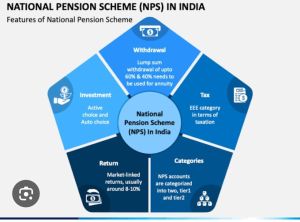

National Pension System Service

NPS INVESTMENT--- The National Pension System (NPS) is a retirement savings plan that allows individuals to contribute to their pension account while they are working. The goal is to build a pension fund that can provide a regular income after retirement. Here are some things to know about NPS: Eligibility NPS is available to all Indian citizens between the ages of 18 and 70, including those living abroad. It is mandatory for Central Government employees who started working on or after January 1, 2004, with some exceptions. Many State Governments have also adopted NPS for their employees. Contributions Individuals can contribute to their NPS account, and their employer can also contribute on their behalf. Account opening When an individual opens an NPS account, they receive a unique Permanent Retirement Account Number (PRAN). Withdrawals Individuals can make partial withdrawals from their NPS account up to three times during the account's lifetime. They can withdraw up to 25% of their contributions at any time, excluding employer contributions. Phased withdrawals Subscribers can choose to withdraw their lump sum amount in phases over a period from age 60 to 75. Tax efficiency NPS is a tax-efficient way to save for retirement. Risk tolerance NPS may be a good option for people who are willing to take moderate risks and seek higher returns.

...more

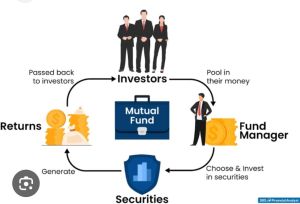

mutual fund service

A mutual fund is a pool of money collected from many individual investors and companies in order to invest in various types of assets. A professional portfolio manager is hired to invest the capital in a portfolio of securities. In the end, any gains are passed down to the investors on a pro-rata basis. Unlike stocks, mutual funds represent an investment in many different stocks instead of just one holding. It can be compared to buying a part of a portfolio’s value.

...more

mutual fund

Lumpsum Investment Plan Service

A lump sum investment in a mutual fund is when an investor invests a large amount of money in a single transaction. This is different from a Systematic Investment Plan (SIP), where an investor invests a fixed amount of money at regular intervals. Lump sum investment Systematic Investment Plan (SIP) Investment strategy Invest a large amount of money at once Invest a fixed amount of money regularly When to consider When you have a large amount of money to invest, such as from an inheritance, bonus, or gift To build a corpus for retirement Suitability Ideal for long-term investment, and for investors who are comfortable with higher risk Helps avoid timing the market Lump sum investments are popular with big-ticket investors and HNIs. They can be a good way to take advantage of potential market growth, but they're not suitable for short-term investments. You can use an online mutual fund lump sum calculator to estimate the returns on your investment.

...more

health insurance service

Healthcare expenses are increasing at a rate higher than medical inflation, and that is why it is must for everyone to have a health insurance cover which not only helps you to save your emergency funds and saving of lifetime, in case any medical emergency occurs to you or your near and dear ones, but also supports you to deal with rising medical costs. Experts believe that a health insurance policy must be a part of your financial planning and it should be purchased early when you are young and responsible to stay safe and secured. Investing in a health insurance plan at an early age also provides other numerous advantages such as better sum insurance coverage, lower premium rates, no medical tests and so on. Here’s a guide which explains clearly all about health insurance policy , factors affecting health insurance, what are the different kinds of health plan which one can opt for and much more. Featured Partners 1 Manipal Cigna Health Insurance Sum Insured INR 3 Lakhs to INR 1 Crore Features Cashless cover up to INR 50,000/year for pharmacy, consultations, diagnostics, etc. Benefits Get air ambulance cover up to INR 10 lakhs and choice of any room category. Buy Now On Manipal Cigna's Secure Website 2 Aditya Birla Activ Health Insurance Sum Insured INR 2 lakh to INR 2 crore Network Hospitals 9,000+ Early Bird Discount 5% discount from 4th to 7th policy year Buy Now On Aditya Birla's secure website 3 Care Health Insurance Cashless Providers 24800+ healthcare providers Benefits Tax benefits under section 80D Features 24*7 claim and customer support Buy Now On Care Health Insurance's Secure Website. What Is Health Insurance: Health Insurance Meaning Health insurance policy is an assurance which provides immediate financial help in case when any medical emergency arises. It is a contract between a policyholder and the insurance company which covers medical expenses that might occur due to illness, injury or accident. If you have a health insurance policy, then some or all the medical expenses will be borne by the insurance company, against which an insured is supposed to pay a certain amount known as premium. There are two ways by which which the insurance company compensate for your medical expenses: Cashless Treatment: Here, the policyholder is not supposed to pay anything to the network hospital. As the insurance company pays the hospital directly. Reimbursement: Here, the policyholder is supposed to settle their medical expenses first and later ask for reimbursement from the insurance company. Why Should I Have A Health Insurance Policy? Purchasing a health insurance plan is something that we all avoid till the time we understand its importance. Before buying one, it is crucial to understand the various benefits of a health insurance plan as medical emergencies can knock anytime and could make a big hole in your pocket. Therefore, it is advisable to buy a health insurance policy at a very young age, where one can have the comprehensive coverage at an affordable premium cost, plus you also get the advantage of tax deductions on premium paid. In a nutshell, one should purchase a health insurance policy because: It facilitates you to get superior medical treatment without any worry of high medical costs. Offers specialized coverage for critical illnesses. Covers road emergency ambulance costs. Offers an affordable premium for youngsters. Provides cashless claim benefit, which allows you to take care of your health instead of worrying about hefty medical bills. Protect your savings during medical emergencies. Provides tax benefits under Section 80D. Lastly, it safeguards you and your family and protects your savings. Read More: Best Health Insurance Policy in India Types Of Health Insurance Policies There are basically two kinds of health insurance policies such as individual or self-plan and family floater policy. As the name suggests, individual policy would only provide coverage and benefits to the main policyholder. On the other hand, in case of a family floater plan, there is only one plan which provides coverage to your entire family such as spouse, dependent children, parent and parent-in-laws or dependent siblings. One should select the plan, depending upon the factors such as your age, family medical history, children’s age, medical history and of course one’s budget. Let’s understand about each of these plans in detail: Individual or Self Health Insurance Plan An individual health insurance policy is issued under the name of a single policyholder, which means that the sum insured coverage and the benefits of the policy is totally dedicated to the insured and covers no one else. Here, the individual purchases the policy to maintain their own health which in turn provides financial help in case of their own medical emergency. Family Floater Health Insurance Plan Family floater health insurance is one policy which aims to provide sum insured coverage to individual and as well his family members. Rather than taking a single policy for each member of the family, the family health insurance plan is a better option, as it acts as an umbrella for the entire family. Here the sum assured coverage is shared by all the members who have been covered under the same plan. However, it is advisable to have a separate plan for your senior citizen parent or parent-in-laws as it will prove to be a more affordable option. Similarly, if any member in the family has a huge medical history, then it is also better to buy a separate plan for them rather than covering them in the family floater plan. Factors To Consider Before Deciding On A Health Insurance Plan Step 1: Finding the Right Insurance Company Here are some factors that you can use in deciding on the right health insurance company – 1. The Range of Plans Offered Check out the different types of plans that a company offers as well as the plan USPs. Some companies offer a range of products to suit the varied coverage requirements that you have. Choose a company with a diverse range of plans so that you can find the right policy suiting your needs. 2. The Network of Hospitals The network of hospitals is extremely important for availing cashless claims. The wider the network that an insurer has, the better it would be. This would allow you to locate the nearest cashless hospital with ease. 3. Claim Settlement Ratio The claim settlement ratio points to one thing – what percentage of claims did the company settle in a financial year. A higher ratio indicates that the company is steadfast in settling its claims. A factor that works in favor of the insurer. 4. Claim-Based Loading Some companies tend to increase the renewal premium if you made claims in the previous years. This converts to higher premium expenses. As such, avoid companies that follow this practice. 5. Premium Rate Pricing policy is how much premium the company charges vis-à-vis its competitors. You can check the pricing policy by comparing similar plans across different companies. For instance, the Aarogya Sanjeevani policy offers uniform coverage features across all insurers. Its premiums, however, depend on the insurer’s pricing policy. Compare the premium of the plan across insurers to find the insurer that charges the least. Chances are, its pricing policy would be fair across all its plans. 6. Ease of Claim Settlement Insurers have revolutionized their claim process and made it simpler. The following concepts are gaining traction: AI-enabled claim processing WhatsApp intimation Digital documentation Quicker approvals App-based claim intimation and tracking, etc. Such facilities speed up the claim process and make it hassle-free. Thus, look for insurers that provide such facilities for quicker claim settlements. 7. Reviews Lastly, don’t ignore customer testimonials and reviews. Most insurers showcase their customers’ reviews on their websites. You can check them out. Alternatively, you can talk to your friends and relatives about their insurers. If they have made a claim, find out their claim experience to know which company follows the best practices. Featured Partners 1 Manipal Cigna Health Insurance Sum Insured INR 3 Lakhs to INR 1 Crore Features Cashless cover up to INR 50,000/year for pharmacy, consultations, diagnostics, etc. Benefits Get air ambulance cover up to INR 10 lakhs and choice of any room category. Buy Now On Manipal Cigna's Secure Website 2 Aditya Birla Activ Health Insurance Sum Insured INR 2 lakh to INR 2 crore Network Hospitals 9,000+ Early Bird Discount 5% discount from 4th to 7th policy year Buy Now On Aditya Birla's secure website 3 Care Health Insurance Cashless Providers 24800+ healthcare providers Benefits Tax benefits under section 80D Features 24*7 claim and customer support Buy Now On Care Health Insurance's Secure Website. Step 2: Finding the right plan Once you have zeroed in on the right insurance company, the next, and also the most important, step would be to select the plan. With multiple insurers offering multiple plans, you have a lot of choices. However, choosing the right policy is important. As such, here are some factors that would help you with the same – 1. Coverage benefits The first thing that you need to check is the coverage benefits that are offered by different plans. While most plans offer the basic coverage benefits, look for plans that have unique features. First, assess your coverage needs and then look for plans that offer those. For instance, if you are planning to have a child in the near future, look for plans that offer maternity coverage. Alternatively, if your family is complete, skip such plans. Second, look for other additional features that might enhance the scope of coverage. For instance, sum insured restoration, high no claim bonus, value-added benefits, annual health check-ups, etc. are some of the features to look for. Choose a plan which has the most comprehensive scope of coverage. This would minimize your out-of-pocket expenses during claims and give you better financial security. 2. Customization option Look for plans that allow you to customize the coverage features as per your requirements. This is possible through add-ons that health insurance plans offer. The add-ons help you to opt for additional coverage features as per your needs and make customization possible. 3. Premium Amount Of course, the premium amount is important. Check the premium charged vis-à-vis the coverage offered. To get a better idea, compare. Compare the premium across other plans of different insurers that have similar coverage benefits. See if the premium is competitive or inflated given the coverage. Choose a plan with the most competitive premium rate for the same coverage benefits, even if it means selecting another insurance company. 4. Sub-Limits Health plans might have sub-limits on different expenses like room rent, ICU room rent, AYUSH coverage, domiciliary treatments, etc. These sub-limits limit the scope of coverage and might result in out-of-pocket expenses. As such, choose a policy that has no sub-limits so that you can enjoy the maximum possible coverage. 5. Co-Payment Clause Health insurance plans might have co-payment clauses for different reasons. Co-payments mean that in every instance of a claim, you are supposed to pay the specified part of the claim from your pockets. For instance, a co-payment of 10% means that 10% of every claim would be borne by you. Common co-payment clauses are applicable in the following instances: If the insured is aged 61 years and above at the time of buying the policy If you buy the policy in a city belonging to a lower Tier and avail of treatments in a city in a higher tier In the case of specified illnesses and/or treatments Look for health insurance plans that do not have the co-payment clause. Even if the clause is unavoidable, like in the case of senior citizen plans, opt for plans with a lower co-payment rate. 6. Waiting Period The waiting period is when specific coverage is not allowed by the health insurance policy. Once the waiting period is over, coverage is allowed. Health insurance plans impose waiting periods in various instances. These include the following: First 30 or 60-day waiting period for the coverage of illnesses. This is also called the cooling-off period during which illnesses are not covered. Accidental injuries, however, are covered from day 1. Waiting period for specific illnesses or treatments like hernia, fissures, hydrocele, tonsillectomy, cataract, joint replacement, etc. This waiting period is generally 24 months. In some plans, however, the tenure might vary. Pre-existing waiting period ranges from 12 months to 48 months. This waiting period is for illnesses or medical conditions that you might have when buying a fresh policy. Complications arising out of existing conditions are not covered during this period. The maternity waiting period might range from 9 months to 48 months. Waiting period for the coverage of OPD expenses, bariatric treatments, etc. Waiting periods are inevitable. However, you can find a plan where the period is low. This is especially relevant if you are looking for maternity coverage or if you have pre-existing conditions and you want coverage for them at the earliest. 7. Discounts Available Health insurance plans allow various types of discounts to lure customers. Some of the commonly available discounts include the following: Discount for buying a two or three-year policy Discount for covering two or more members under the policy on an individual basis Discount for buying the policy online Discount for paying the premium in a lump sum rather than in installments Discount for the existing customers of the company Discount for maintaining a healthy lifestyle Renewal discount if you have not made a claim in the last policy year Discount for choosing a voluntary deductible Discount for availing of treatments at a network hospital Look for the available discounts. Choose a plan that offers the highest discount so that you can get the best deal on the premium. Now that you have found the best company and the most suitable plan, you might think that your work is done. It is not. You should keep in mind another aspect – choosing the right sum insured. Step 3: How To Find the Right Coverage Amount? An optimal sum insured is important to ensure that your health plan sufficiently covers your medical expenses. A low sum insured defeats the whole purpose of investing in health insurance and is a strict no-no. Selecting the right sum insured is easier than you think. You just have to consider the following factors: The number of members being insured under the policy Whether you or any other member suffers from any pre-existing condition The basic cost of hospitalization and medical treatments The rising medical inflation Most insurers help you calculate the ideal sum insured based on your income, expenses, existing coverage and members to be insured. You can also estimate the optimal requirement through a simple formula which is as follows: Sum insured = 50% of your annual income + total hospitalization costs incurred during the last 3 years For instance, say your annual income is INR 15 lakh and in the last three years you have incurred a hospital bill of INR 5 lakh. In this case, the optimal sum insured would be calculated as follows: 50% of INR 15 lakh + INR 5 lakh = INR 12.5 lakh Step 4: How To Afford a Health Plan The premiums of health insurance plans are affordable. Moreover, insurers offer you the facility of installment premiums wherein you can pay the premium monthly, quarterly or half-yearly. This makes the health plans affordable. Furthermore, if affording a high sum insured poses a challenge, you can opt for super top-up health plans. Super top-up plans help in enhancing the coverage while keeping the premium low.For instance, say you want coverage of INR 15 lakh but the premiums are unaffordable. In such cases, you can opt for a comprehensive health plan of INR 5 lakh or INR 10 lakh and add a super top-up plan of INR 10 lakh or INR 5 lakh respectively. The super top-up plan would help you enjoy an aggregate coverage of INR 15 lakh. However, the aggregate premium would be lower compared to buying a health plan of INR 15 lakh. How To Purchase A Health Insurance Policy Online? The simplest way to purchase a health insurance policy via online mode which can be done in minutes with a paperless process and no physical signatures. All you have to get is full detailed information on various health policies as per your needs and requirements. Review the best health insurance policies and compare them further and as per your needs and requirements to finally select the best one. Research them online to know more about the coverage, benefits and premium quotes at your convenient place and time. Once you have finalized the policy, read the policy document carefully and complete the documentation process. Once the documents have been uploaded, it is the time to make the final payment which can be done by credit card, debit card or by net banking. Insurance companies generally take seven to ten days to complete the full process and then handover the policy document to you. Things To Avoid While Buying A Health Insurance Policy Rushed Into Buying A Policy : Do not buy a health insurance plan in hurry. It is advisable to do proper research and then select the best health insurance for you or for your family. You can do your own research and compare the premium quotes online, before choosing a health insurance policy. Choosing Insufficient Coverage: The premium cost is a major consideration while buying a health plan. Do not choose insufficient or restricted policy coverage in order to save premium cost. Rather go for a comprehensive coverage plan with considering the family size, medical history and your financial situation. Hiding Health-Related Details: While purchasing a health insurance plan, disclose all the necessary details about your health, lifestyle habits or and pre-existing diseases. Hiding relevant medical history can cause major damage as insurance claims can be rejected on the basis of undisclosed medical information. Not Buying A Separate Health Insurance Policy: Do not rely completely on medical coverage provided by your employers as it has only limited coverage. Also, when you leave the organization, the contract will be terminated on an immediate basis. It is crucial to buy a separate health insurance plan where the quantum of coverage is more and it will not be affected by the terms and conditions of your current employment. Ignoring Terms And Conditions Of The Policy Document: Do not ignore or overlook the terms and conditions of the policy document. Whether it is related to coverage, premium costs, renewability conditions, discounts, sub-limits, free-look period, waiting period, co-payment clause or any sort of deductibles, everything is clearly mentioned in your policy document. If you still have any doubts, do not hesitate to reach the concerned insurance company for more clarity on your health insurance policy. Buying A Policy For Just Saving Tax: Do not buy a health insurance policy just for the sake of saving tax on the premium paid. One should definitely know the tax benefits provided under health insurance premium paid, but the main aim of buying a health insurance plan is to get sufficient coverage which would financially help you and your family at the time of medical and health contingencies. Featured Partners 1 Manipal Cigna Health Insurance Sum Insured INR 3 Lakhs to INR 1 Crore Features Cashless cover up to INR 50,000/year for pharmacy, consultations, diagnostics, etc. Benefits Get air ambulance cover up to INR 10 lakhs and choice of any room category. Buy Now On Manipal Cigna's Secure Website 2 Aditya Birla Activ Health Insurance Sum Insured INR 2 lakh to INR 2 crore Network Hospitals 9,000+ Early Bird Discount 5% discount from 4th to 7th policy year Buy Now On Aditya Birla's secure website 3 Care Health Insurance Cashless Providers 24800+ healthcare providers Benefits Tax benefits under section 80D Features 24*7 claim and customer support Buy Now On Care Health Insurance's Secure Website. Frequently Asked Questions (FAQs) What is waiting period in health insurance? Waiting period is a very important factor in purchasing a health insurance policy. It refers to a duration which the insured has to wait for claiming the insurance benefits. It varies from one health policy to another. How long is health insurance valid? What happens if you forget to pay your health insurance premiums? Can I take multiple health insurance policies? Can we add family member in existing health insurance? What is the best age to buy health insurance in India? Information provided on Forbes Advisor is for educational purposes only. Your financial situation is unique and the products and services we review may not be right for your circumstances. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. Performance information may have changed since the time of publication. Past performance is not indicative of future results. Forbes Advisor adheres to strict editorial integrity standards. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are the author’s alone and have not been provided, approved, or otherwise endorsed by our partners.

...more

Health Insurance

Fixed Deposits And Bond Service

What are Governments bonds? When you lend money to the government in exchange for an agreed-upon interest rate, the transaction is known as a government bond or G-sec. They are frequently thought of as one of the safest asset classes. How do they operate, though? When you purchase a government bond, you are lending money to the government, which will utilize the funds raised to finance infrastructure or project development. The bond coupon specifies the frequency of the government’s fixed interest rate payments in return. The bond will keep making these payments until its maturity date, at which point it will expire and you will receive your initial investment back. From one year to 30 years or more, there are several maturities. Types of Government Bonds Indian Government issues several bonds in order to execute various projects. What is the Difference Between Corporate Bond and Government Bond? a. Treasury Bills (T-bills) The central government of India issues treasury bills, often known as T-bills, which are short-term government securities with a maturity of less than a year. Short-term financial instruments known as Treasury Bills come in three varieties: 1) 91 days 2) 182 days 3) 364 days Treasury bills are zero coupon securities and do not pay interest, although a number of financial instruments do. They are instead issued at a discount and redeemed at face value when they reach maturity. For instance, a 91-day Treasury bill would normally cost Rs. 100, but an investor can get it for Rs. 98.20, saving them Rs. 1.80. The investor will receive the returns after 91 days, computed on the basis of Rs. 100, the actual price. Investors will receive a total amount = Rs.721 Treasury Bills b. Cash Management Bills (CMBs) In the Indian financial sector, cash management bills are new securities. This security was first made available in 2010 by the Indian government and the Reserve Bank of India. Cash management bills are issued to cover short-term inconsistencies in the government of India’s financial flow. The RBI issues the bills on behalf of the government. Treasury bills and cash management bills are both short-term securities that are issued when necessary. However, the main distinction between the two is the maturity period CMBs are an extremely short-term investment option because they are issued with maturity duration of fewer than 91 days. For instance, if a Cash management bill has a face value of Rs.50, we can purchase it for Rs. 45 and receive Rs. 50 at end of the maturity period, which is typically 60 days. Due to the short maturity period, there is no interest payment in this case. However, a discount is received as payment for purchasing the Cash Management bill. c. Dated G-Secs Dated Government Securities are a distinct class of securities since they can carry a fixed or fluctuating interest rate, generally known as the coupon rate. They are first issued at face value, which remains constant until redemption. Government securities, as opposed to Treasury and Cash Management Bills, offer a wide variety of tenure ranging from 5 years to 40 years, making them known as long-term market vehicles. Those who are investing in dated government securities are called primary dealers. There are different types of dated government securities issued by the Government of India 1) Fixed Rate Bonds 2) Floating Rate Bonds 3) Capital Indexed Bonds 4) Inflation Indexed Bonds 5) Bonds with Call/Put Options 6) Special Securities 7) STRIPS – Separate Trading of Registered Interest and Principal of Securities 8) Sovereign Gold Bonds (SGB) 9) Zero Coupon Bonds Let us understand what are those 10 types of Government securities. 1. Fixed Rate Bonds Fixed rate bond’s coupon rate is constant for its entire life as a government obligation. In other words, regardless of changes in market rates, the interest rate stays the same throughout the investment period. For instance, an investor might purchase a fixed-rate bond from the government with a face value of Rs. 1000 and a coupon rate of 10%. The bond’s term is 10 years, and the payment schedule is either semi-annual or annual. Following that, the investor would get Rs. 50 (5%) every six months and Rs. 100 (10%) every year for the following ten years. While the market rate may fluctuate greatly, the coupon rate on this bond will not change at all. 2. Floating Rate Bonds Bonds usually have a specified coupon rate or interest rate. However, a floating rate bond, on the other hand, is a type of debt obligation without a fixed coupon rate and instead has an interest rate that changes according to the benchmark from which it is taken. Benchmarks are tools of the market that have an impact on the national economy. Examples of benchmarks for a floating rate bond are the repo rate and the reverse repo rate. You might have got confused now, about how this is going to work out – don’t worry let us illustrate with an example. Bond Price Rs. 1000 Quoted margin – 4% (It will not change the entire tenure of the bonds) Liable – 6 months Liable rate – 1% Tenure – 2 years Then the investor gets the following after the six months 4% (quoted margin) + 1% liable rate at the time of purchase = Rs.50 Since every six months’ the liable rate changes, if it increases to 2% Then the investor will receive it after one year – 4% (quoted margin) + 2% liable rate since it is reversed = Rs.60 Most of the bonds also will come up CAP which means – the coupon rate can go a maximum of 6%, not beyond that. For example, Coupon rate is 5 % and the liable rate is 1.5 % then it is 6.5%. It cannot be paid to the investors because the CAP rate is 6%, it should not go beyond. Therefore, the investors will only receive 6% irrespective of the liable rate changes. 3. Capital Indexed Bonds Bonds known as “Capital Indexed Bonds” (CIBs) have periodic adjustments made to their capital value and interest payments to account for fluctuations in the Consumer Price Index (CPI). Typically, a fixed rate of interest is charged on the recalculated face value. Investors receive the bond’s adjusted face value along with the final coupon calculated from the modified face value when the bond matures. 4. Inflation Indexed Bonds Inflation Index bonds (IIBs) are where the principal amount and the interest payment are linked to an inflation index. The Consumer Price Index (CPI) or the Wholesale Price Index may be used as an indicator of inflation. Investing in these bonds ensures steady real profits. Additionally, it might protect the investor’s portfolio from inflation rates. For example. Governments issue Inflation Index bonds Bond price – R.1000 The interest rate or coupon rate – CPI (The consumer Price Index) + 5% Here the interest rate of 5% would remain constant and CPI may change based on inflation. Tenure – 5 years Payment – Semi-Annually At the end of the 6 months if the inflation is 8 % then the investor would be receiving = 8 % + 5 % = 13% = Rs.130 At the end of the year if the inflation is 6% then the investors would be receiving = 6 % + 5 % = 11 % = Rs.110 How does Inflation Affect Bond Price? 5. Bonds with Call or Put Option These bonds include a call option that gives the issuer the opportunity to repurchase the bond or a sell option that gives the investor the option to sell the bond to the issuer (put option). Only five years after the date of issue will the investor or issuer be able to exercise their rights. Example Bond Price – Rs. 1000 Tenure – 10 years Government can buy back the same bond at the same price Rs. after the completion of 5 years before the maturity period (10 years). If only the government wants to re-purchase the bond. In the same way, the investors can sell the bond to the government at the same price which they had purchased five years before. 6.. Special Securities The Government of India also occasionally issues special securities to companies like Oil Marketing Companies, Fertilizer Companies, the Food Corporation of India, etc. under the market borrowing program as payment in place of cash subsidies. These securities are known as oil bonds, fertilizer bonds, and food bonds, respectively. These securities are often long-dated and have a little larger coupon than the yield of similarly dated assets with a similar maturity. Example companies – Indian Oil, Hindustan Fertiliser Corporate limited, 7. STRIPS – Separate Trading of Registered Interest and Principal of Securities Separate Trading of Registered Interest and Principal of Securities is referred to as STRIPS. Here, a fixed-rate bond’s cash flow is transformed into separate security. The secondary market is where they are traded after that. Additionally, they resemble zero-coupon bonds in many ways. They are made from the securities that already exist, though. I’m sure you might be confused with the definition of STRIPS. Let us understand with an example. Bond price Rs.1000 Coupon rate – 10 % Tenure – 5 years Payment mode- Semi-Annually Now let’s apply the STRIPS concept- since it’s a 5-year bond and the payment period is semiannual; the bonds will be stripped into 10 semiannual coupons and each coupon will be treated as a standalone coupon bond. The final payment of the principal payment also will be treated as a standalone zero-coupon bond. Here the investor either can trade the coupon rate or principal amount separately 8. Sovereign Gold Bonds (SGB) We are so dramatically attached to its physical gold, but Sovereign Gold bond (SGB) online issued by the government. The best part is the interest on these bonds falls under tax exemption for individual taxation. Minimum investment in the Bonds shall be one gram with a maximum limit of subscription per fiscal year of 4 kg for individuals, the nominal value of the bonds will be determined in Indian Rupees using the three last working days of the week before the subscription period’s simple average closing price of gold with a purity of 999.9, as announced by the India Bullion and Jewelers Association Limited. For investors applying online and making a payment in response to their application via digital means, the issue price of the Gold Bonds will be Rs. 50 per gram less than the nominal value. The Bonds will accrue interest at a fixed rate of 2.50 percent (annually) on the nominal value. The last interest payment will be due along with the principal at maturity and will be made in half-yearly installments. What is Sovereign Gold Bond? 9. Zero Coupon Bonds The majority of bonds give monthly, quarterly, semiannual, or annual interest based on the coupon rate; but zero-coupon bonds do not have any such interest. With a zero bond, you purchase the bond at a discount from its face value and are paid the face amount when the bond expires rather than receiving interest payments. Let us take an example. The actual face value –Rs. 10000 You buy it at a discount price – Rs 7000 Tenure or lock-in period – 5 years At the end of the five years, you will receive Rs. 10000 (which was the face value of the bond while you were purchasing) This situation can vary if the market fluctuates, and the face value can be lesser than the purchase price. Let us take an example. The actual face value –Rs. 10000 You buy at a discount price – Rs 7000 Tenure or lock-in period – 5 years At the end of the five years, if the same bond is trading at Rs. 6500 then you will receive only Rs. 6500 due to the market fluctuation. You can also sell the same bond before maturity in the secondary market. The face value can depend on the again the market condition. It can be sold at a discount price or a higher price. Closing Thoughts It’s significant to have a better option for your portfolio because Government issues a wide variety of government securities. You can select the G-Sec that best fits your investment timeline because tenure is one of the key distinctions from other instruments. Government bonds or G-sec not only provide assurance of better returns and comes with less risker than other types of bonds. FAQ’S ON Government Bonds Can government bonds be redeemed before maturity? Callable bond can be redeemed by the issuer before it’s maturity date. They are typically issued with a face value and a maturity date, at which point the bonds can be redeemed for the face value What is the minimum amount to invest in bond? The minimum amount to invest in savings bons is Rs 1000 and in multiples thereof. Are govt bonds tax free? Government bonds in India are not tax free. However, the interest earned on these bonds is exempt from tax. This means that you will not have to pay any tax on the interest you earn from investing in government bonds. For example, interest on certain municipal bonds may be exempt from federal and state taxes. Capital gains from the sale of government bonds are also generally taxable.

...more

financial planning service

Financial planning is the process of evaluating your current financial situation and creating a plan to help you achieve your financial goals. It can involve: Assessing your current situation: Taking stock of your finances, including your savings, debt, and investments Setting goals: Deciding what you want to achieve, both short-term and long-term Creating a budget: Estimating your expenses and allocating money to different areas of your life Managing debt: Developing strategies to manage your debt Investing: Finding ways to invest your money Protecting your assets: Using insurance and estate planning to protect your assets Managing taxes: Developing strategies to manage your taxes Financial planning can help you make sound financial decisions and feel more secure about your future. It's never too late to start creating a financial plan, and you can use tools like financial ratios, forecasting models, and investment analysis tools to help you along the way. The financial planning process can hold a different meaning depending on who you ask. If you were to ask a random person on the street what the financial planning process is, they might say, “budgeting and saving money.” While this answer is not wrong, it’s only a small part of the actual 7 step financial planning process. Finances are stressful enough without the added complications of planning your financial future — from your current financial situation to determining a retirement plan. Hiring a financial advisor can make this process easier by outsourcing this critical aspect of your life to a professional. To achieve your financial goals, you need to set financial objectives and determine a plan to reach those objectives. There’s a lot that goes into building a financial plan. However, if you take the time to learn the financial planning process steps, you’ll know if and when is the right time to hire a financial advisor. What Is The Financial Planning Process? Simply put, the financial planning process is efficiently managing your money and achieving personal, economic, and financial satisfaction. This process also allows you to take control of your financial situation. Determining the suitable courses of action to achieve your financial objectives is what it’s all about when it comes to planning. A financial plan should thoroughly detail your entire financial situation. A financial advisor who is working with you to build a financial plan should take a holistic approach. A holistic approach includes reviewing your current financial situation, investments, and short-term and long-term financial goals. They will look at how you currently spend your money, help you organize your finances, and help you with an investment plan. They may even help with an estate plan when the time comes. This is why the financial process can be cumbersome and overwhelming to many people trying to do it themselves. There’s so much involved that it can be less time-intensive to hire a Certified Financial Planner™ Professional, who can help you with small financial decisions and the large ones like retirement saving and investment planning. Financial Planning Steps – From Start To Finish There are several critical steps to financial planning that need to be taken to achieve financial goals successfully. If any action is overlooked, it could mean postponing your dream retirement or having to rethink your entire financial future and plans. There are seven crucial steps that you and a financial advisor need to take to make the whole process successful. Step 1. Establish Clear Goals In order to kickstart the financial planning process, the first crucial step is to establish crystal-clear goals. This entails identifying your financial objectives, be it saving for retirement, creating an emergency fund, or eliminating debt. When setting these goals, it’s vital to consider the timeline for achieving them, along with the necessary resources and strategies. By having well-defined goals, you can direct your efforts and make informed decisions. Moreover, setting measurable goals enables you to track progress and stay motivated. By establishing unambiguous goals, you pave the way for taking decisive actions and making significant strides toward your financial aspirations. Step 2. Gather and Organize Financial Information Moving on to the next crucial step of the financial planning process, we delve into the task of gathering and organizing your financial information. In this phase, it becomes essential to compile all relevant documents, such as bank statements, tax returns, insurance policies, and any other records pertaining to your financial standing. Once you have acquired these materials, the next important undertaking is to arrange them in a logical and easily accessible manner. This involves categorizing your expenses, gaining a comprehensive understanding of your income, and constructing a well-thought-out budget. With everything meticulously organized, you’ll be primed to forge ahead to the subsequent stages of the financial planning process. Step 3. Analyzing Your Current Financial Situation With your financial information meticulously gathered, it’s time to delve into a comprehensive analysis of your current financial commitments. Scrutinize your income, expenses, assets, debts, investments, and other financial commitments. Assess whether you’re making progress towards your short-term and long-term goals, or if adjustments to your spending and saving habits are necessary. Take a moment to evaluate your risk tolerance and pinpoint any areas where modifications to your financial plan might be warranted. It’s crucial to grasp the implications of each financial decision you make and ensure they align harmoniously with your overarching financial objectives. By conducting this meticulous evaluation, you empower yourself to make informed choices and maintain an unwavering focus on your financial aspirations. Step 4. Develop a Comprehensive Financial Plan Proceeding forward, the subsequent step in the financial planning process entails crafting a comprehensive financial plan. This plan should encompass a wide spectrum of both short-term and long-term goals and objectives. Moreover, it ought to encompass meticulous strategies that pave the way for achieving these aspirations. A detailed budget and a well-crafted blueprint for managing and investing funds are integral components of this plan. Equally important is the inclusion of a robust strategy for effectively handling debt and securing a comfortable retirement. A truly comprehensive financial plan is one that is custom-tailored to suit the individual’s unique financial circumstances, goals, and objectives. Regular reviews of the plan are imperative to ensure its continued alignment with the individual’s evolving needs and objectives. Step 5. Put Your Financial Plan into Action With a clear roadmap of the necessary steps to construct your financial plan in hand, it’s time to take decisive action. Begin by establishing a budget and diligently tracking your expenses, providing invaluable insights into the flow of your finances. Armed with this knowledge, you can now embark on setting goals, ensuring that they are both attainable and in line with your short-term and long-term aspirations. As you move forward, it’s vital to maintain motivation and unwavering focus on your financial plan. This entails regular reviews of your financial plan and making adjustments whenever necessary. Remember to celebrate your triumphs along the way, acknowledging your accomplishments and rewarding yourself for achieving milestones. By embracing this proactive approach, you forge a path of financial success and ensure the fulfillment of your goals. Step 6. Monitor Your Progress and Make Adjustments Sustaining momentum and maintaining a vigilant eye on your financial planning process are pivotal to staying on course. As you journey forward, it remains crucial to regularly scrutinize your budget, diligently track your expenditures, and evaluate the performance of your investments. Continually ask yourself if you’re making strides toward your intended goals. If the answer suggests otherwise, take the requisite measures to enact modifications. You might need to fine-tune your budget, reallocate your investments, or shift your focus. By consistently monitoring your progress, you equip yourself with the ability to remain on track and swiftly adapt whenever necessary, ensuring that you forge a path toward the attainment of your financial objectives. Step 7. Revise and Update Your Financial Plan Over Time Continually revisiting and refining your financial plan is pivotal in preserving its relevance and efficacy. Ensure that you adapt your plan in response to evolving life circumstances, such as marriage or starting a family. Furthermore, conduct an annual review of your plan or whenever significant changes occur in your financial situation. This practice will enable you to identify any new objectives that warrant inclusion or modifications required to align with existing goals. Additionally, dedicate time to assess your investment allocations and verify their alignment with your objectives. Finally, maintain a vigilant watch over any economic or market fluctuations that might impact your plan. By diligently undertaking these regular reviews, you remain firmly on course so that your plan continues to work seamlessly in your favor. The financial planning process demands considerable dedication, commitment, and knowledge. It necessitates a comprehensive evaluation of your financial landscape and prudent preparation for what lies ahead. Creating a financial plan can be difficult and overwhelming to many people, so a financial planner is essential to finding and building the right financial path. With access to the appropriate resources and guidance, you can confidently navigate the path toward making sound financial decisions that will shape a prosperous future for you. If you are ready to go through the financial planning process, contact The Retirement Planning Group today. Our team of financial planners can help you with all of your financial planning needs.

...more

ETF Equity Traded Funds Investment Service

ETF's TRADING & INVESTMENT--- Table of Contents By James Chen Updated August 01, 2024 Reviewed by Gordon Scott Fact checked by Jiwon Ma Part of the Series Exchange-Traded Fund Guide for Beginners ETF Basics Exchange-Traded Fund (ETF): How to Invest and What It Is CURRENT ARTICLE 7 Best ETF Trading Strategies for Beginners Introduction to Exchange-Traded Funds (ETFs) 7 Easy-to-Understand ETFs to Replace A Savings Account Definition An exchange-traded fund is an investment vehicle that pools a group of securities into a fund. It can be traded like an individual stock on an exchange. What Is an Exchange-Traded Fund (ETF)? An exchange-traded fund (ETF) is a pooled investment security that can be bought and sold like an individual stock. ETFs can be structured to track anything from the price of a commodity to a large and diverse collection of securities. ETFs can even be designed to track specific investment strategies. Various types of ETFs are available to investors for income generation, speculation, and price increases, and to hedge or partly offset risk in an investor’s portfolio. The first ETF was the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 Index. Key Takeaways An exchange-traded fund (ETF) is a basket of securities that trades on an exchange just like a stock does. ETF share prices fluctuate all day as the ETF is bought and sold; this is different from mutual funds, which only trade once a day after the market closes. ETFs offer low expense ratios and fewer broker commissions than buying the stocks individually. Types of ETFs Passive ETF: Passive ETFs aim to replicate the performance of a broader index—either a diversified index such as the S&P 500 or a more specific targeted sector or trend. Actively managed ETF: Do not target an index of securities, but rather have portfolio managers making decisions about which securities to include in the portfolio. Actively managed ETFs have benefits over passive ETFs but can be more expensive to investors. Bond ETF: Used to provide regular income to investors and distribution depends on the performance of underlying bonds which may include government, corporate, and state and local bonds, usually called municipal bonds. Unlike their underlying instruments, bond ETFs do not have a maturity date. Stock ETF: A basket of stocks that track a single industry or sector like automotive or foreign stocks. The aim is to provide diversified exposure to a single industry, one that includes high performers and new entrants with growth potential. Unlike stock mutual funds, stock ETFs have lower fees and do not involve actual ownership of securities. Industry or sector ETF: Funds that focus on a specific sector or industry. An energy sector ETF will include companies operating in that sector. Blackrock's iShares U.S. Technology ETF (IYW) mirrors the performance of the Russell 1000 Technology RIC 22.5/45 Capped Index and holds 1374 stocks of technology sector companies. Commodity ETF: Invest in commodities like crude oil or gold. Commodity ETFs can diversify a portfolio, making it easier to hedge market downturns. Holding shares in a commodity ETF is cheaper than physical possession of the commodity. Currency ETF: Track the performance of currency pairs consisting of domestic and foreign currencies. Currency ETFs can be used to speculate on the prices of currencies based on political and economic developments in a country. They are also used to diversify a portfolio or as a hedge against volatility in forex markets by importers and exporters. Bitcoin ETF: The spot Bitcoin ETF was approved by the SEC in 2024. These ETFs expose investors to bitcoin's price moves in their regular brokerage accounts by purchasing and holding bitcoins as the underlying asset and allowing them to buy shares of the fund. Bitcoin futures ETFs, approved in 2021, use futures contracts traded on the Chicago Mercantile Exchange and mimic the price movements of bitcoin futures contracts. Ethereum ETF: Spot ether ETFs provide a way to invest in ether, the currency native to the Ethereum blockchain, without directly owning the cryptocurrency. In May 2024, the SEC permitted Nasdaq, the Chicago Board Options Exchange, and the NYSE to list ETFs holding ether. And in July 2024, the SEC officially approved nine spot ether ETFs to begin trading on U.S. exchanges. Inverse ETF: Earn gains from stock declines by shorting stocks. Shorting is borrowing a stock, selling it while expecting a decline in value, and repurchasing it at a lower price. An inverse ETF uses derivatives to short a stock. Inverse ETFs are exchange-traded notes (ETNs) and not true ETFs. An ETN is a bond that trades like a stock and is backed by an issuer such as a bank. Leveraged ETF: A leveraged ETF seeks to return some multiples (e.g., 2× or 3×) on the return of the underlying investments. If the S&P 500 rises 1%, a 2× leveraged S&P 500 ETF will return 2% (and if the index falls by 1%, the ETF would lose 2%). These products use debt and derivatives, such as options or futures contracts, to leverage their returns.

...more

government bonds

Opening Hours

Majic Financial Distribution, based in Mumbai, Maharashtra, was established in 2020 by Mr. Nitin Shah. Since its inception, the company has grown to become a trusted name in both the manufacturing sector and the financial services industry. Majic Financial Distribution offers a diverse range of high-quality household cleaning products and essential consumer goods, while also providing reliable health insurance and mutual fund services. The company’s unique blend of expertise in manufacturing and financial distribution has made it a versatile and dynamic player in the market.

With a strong commitment to quality and innovation, Majic Financial Distribution ensures that its products meet the highest standards of effectiveness and safety. The company leverages advanced manufacturing processes and stringent quality control measures to create products that cater to everyday household needs. Whether it’s hygiene, cleaning, or maintenance, Majic Financial Distribution is dedicated to improving the lives of its customers by offering effective and environmentally friendly solutions.

In addition to its manufacturing operations, Majic Financial Distribution has a strong foothold in the financial sector. The company’s health insurance and mutual fund services are designed to provide customers with peace of mind and long-term financial security. By offering a wide range of financial solutions, Majic Financial Distribution aims to help individuals and families plan for a secure future, manage their investments, and safeguard their health with comprehensive insurance coverage.

The company prides itself on its customer-centric approach, delivering both its products and services with a focus on reliability, affordability, and excellent customer support. Whether catering to the needs of households or guiding clients through financial decisions, Majic Financial Distribution is committed to building long-lasting relationships based on trust and transparency.

Under the leadership of Mr. Nitin Shah, Majic Financial Distribution continues to grow, driven by its mission to provide superior products and financial services that improve the quality of life for its customers. With a focus on innovation, sustainability, and customer satisfaction, the company is well-positioned to expand its presence across various sectors in the years to come.