Cantt Board Pr Tax Software

Get Price Quote

Definition of Tax Master including Property Tax %, Sanitory Tax % , Water Tax %, Interest % …. Property Tax Master with all Details, showing all receipts so far and all demands so far With outstanding as on Today Generation of Demand ( Property Tax Bills ) Generation of Notice Generation of Interest Generation of Warrant Fee Any modification in Arrears/Demand if required 4B Receipts Entry All Masters Registers like Area, Property Category, Tax Master, Property Master, Property Master-Taxes, Water Connection, Area wise Property Summary, ARV wise Summary Reports Generated Printing of Property Tax Bill Notice Notice Summary Warrant Printing Arrears Demands Arrears + Demand Demand & Collection Register – Excel, Format I, Format III 4B Receipts Register – Against Demand, Against Arrears and Against Arrears+Demand Demand Collection Net-Slabwise Assessment Register Assessment Register – Excel Assessment Letter US 76 Notice US 76 Notice Register US 76 Additional And blank form for Assessment

GST Software

5,000 - 10,000 Per No

Create professional GST invoices in just few second , share them on email , WhatsApp, Manage inventory, Software designed for Indian medium and Small Businesses.

Best Deals from Tax Software

excise software

Get Price Quote

We are offering excise software . Updated with education cess, s & h cess an option of daily / monthly posting calculation of excise duty on the basis of mrp / abatement / pro-rata / deemed credit progressive calculation (considering branded / unbranded / without export value) posting of sales return entry to rg 23a part I & ii differential rate invoice entry percentage of excise duty linked with progressive amount user definable percentage of excise duty (e.g. 9.6% to 16%) auto bom (bill of material) loan & license part-wise page number generation different excise duty consideration like bed, aed (gsi), sed, nccd, aed (t & ta), education cess in invoice, rg 23 a part ii, er ii and er iii data security through mirror image and encrypted form of backup option user-wise entry level security front office documents: excise invoice (with / without progressive amount) daily input to production slip daily output from production slip tr-6 challan annexure 22 for captive use registers: personal ledger account (pla) personal ledger account (pla) with education cess rg 23 a part I (item-wise/date-wise/group-wise) for raw material / capital goods rg 23 a part ii for raw material / capital goods input service tax credit register with education cess rg I (item-wise/group-wise/chapter-wise) daily stock statement duty payable report (date-wise / invoice-wise / chapter-wise / group-wise) duty available report deemed credit availed report daily production report captive use stock ledger report form iv for stock of raw material form rt v for raw material used & finished goods produced duty deposited under tr-6 challan er I (rt 12) reports: er- I (monthly return for production and removal of goods and other relevant particulars and cenvat credit) er- I weekly er- iii submitted by the assessee falling under provision to rule 12 (quarterly returns) er-v and er-vi abstract of input goods & capital goods under rule 7.

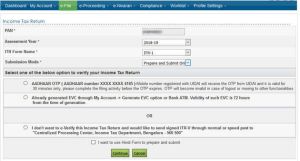

Income Tax Software

Get Price Quote

We are offering income tax software.

GST Software

Get Price Quote

payment solutions, Financial Management Services, ERP Integration

excise software

Get Price Quote

excise software, erp software solution, excise erp solution

Taxation Software

Get Price Quote

Epson Industrial Printer, Epson Multifunction Printer, E-Tendering Services

excise software

Get Price Quote

excise software, Property Management Software, call recording software

tax software

Get Price Quote

tax software