National Pension System Service

Get Price Quote

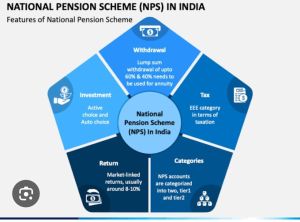

NPS INVESTMENT--- The National Pension System (NPS) is a retirement savings plan that allows individuals to contribute to their pension account while they are working. The goal is to build a pension fund that can provide a regular income after retirement. Here are some things to know about NPS: Eligibility NPS is available to all Indian citizens between the ages of 18 and 70, including those living abroad. It is mandatory for Central Government employees who started working on or after January 1, 2004, with some exceptions. Many State Governments have also adopted NPS for their employees. Contributions Individuals can contribute to their NPS account, and their employer can also contribute on their behalf. Account opening When an individual opens an NPS account, they receive a unique Permanent Retirement Account Number (PRAN). Withdrawals Individuals can make partial withdrawals from their NPS account up to three times during the account's lifetime. They can withdraw up to 25% of their contributions at any time, excluding employer contributions. Phased withdrawals Subscribers can choose to withdraw their lump sum amount in phases over a period from age 60 to 75. Tax efficiency NPS is a tax-efficient way to save for retirement. Risk tolerance NPS may be a good option for people who are willing to take moderate risks and seek higher returns.