GST Refund Service

Get Price Quote

Our GST Refund Service ensures a hassle-free process for businesses to claim refunds on excess Goods and Services Tax (GST) paid. Whether due to export-related zero-rated supplies, inverted tax structure, or other eligible cases, we assist in filing accurate refund applications with the necessary documentation. Our experts handle everything, from verifying tax payments and preparing claims to liaising with tax authorities for timely refunds. With our service, businesses can improve cash flow and avoid delays or rejections due to filing errors. Let us take care of the complexities while you focus on your business operations, ensuring you receive your rightful GST refunds promptly.

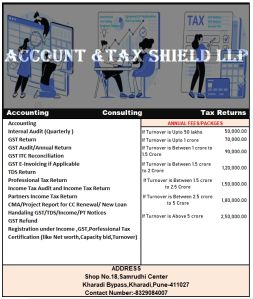

Taxation Services

Get Price Quote

We are one of the most sought-after Taxation Service Providers from Pune, and we pride in offering the highest quality of Taxation Services to our esteemed clients across the globe. We closely deal in Taxation Services and help the clients in matters relating to Income Tax Assessment, International Taxation, Corporate Tax Advisory, and Indirect Tax Services like VAT/CST, and many more. We have a team of skilled professionals who have a great understanding of the subject, and excel in offering these Taxation Services at highly affordable rates in the market.

Looking for Tax Consultancy Service Providers

GST Registration service

3,000 - 5,000 Per Nos

1 Nos (MOQ)

GST registration service for all types of business

Corporate Tax Advisory Services

Get Price Quote

Corporate Tax Advisory services.

soft gst medical billing software services

Get Price Quote

Goods and Services Tax (GST) software in India is designed to help businesses comply with the GST regulations. These software solutions automate various aspects of GST compliance, including invoicing, filing returns, and maintaining records. Features of SoftGST : 1. GST Invoicing 2. Return Filing 3. Reconciliation 4. Input Tax Credit ( ITC ) Management 5. Data Import and Export 6. Complaince Management 7. Reporting and Analytics 8. User Management 9. Integration 10.E-way Bill generation 11.Mobile Accessibility 12.Customer Support Benefits of SoftGST : 1. Time Saving 2. Accuracy 3. Complaince 4. Efficiency 5. Visibility

income tax return filing

Get Price Quote

Are you worried about your Income Tax Return Filling Services? We are aware that completing income tax returns, like filing GST returns, is a very time-consuming task that, if you run a large business, needs expert assistance. A very reputable and well-known brand in the market for income tax return filing services is MAHAMUNI & ASSOCIATES. Our business is armed with highly skilled tax specialists who are particularly competent in meeting all our clients' needs. Contact us if you have concerns concerning the income tax return of your business to receive hassle-free, secure services. You will not be let down, we promise.

gst return filing service

Get Price Quote

With Legal Mind Business Solution, submitting your GST return would be easier. As a reputable company in the field, we specialize in offering knowledgeable support for effortless GST return filing. Our team of experts guarantees quick and accurate filing while smoothly assisting you during the entire procedure. Our GST Return Filing Service is geared to match your unique needs, whether you're a little business or a huge corporation, and they ensure compliance with GST rules. Customer satisfaction is our priority at Legal Mind Business Solution, and we provide quick support and affordable solutions. Join us to file your GST returns without hassle. To simplify tax compliance so you can concentrate on expanding your business, get in touch with Legal Mind Business Solution right away.

GST Filing

Get Price Quote

Troubled with numerous return filings monthly and still struggling to file accurate returns and claiming taxes? Then the solution is right here. Our service includes preparation, experts’ advice and online submission.

tax compliance services

Get Price Quote

Direct Tax Compliance with the government laws requires in depth knowledge of various tax laws. Direct Tax consultancy and planning with efficient tax strategies, provided by us form an integral part of viable business decisions. We adopt a which is flexible and emphasizes delivery and value. Service Tax : Service Tax is a central tax, which has been imposed on certain services and is the latest addition to the genus of indirect taxes like customs and central excise duty. India, a developing country, was somewhat slow in discovering the potential of this kind of indirect taxation for enhancement of revenue collection and it was the Finance Act 1994 that first introduced the service tax provisions through its Chapter V. Service Tax is collected by Central Excise Department. Value Added Tax (VAT) : Value Added Tax (VAT) is a tax on value addition and a multi point tax, which is levied at every stage of sale. It is collected at the stage of manufacture/resale and contemplates rebating of tax paid on inputs and purchases. Excise And Cenvat : Excise Duty is charged on goods produced within the country (as opposed to customs duties, charged on goods from outside the country). It is a tax on the production or sale of excisable goods. This tax is now known as the Central Value Added Tax (CENVAT). Every person who manufactures, produces, carries on trade,holds warehouses for excisable goods shall have to obtain registration under the excise laws. No excisable goods may be removed from the factory or a warehouse except under an invoice signed by the owner of the factory or his authorized agent.

Tax Receipt Name Change Services

Get Price Quote

Based in Pune, India, we are actively functioning as a reliable name engaged in providing Tax Receipt Name Change Services to all of you out there. We are backed by a team of professionals having years of experience and vast knowledge in the domain. Clients across various parts of the country have complete trust on our services which has helped us in building strong and new relations. So, dont ponder upon much and get in touch with us to avail these services.

Gst registration and filing of various returns.

Get Price Quote

GST registration @ Rs. 750/- and filing of various returns @ Rs. 500/- each filing return. ( subject to change case to case basis)

GST Consultancy Services

Get Price Quote

GST Registration Charges Rs-3000- other consultancy fees will be negotiated on case to case basis. Also we provide GST Services such as Registration and Migration, Periodically return filing, GST functional Consultancy, GST System design and implementation in various ERP environment such as SAP, Tally, Accpac etc. We have expertise to deal in any ERP environment

tax consultancy services

Get Price Quote

In the new environment, it is important that your tax advisors understand and plan your taxes with a global picture in mind. We have an aptitude for providing expert advice in tax planning. Our tax consultancy services include income tax planning, fringe benefit tax consultancy, Indian direct tax consultancy to individuals, firms and NRIs.

GST Audits Services

Get Price Quote

YKTs prime focus of GST Audit, apart from Statutory Compliance, is to reduce or remove the errors and save the businesses from interest & penalty. YKT benefits its clients with 3 deliverables. Accounts are in compliance with the GST Law Shortcomings can be found out & dealt with in future Deviation from the laws can be identified and corrected

Tax Saving Plans

Get Price Quote

Bajaj allianz brings to you some simple tax saving plans to help to plan your taxes and invest your money well at the same time.

Income Tax Audit services

Get Price Quote

Every business entity begins with a dream of its founder, forits success and prosperity. But, setting up a business in the real world takes a lot of effort. We, at Burad Associates, understand the intricate needs of a new firm trying to establish itself in today's competitive market and have packaged our services accordingly.

Service Tax Registration

Get Price Quote

Service Tax Registration , service tax return filling done quarterly, half yearly, yearly.

gst registration

Get Price Quote

gst registration, Company Registration Services

Income Tax Services

Get Price Quote

Income tax, vat, service tax, tds, advance tax services for corporates, individuals.

tax planning

Get Price Quote

tax planning, Mutual Fund Services, Asset Management, risk management

Tax Consultancy

Get Price Quote

Tax Consultancy

Sales Tax Audit Services

Get Price Quote

It is the audit of a companyindividual's tax liability. It is a check on whether the tax liability on the companyindividual is as per accordance to the tax laws, or there has been any manipulation in that regard. Our experts know the best answer to it after the audit is conducted.

Sales Tax Registration Service

Get Price Quote

We provides sales tax registration service. Sales tax registration is mandatory for any business entity with a turnover of over rs. 5 lakh engaged in the sale of goods in india. Also known as value-added tax, it is a multi-stage state tax that accumulates at various stages of production and supply.

Tax Advisory

Get Price Quote

The tax implications of esop heavily impact the employees of the company. For a multinational company, the taxation laws applicable would vary in different countries. Simply put, multiple taxation parameters must be simultaneously balanced and esop direct helps you do exactly that. Esop direct offers consultancy on the tax implications of stock option schemes under various scenarios, be it under trust management or different geographies or different resident status of the employees. We also give expert recommendations to mitigate tax liability within legal parameters without impacting the efficacy of the scheme. Legal opinion and advisory on tax liability of the resident and non-resident employee in different countries, tax withholding by the companies and amount of deduction which can be claimed in each assessment year in respect of the esop cost. Preparing country wise tax handbook in accordance with applicable laws and amendments and quarterly updates, serving tax administration of plans having global coverage or mobile employees. Taxation of esop trust set up for administration review of historical tax treatment of esops and compliances thereof

online pan card services

Get Price Quote

online pan card services, jeevan pramanpatr pension yojna service

Tax Audits Service

Get Price Quote

It is the audit of a companyindividul tax liability. It is a check on whether the tax liability on the companyindividual is as per accordance to the tax laws, or there has been any manipulation in that regard. Our experts know the best answer to it after the audit is conducted.

Vat Registration Services

Get Price Quote

Vat Registration Services, IEC Number Allotment Service, Passport Services

gst services

Get Price Quote

gst services, Tax Consultancy, import export tax service, Taxation Advisory

tax consultants

Get Price Quote

tax consultants, accountant, pancard, income tax filing, gst services

GST Compliance

Get Price Quote

GST Compliance, chartered accountants, investment planning services